Contents

Quick overview

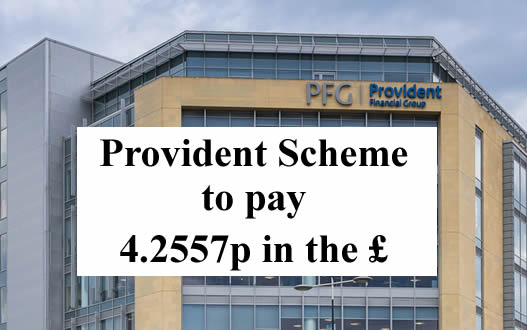

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Rick says

Right I got my history of all my loans I’ve had with provident.

But very confused where I had 2 loans at same time

But only said about 1 which was the lowest

Also on interest it doesn’t work out of what it should be.

Annie says

I just phoned them there Mine still not been assessed Will know by end of April at latest

Robert says

I am still waiting for my email to say what the outcome of my claim is. They should have given a date when they would have decided what is going to be upheld or not.

Lyn says

Check your portal as I had my outcome but wasn’t notified by email

Lyn says

I’ve had my reply this morning they’ve upheld most of my loans which totals 5545 told my redress will be between 218 and 327 pound and to expect payment by July 1st. I’m happy enough with that result as I figured I wouldn’t get anything especially since I still owed them 900 pound when they went bust which was written off

Huseyin says

I had 15 Loans with Provident over the years excluding my wife’s loans. Before the redress scheme was introduced last year I applied for compensation directly with Provident for unaffordable loans which they upheld on 2 of the loans as unaffordable but offset it against 2 outstanding loans I had remaining. I appealed this through the Financial Ombudsman who agreed that I had a case as their were other loans around the same time as the ones they compensated me for but did not uphold. However with Provident bringing in the redress scheme the Financial Ombudsman had to withdraw my case and leave for me to make a claim through the redress scheme.

I have not had an outcome yet and had a message today to say that they have had to extend the timescale for outcomes from first week of April 2022 to end of April which hopefully I should have a decision by then. They did apologise for this saying that the amount of workload has overwhelmed them in not too many words.

All the best every body.

Adreva says

Completely baffling how they’ve worked this out I had 3 out of 4 loans upheld.

Loan 1 £500 Jan 2017 Upheld

Loan 2 £990 ?? 2017 Upheld

Loan 3 £1000 Feb 2017 Upheld

Loan 4 £400 June 2017 Not assessed as unaffordable despite having a Satsuma Loan already open.

Interestingly I have the affordability calculations undertaken by Provident from a previous compliant that clearly shows my disposable income for the last loan was less then for the previous loan.

I’ve no idea how they’ve worked out if its affordable or not and I’m beginning to suspect there is a an error in the algorithm.

I’m currently writing an appeal and waiting for a statement of loans from satsuma.

I suspect there’s going to be alot of appeals and I don’t hold much hope of getting a response with the 30 day timescale indicated by Provident for appeals.

Max says

Hi Sara,

Absolutely livid” Never received any email about my decision and having stumbled upon this thread earlier today, just logged into the portal to see my claim was rejected on 1 March and I’m now beyond the 30 day appeal deadline.

I urge everyone to be proactive and check their claims portal immediately, so no-one else loses out to their underhand tactics.

I had a couple of Satsuma loans which I was confident about; paid over £1,250 in interest so was hoping to get something back.

Their behaviour is absolutely shocking and the only consolation is I’m quietly confident my Vanquis credit card complaint currently with the FOS will go in my favour, at which point I’ll be scrutinising their substantial redress figures with a microscope to ensure they don’t steal a penny more.

Provident deserve to be deluged with Vanquis and Moneybarn complaints that go to the FOS and cost them £649 a pop regardless of the outcome.

Sara (Debt Camel) says

I suggest it is worth trying to make an appeal – this isn’t very late and you can explain you never received the email.

Peter nicon says

If you’ve had a pay out from provy via the fos for unaffordable lending before the scheme of arrangement was announced but then still asked to make claim through the scheme does that result in further redress from the scheme,thanks

Sara (Debt Camel) says

It is possible the Scheme may uphold more loans. In this case they will then deduct the refunds you had before and you will be a paid the small percentage of the extra amount.

