Contents

Quick overview

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

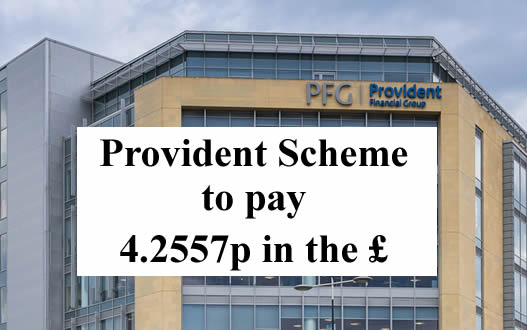

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

olivia says

HI, i made a claim online,but heard nothing as yet,are people getting letters or will they be told by email? thank you.

Diane says

Hi. My hubby was informed by email over two weeks ago, the email states you have an important message in the portal, so you log in to your portal once they send you a message.

Unfortunately, my hubby was unsuccessful but have since requested for copies of his loans, dates etc which he received today, he’s going through them at the moment.

I’ve not heard anything on mine yet though.

Good luck.

Siobhan McMurdo says

I had a refund of 3 out of 5 provident loads last year through FOS.

I’ve had an email from provident today saying my claim has been upheld, one of the 2 loans that weren’t upheld through FOS is considered unaffordable by provident. However the refund shows £1250 but then they have taken off the £2.5k I was refunded through FOS so my redress is 0, the refund for FOS was for other loans not the one they’ve said was unaffordable?

Sara (Debt Camel) says

think of the loans as beint,1,2,3,4,5 tkaen in order.

Which 3 loans did the ombudsman uphold?

Which 1 loans is Provident upholding?

Siobhan McMurdo says

Loans 3,4 and 5 were upheld. Provident is saying loan 2 was unaffordable. I wasn’t really expecting anything anyway because I had a refund through FOS

Sara (Debt Camel) says

say you want to appeal Provident’s decision not to uphold loans 3,4 and 5. Sounds like a very poor decision.

If Provident uphold loans 2,3,4,5 then you will get a refund on loan 2. the refunds on loans 3,4 and 5 will be canceled out by the one you have already had, which is fair enough!

Kirsty says

I really don’t understand any of the way this works, they have 50mil to give to people who had unaffordable loans and Iv read that they think it will affect 4.5 mil people, but what I can gather people are only going to get a amount that’s small, so I know I probably had about 10-14 loans with provident, but some of the loans where in the early 2000 and they are not classing the ones b4 2007.

My loans where for between £400-£500 I can’t remember the amounts and I always received my loans in cash from my agent and always paid cash every week,

So that means I won’t get back the interest I paid that was extortionate. It’s all so confusing

Sara (Debt Camel) says

I assume you have made a complaint and are waiting to hear if it has been upheld or not.

It is correct that loans before 2007 will not be considered I am afraid. Refunds are given because of a change in the law in April 2007.

Cathy says

I am yet to have a decision. I contacted Provident and they said I should hear back in April 2022. Wouldn’t that be too late to appeal any decision against my claim?

Sara (Debt Camel) says

no, the deadline to make an appeal will start from the point you are told what the decision is.

Julie says

Hi, do you think provident started sending out letters and emails to the people whose complaints were rejected early so that they can start the appeals process to give them the 30 day window so all of this is done and dusted in April… so maybe the rest of us whom have not heard anything yet might actually be lucky enough to get our complaints upheld with some offer of payment, I am yet to hear from them

Sara (Debt Camel) says

I have no idea. Sorry, not much point in guessing about this.

Julie says

Hi Sara

I have just spoken to a member of the provident staff this morning, she has said that their are delays in processing all claims so the deadline is no longer first week in April but now looks like it could be end of April or longer for everyone to get an outcome, so as usual the deadlines given are never met, she just said to check the claims portal or wait for an email, so your right no point speculating those that have not heard anything we just have to wait

Robert Liddell says

I see provident are paying out £30M to shareholders in dividends I thought it was illegal to pay company dividends while making a loss! Time our Government got their act together.

Sara (Debt Camel) says

Not illegal but pretty revolting.

30m would have been a decent addition to the 50m in the post for paying redress to mis-sold customers. But provident doesnt care about you and loves its well off shareholders.

Gemma says

I’ve just had a reply from the soa email saying everyone will be contacted by the end of march april. If there loan is upheld payments will be received by June/July 2022. Hope this helps.

Gemma says

Sorry loans if upheld will have outcome of amount payable in June/July not the funds. But we will find out before April is over if loan is upheld. So still have a way to go yet before anyone finds out how much they could be due?

Sara (Debt Camel) says

yes.

Nicola says

Just an update on my claim. Mine was upheld . £1400 this was against a Fresh Start load from 2011. Provident bought a debt and then I owed it to them . After sometime I questioned this . Provident then stopped calling for payments . I was never chased in any shape of form for any further payments . I’ve checked my credit file and nothing is on there outstanding for Provident or anyone else for that matter and even if it was surely the limitations act make it unlawful for them to try and take this amount which is questionable that owe to them to offset it and avoid paying me any compensation . Does anyone know if this scheme is allowed to over rule statute barring laws? They also cannot provide me with any information on who the debt was originally for because for all I know they may have resold it and I then paid it off to the new debtor. I have appealed on these grounds .

Sara (Debt Camel) says

So you never knew what lender/debt the Fresh Start loan related to? You should be told that if you say you are disputing that you ever owed the amount.

Are you sure the fresh Start loan was not clearing some provident doorstep lending debt?

If a debt is statute barred, it still legally exists, so it would be valid to offset it.

Nicola says

The only loans I ever had from Provident were £200, £100 etc and were cleared and I remember the agent said they’d bought my debt and now I owed them. Provident have said they can’t tell me who the original lender was and I was too check my credit file and there’s nothing on there. This was £2390. £1400 outstanding (so they say) so they want to keep my compensation.

Sara (Debt Camel) says

I think they should be able to tell you where the debt came from. Why didn’t you challenge this years ago?

Nicola says

I did . I wrote