SM says

Hi

Hope your well

I am awaiting PROVIDENT loans pay out via Scheme: wondering if u/anyone knows the DATES to pay outs. Long time coming…😒😅

Thank you

Sara (Debt Camel) says

Not before July.

Marc says

I noticed this on the claim outcome letters.

“The current estimate of the total value of valid claims is between £833m and £1250m, so the pence in the pound compensation rate has been

estimated as £50m ÷ £833m to £1250m = 4p to 6p pence in the pound.”

If you think about it, there must be some level of accuracy in those figures for Provident to be able to publish them.

The two numbers £833m and £1250m seem quite important. I believe £1250m is the total of all claims submitted. I also believe that the £833m refers to the total of all claims submitted minus the loans that they have assessed as ‘affordable’ and as a result could be subject to appeal.

I think it’s fair to assume that they have already made the initial assessment on all claims already in order to produce those figures. Which means the reason some people haven’t heard anything yet is purely down to Provident limiting the flow of updates out to customers. They will be holding back the next batch to be emailed out to the customers until they’re sure they’re able to manage the flow of potential phone calls and emails that each batch generates into them.

So ultimately the final % pay out will be decided by how much of the (1250 – 833 = 417) £417m that people could appeal, is ultimately upheld. Worst case payout is 4%, best case is 6%. If only half of the appealable £417m is upheld it could mean 5% for example.

Sara (Debt Camel) says

I think you are are reading way too much into those numbers. If they have got through half the claims it would be reasonable to guess the results from the other half would be similar.

Zara says

I’ve heard nothing no emails or letters I’ve had 3 loans! Do you think I should call or just see if I get any emails over the next few weeks?

Sara (Debt Camel) says

Lots of people haven’t heard yet. I suggest you log into the portal every week to check, just in case you miss the email.

Maria Murphy says

Sara I’ve received an email with 15 out of 19 loans being repaid, I’m happy enough with the estimated redress. I’m going for Morses club right now, I copied your template and adapted it where it needed to be but even though I sent it through their complaints section on their website it’s not showing as having been sent on my email address.

Is this ok or do I need a certain email to send my complaint to? Each time I look it just brings me back to Morses website.

I’d really appreciate your help with this.

Sara (Debt Camel) says

You could phone them up and ask if they have got your complaint.

or you should try ricky.essex@morsesclub.com – I don’t know if that email works, let me know?

Marc says

Or try Resolver

https://www.resolver.co.uk/users/sign_in

Maria Murphy says

Thank you so much, I’ll email them first and let you know.

Maria Murphy says

Marc I did it through resolver so here’s hoping, while on resolver I noticed my previous claim to provident through them in October 2018.

They turned me down for redress amid a lot of legal jargon (though now I’m getting 15 of the previous dismissed loans upheld?), I was going through a lot of personal issues at the time and hadn’t the mental energy to fight them, I’m sorry now I didn’t.

I didn’t vote into this pathetic scheme because I knew they’d try and pull something like this, I’m just hoping Morses don’t do the same.

Nicky says

Hi

I actually think that makes alot of sense what Marc says, I am still waiting was a customer for 20 years with 19 loans

No checks were done I was on a dmp they didn’t even check that, I lot of bullying tactics were used years ago and was offered multiple loans all over 1000 the biggest was 2300. They were all paid off at 10 quid a week finished in 2019 thank god. I think the compo should be paid due to the underhand way these loans were pushed on people that alone is disgusting.

A Scott says

I just rang this number 08000568936 I had a fairly short wait to be answered . My problem was I could not remember my username or password to log in to my portal email . The gentleman was very helpful and read the email for me and told me what my refund would be and that it would be put in my bank in june . It’s not as much as I’d hoped but better than nothing between £76 -_£115.21 I’ve accepted literally 5 mins ago . I had no existing loans . Hope this helps .

Michelle says

Just recieved my outcome. Upheld 17 loans out of 19.. Compensation of £530.. Happy with that as was expecting less than £50.

Evie says

I’ve received my response 5 out of 10 upheld. Estimated to be receiving between £499 and £748 back.

I’ll sit later and go through what they’ve upheld to when I actually took the loans out later as doesn’t look like they have them in correct order from 1st to 10th.

Kim says

Has anyone heard back from an appeal they have submitted following the initial response being they were not upholding the complaint?

Sarah Louise Tansley says

I appealed and was wondering the same as I’ve heard nothing yet.

Miss joanne payne says

Hi there.

So today I’ve had my notification from provident that they are uphold 10 out of my 16 loans.Not sure why the others haven’t been up held? 1 was for £1000.Id probably understand small ones being rejected.

Overall my claim value would of been £8052.92 but under the scheme they are offering between £322-£483.Not sure if I should except or appeal..

Thanks jo

Sara (Debt Camel) says

I suggest you appeal and say that the 1000 loans was clearly unaffordable and you can’t see why it hasn’t been included. If it is, you will get another £50 – not bad for sending an email or two?

Miss joanne payne says

Yes I think I will too.

I could kick myself I hadn’t done it sooner,my claim went in then they decided to do the scheme so I only just missed out on the full amount.

But at least I got something back,as you say just for a couple of emails, 😊

KENNY says

hI .. YOU SHOULD APPEAL..its scandelouse what they are trying to get away with. my claim value is over £11.000 + said between £464 and £635

sent them an email appealing and if the refuse my appeal will take it to the financial Ombudsman..

Yes its a hassle but need to stand up to them…make them acountable..

Kenny .

Sara (Debt Camel) says

It isn’t possible to go to the Ombudsman when a Scheme has been approved.

Maggie says

How long had you to wait till money in bank

Sara (Debt Camel) says

no one has been paid yet – everyone will be paid at the same time when all the claims and appeals have been sorted out.

Miss joanne payne says

I’ve appealed so don’t expect it anytime soon.

Chris says

I keep trying to log in but dont no scheme number

Chris says

Provident Website for Scheme has been updated it now says:

“ We have commenced writing and emailing to all Claimants with their Claim outcomes. All letters and emails are expected to be delivered by the 1st week of May…”

Darren Keneford says

Im checking my emails and the portal daily but haven’t heard anything yet. It’s interesting that as the days go by the refunds appear to be increasing in value. I was only expecting about £50 but maybe I’ll get more 🤞

diane says

I have tried to login to the portal but keeps saying sent authentication code. when I put the code in it says code is incorrect or has already been used. could you please help me with this problem as I have tried this with different codes that have been sent to me and nothing is working

Sara (Debt Camel) says

I think you need to phone them up and ask.

Andrew says

The code is case sensitive and your id must have the – between each four digits I signed into mine last night

Jade Collins says

I had an email today asking me to read the outcome of my claim but I don’t understand what they are saying or whether it’s been upheld?

It also says that cheques will be sent out in post but I can’t see any redress figures?

Sara (Debt Camel) says

Can you log into the portal? The numbers should be there.

Evie says

I’ve sent in an appeal after looking over my loans. They upheld 5 of 10 so I’ve asked if 3 of the ones not upheld can be looked at. As they upheld a loan of £2000 saying it was unaffordable then I got £1500 3 months later which they said was affordable then 2 months later another £2000 which they upheld as being unaffordable. Then my last two loans weren’t upheld, both paid off but took me far longer to pay off because I was struggling to pay.

Bev says

I received my outcome of my claim, they have upheld 4 out of 13, the loans that were upheld are as follows £1800, £400, £1500, £200.

The ones that were rejected were £1000, £500, £150, £250, £100, £700, £400, £200, £500.

I payed them all off in 2019 but I don’t understand why only four have been deemed as unaffordable.

The compensation offered was £242-£317

I have appealed this as I don’t believe this is correct.

Thanks

Squirrel says

I appealed my offer; they upheld two loans of £1000 and £900 as unaffordable and one of £6000 as affordable, all within weeks of each other in 2016 when I was mentally unwell and in changing and precarious employment. Makes no sense.

Carl says

Hi Sara I have a copy of all my so called loans they say I have none between 2006- 2011 which is rubbish it shows a loan in 2006 and payed off in 2011 the loan repayment was one year no way did in take me five years it also shows I had no loan balance on any yet they are saying I owed them but they have sent me the list this morning?

Sara (Debt Camel) says

I have detailed the details as they have people’s names on and it isn’t possible to reading because the formatiing has been reloved.

have you asked which loans they say there is a balance owed on?

Have you at any point had Provident write off a loan? Or Have you gone bankrupt, had an IVA or a DRO?

Carl says

They sent me a copy of my decision and the loans they said I owed on but I had already asked for a copy of my loans with them which I received this morning and it shows the loans they say I owed on with zero balance next to them as I say I had a stroke in 2012 and was in hospital for four months when I came home provident contacted me saying the depts had been written off but now they are saying I still owed on them but the detailed loan information what they sent me shows they had wrote them off because the other ones have a payed up date where the three don’t but still says zero owing at the side of them no I have never been bankrupt or anything like that and never had anything from provident on my credit file saying I owed them sorry I don’t know how to post the details on here I have copied it but can’t seem to paste into the comments.

Sara (Debt Camel) says

I am afraid legally they are probably right to say they will offset any refund against that amount they wrote off.

Ethically it stinks.

Catherine says

They’ve denied my appeal and says their decision is unchanged so they’ve now sent it to the independent adjudicator for their decision. They are a joke. I had 15 loans they’d only looked at 13 and upheld one that was in the middle and not the rest. The final loan took me 3 years to pay off and had to go into a payment plan after 3 months and missed loads of payments on it before it went to the plan. Hopefully the adjudicator will be fairer.

William says

Just received a email saying that only 2 of 10 loans are being upheld after my appeal now going to adjudicator. Who are/is the adjudicator’s

Sara (Debt Camel) says

The adjudicator is a person external to provident appointed to consider appeals. So far they have just reviewed their own decision.

Evie says

How long did it take for you to hear back about your appeal from when you submitted it?

Marc says

Adjudicator details are here in the Explanatory Statement document on Provident’s Scheme website.

Joanna says

So only 1 of my 9 claims were upheld so I appealed and today received this.

Thank you for raising your appeal with us, we have now had the opportunity to review this but our decision remains unchanged.

Under the Scheme your claim will be a Disputed Scheme Claim and will now be referred to the Adjudicator for an independent review to take place. Once the Adjudicator receives your appeal they will have up to 60 days to review the information and determine an outcome. If any further information is required from you we will be in touch.

In the meantime no further action is required from you.

Regards,

Provident SPV Limited

What’s the chances of the adjudicator upholding my appeal considering I was paid out for one previously and then told not upheld for that loan?

Sara (Debt Camel) says

no idea! Sorry, in some administrations a lot of people have had appeals upheld. I think quite a few were in the Money Shop’s Scheme. But there is no track record for me to make a guess about with this Scheme (which seems to have made some very strange decisions) and this adjudicator.

Joanna says

Thank you Sara

Just a waiting game then, fingers crossed :)

Mark says

Has anyone managed to get the CRA’s to suppress the defaulted account with Provident?

Whilst mine is showing as closed / settled, it is also still showing as a default.

Thanks

Sara (Debt Camel) says

It is too early to try that. You can only do that when a lender has stopped talking to the CRAs – that cant be for at least 3 or 4 months, probably a bit longer.

IAN R says

Waiting as ever had loans from both provident & greenwoods before the cut off date-not expecting much because had a return of £250 4 years ago through my complaint to fos-or will that make any difference Sara ?

Sara (Debt Camel) says

then £250 will be taken off the redress that provident calculate. Which is the fair way to do it.

Jenny says

I had this trouble once you come off the page to get your code the code is no longer accepted what I did was I stayed on the page and then got my daughter to sign in to my Google account on another phone to get my code once you put the code in it last 7 days hope this helps

Maria Murphy says

Jenny I copy the code once it arrives to my email then paste it, much quicker. The same had been happening to me and it was quite annoying having to resend for a new code. They don’t give you long enough to type it in, I mean literally 30 seconds which is ridiculous.

Jenny says

Still not heard anything sent them a email as couldn’t get through on the phone and they sent a email saying not redressed your out come yet will be done in April 22 but no actual date

Matt says

I had the same thing still not heard anything

Rozanne says

I haven’t heard anything as yet.

Matt S says

Well my claim has been upheld on the 3rd and last loans out of 9. I’ve appealed it as no idea why they would only randomly pick that 2. So annoying that i missed out by a matter of weeks at the FOS (my investigation was already there a couple of months when the scheme was proposed).

Catherine says

I only just missed out too. The FOS had started on mine cause they’d asked me for bank statements. It’s so frustrating knowing what they should be awarding us and what we are actually going to get from them. You’ll probably get the standard reply that they’re not upholding your appeal and sending it to a advisor. Seems everybody is getting that reply to a appeal.

Adreva says

Anyone else have issues with there appeal form not having enough characters to fully explain the issues why the assessment is wrong.

Sara (Debt Camel) says

I suggest you say you want to provide further information but there isn’t enough space as the last line.

Adreva says

Good Morning,

Received the following when queried with Provident.

Thank you for your message.

Unfortunately, we only have the space available in the appeal boxes for your information. Is it possible you can shorten the appeal. i.e bullet points

Kind Regards

This is aboustley disgusting , how can you fully appeal like they want when your limited as to what you can say

Sara (Debt Camel) says

I suggest you reply that if it has to go to the Scheme adjudicator then you expect to be able to provide full information as it is unreasonable to restrict what you can say.

adreva says

I will do thanks Sarah. This scheme gets worse and worse, delays, nonsensical decisions and now an awful appeals process

Tink85 says

Hi,

I emailed them the full resin for my appeal and said I could but fit in all the information in the comment box. I had an email back saying they would add the information. May be worth emailing it all to them.

sue says

I have been told by provident the refund is only 1,5% of what you borrowed and that of the 9000 i will only receive 425 pounds which is really low I have appealed as I dis agree with the percentage of interest they have given as an interest rate when your saying it should be 8%.

Sara (Debt Camel) says

I think you may have misunderstood.

Provident are telling people they will pay out about 4-6% of the calculated amount. Not 1.5%.

the 8% that is being talked about here is NOT the % that provident will pay out. It is part of the way provident calulated the compnsation you should have got.

I am sorry you will get so little. Before this Scheme you would have got £9,000. But you won’t win an appeal saying that the payout percentage is too low.

William says

I made a claim in October 2020 .Some one I know applied after me and received over £2000.00 My claim was not done and when they contacted me I was told my claim was being entered into the scheme which I couldn’t understand why it took ten months it should have been done when it went in Ireceived a decision last week stating I was to receive between £230 and £355 which I was furious about because the net amount was £6000

It has been sent to adjudicator but not expecting good out cone

Sara (Debt Camel) says

Claims are not being assessed in date order. I understand why this is annoying but there is nothing you can do about it.

I received a decision last week stating I was to receive between £230 and £355 which I was furious about because the net amount was £6000

You can’t appear the percentage you are being paid. If you don’t think enough loans were upheld, then you can appeal and give reasons why more loans should be upheld.

But everyone will be paid the same 4-6% that you have been quoted… it’s pathetically little and a disgrace that Provident have been allowed to get away with this. But the Scheme was voted on and approved and it cannot now be challenged.

Lynn says

Does anyone know what will happen in terms of the defaulted loan being with a debt collecting agency? My loans were taken out around 10 years ago and I’ve been paying Lowell £1 per week for about 4 years for over £1000 provident debt. I don’t expect nor care about receiving a cash payout, I just want to be sure that the Lowell debt will be wiped.

Sara (Debt Camel) says

I hope that the assessed refund will first be used to clear the Lowell debt

kat says

Ive just heard my 2 loans are upheld but it does not mention anything about taking them off my credit file. Do we know when we can expect them to take it off the credit file?

Sara (Debt Camel) says

Do the loans show missed /late payments or defaults?

Kat says

Missed and late payments. That is all. No default.

Sara (Debt Camel) says

ok , well either the missed/late payments will be removed or the whole debt will be deleted. but provident are going to do all of these at the same time, so possibly July or August?

kenny says

Have just had an email from SOA provident upholding some not all of my claims and they state that

I may get comensation of between £298.97p and £448.46p this is totaly unnaceptable..

can I make a complaint to the financial ombudsman..???

Had an email from shorttermlending@financial-ombudsman.org.uk saying they coundlt help as SOA were dealing with it. AM CONFUSED.

Thought thats what the Financial Ombudsman was for to make a complaint. And have them look into matters.

ANY IDEAS ?? SUGESTIONS ??

many thanks.

Sara (Debt Camel) says

You have made a claim to the Scheme set up by Provident. This Scheme is a procedure Provident proposed so they would not have to pay people proper compensation. Unfortunately customers voted to approve the Scheme.

In a Scheme you cannot send a complaint to the Ombudsman or go to court – I am afraid the pathetic amount they are offering is all you will get.

adele says

I have been given an offer and have appealed it. Just wondering – if Provident have a cap of £50 million to give compensation to just over 4 million customers then why are they offering us so little? After paying everyone out what happens to the remainder of the £50 million – does this get shared out to their customers?

Sara (Debt Camel) says

50m divided by 4m is £!2.50 each … but of course not all 4m customers have made a complaint. All the £50m will be being divided, there won’t be any left at the end.

Sarah says

Hi iv just not heard anything about my claim

Jenny says

Same here nothing contacted them and they said April 22 no actual date

Jasmine says

Two loans classed as unaffordable

The total estimated amount of money you may receive as compensation is between £9.51 and £14.26.

This is calculated as £237.68 x 4 to 6 pence in the pound = £9.51 to £14.26

Does this mean mi awardees between £9.51 and £14.26???

Really omg !

Sara (Debt Camel) says

how many loans did you have?

Jasmine says

4 in total , two with ticks unaffordable

And 2 with X’s affordable

Am I reading it right thats all I’m eligable for ?

These are them

940.00

✓

£32.01

£0.00

Home Credit

£800.00

✗

£0.00

£0.00

Home Credit

£300.00

✓

£297.89

£0.00

Home Credit

£300.00

✗

£0.00

£92.22

Totals

£329.90

£92.22

£237.68

Previous compensation paid

£0.00

Net Claim Value after deducting previous compensation

£237.68

Estimated compensation £9.51 to £14.26

Sara (Debt Camel) says

It’s hard to read that. the New Claim Value looks loe.

Can you tell from the heading what the £92.77 is?

Are you sure you only had 4 loans?

You also need the details of the loans – the date taken, the date repaid, the interest paid etc. Until you do, you can’t tell if they should have upheld other loans.

I suggest you email them and say you want to appeal but first you need all the loan details.

Jasmine says

Hello ,

The £92.22 is the outstanding balance .

Over the years I have had more than 4 loans

I don’t have documentation of the older loans .

Sara (Debt Camel) says

ok then I suggest you ask them for a list of the loans, with the details, and say you have had more loans than that.

Dee says

Hi Sara got my redress email says appeal in 30 days then payment will be made in July have I read this right. Thank you. And does anyone know any thing about piggybank got my redress letter 9 months ago not hearD anything else.

Diane says

Not heard anything yet, was told by the last email 7th April that we’ll hear March/April, I assumed 22nd April for some reason.

I’ve just emailed them just to ask if they can kindly let me know by email of any updates due to continuous issues of logging in to the Portal.

How would those manage if they’ve no internet facilities who have put in a claim? There’s people I know especially elderly that do not have the relevant facilities.

KENNY says

TRYING TO LOG INTO THE SCHEME OF ARRANGEMENT and when wait for the authentication code its been many days since am still waiting for them to send code.

How is anyone supposed to log in when they do not send provide authentication code ???? its crazy..

They are deliberatly delaying have feel as you have to make complaint on the sceme page.. once passed the 30 day deadline we wont be able to complain or appeal . ???

Anyone else had this problem ??????

Kenny

eck loran says

the code is sent within 2 mins by email try your spam folder code only last 20 mins then you need a new one

Paul says

Still no email about my claim.

I’m only expecting loose change though,

Hayley Brown says

I wasn’t expecting anything really either, I had 4 loans in total and they disregarded the first one with it being 200. The total for the other 3 was 1400 and it says on mine I’m looking to get between 50-80£

Paul says

It seems my redress will be £90+, which is great as I’d set myself up to expect about a fiver. I’m happy to wait until July for that.

Just need QuickQuid to pull their fingers out now.

Richard says

Still waiting to hear about my claim….will be interesting cos i had rolling loans for the entire time…i cant remember how many….and as the agent ….we can do you top ups….thats means get a loan to pay od another….and that was ongoing for so many years…..so will be interesting

Paula says

I’m the same paid one off to get another with said loan, still not heard anything yet

Jade collins says

I appealed and I had an email today saying they have recieved my information and have attached it to my appeal. Not sure what that means.

Denise says

Hello there.

This article just popped up in my news feed

https://www.chroniclelive.co.uk/news/uk-news/provident-mis-selling-loans-compensation-23718461

I hope that you don’t mind me posting this?

Julie says

How many of us do you think are still waiting to hear our outcome, I hope we will hear something by the end of April and it does not extend into May

Constantin says

I didn’t receive any letter or any email about my claim . I don’t have any idea how much I have to receive.

Jenny says

I’m still waiting the lady at provident said we might not hear until June

Julie says

Wow June now, that’s new info and not the best news If that’s the case then I doubt the payouts will be in July if the rest of us are still yet to receive any decision on our claim, let’s hope it’s end of April and no longer

Sean says

Im still waiting, i imagine there is alot of us, i like to believe the longer we wait the bigger the refund, i know that isn’t the case but its a nice thought haha 🤣😊

Annie says

Think lady or the man I spoke to said find out by end of April payments by June or July I’ve not heard anything as yet either

Emma Port says

If we haven’t heard anything does that mean we’re not getting anything haha nearly at the end of April now not getting my hopes up

Sara (Debt Camel) says

no lots of people haven’t heard.

And you will be told even if your claim is being rejected.

gillian says

I spoke to someone today to give my mums bank details, said they will make payment in June, I’m appealing mine, can anyone say how long they waited for a response,

Squirrel says

I appealed and got a response within a week that they hadn’t changed their decision and it would go to an independent adjudicator which could take up to 60 days.

Jenny says

Received 6 out of 17 loans estimated compensation is between 226.49 to 339.74 I’m happy with that thought it would be a lot lower and also received a additional cheque for 139.00 for over paying

Tracy says

Did you get this letter in the post? I’ve downloaded it on line and said cheque enclosed but no cheque, thanks in advance

Jenny says

They said it will be sent out separately it was a email I got

Paul says

Email through

255 issued as a result of paid after aug-21

and 111 ish quid based on a rather poor 4-6p in the pound (2800 upheld)

Tim says

Well got the response today:, 6 out of my 11 loans were found to be unaffordable. Compensation will be £87.83 to

£131.74 and they wrote my balances off which to be fair were around £900.

In the email It also mentions “Additionally, please find your refund cheque for £217.07 enclosed. This refund is for any money

you have paid to us after 27 August 2021′, So it looks like any payments frim 27th August made until they wrote the loans off in December will be refunded back. However it is an email and not a letter so obviously no cheque enclosed. I have just rang them to see if they were sending the same email ( and cheque) by post and was told that this was the first they had heard of any refund cheques and as far as they are aware no letters are being sent out. They are meant to be calling me back regarding this. My redress amount will be paid by 1st July.

Sara (Debt Camel) says

if you see the other comments here, today, several other people have also received this email!

Sam says

Had my outcome on the portal which was a surprise because I’d totally forgotten about it.

It seems I’m due a refund of payments made since August 2021 and says cheque enclosed – has anyone received the actual letter with the cheque?

I understand the compensation itself is separate and the amount for that is not fixed and I’ve updated my bank details for that.

Sonia says

I have had no issue logging into my portal everyday for weeks to check…the morning I get my email with my decision I cant log in..apparently there’s an issue with the site

Constantin says

Just receive my claim and I would like to know if it’s good or not

£300.00 ✗

£1290.00 ✗

£200.00 ✗

£500 ✗

£1500.00 ✓

And my compensation will be between £49.60 to £74.39

And another thing is this “Additionally, please find your refund cheque for £216.00 enclosed. This refund is for any money you have paid to us after 27th August 2021. If you have not done so, please stop paying us.” and I would like to know if I will receive £216 as well . Thank you 🙏

Sara (Debt Camel) says

Did they enclose the cheque?

Constantin says

I don’t know if they did enclose the check. And I wonder where I can find which loan was affordable and which was unaffordable. Thanks 🙏

Sara (Debt Camel) says

Ask them to supply a list of all of your loans and give the date details and how much interest was paid on each loan – without this you can’t tell if their offer is reasonable or not.

Tracy says

I had similar email but no cheque enclosed?

Julie says

Yes looks like the majority of us that was still waiting for our outcomes have now got a response… I have finally received my redress outcome I had 18 loans and 9 have been upheld Total loans£5068.31 estimated compensation between £202.73-£304.10 I also got the message your refund cheque of £70 is enclosed but as it’s an email No cheque so not sure when this will arrive, they should just pay it to the bank account we provide them through the portal… anyway I don’t think I will appeal even though I think the other loans should have been upheld, my outstanding loans are cleared so that’s the main thing for me.

Laura says

I’ve just had email saying refund cheques will be sent via post. Compensation will be by separate cheque or BACS (if you provide them with bank details) they aim to have this all sorted by 1st July. I suggest logging on to portal and updating bank / address details.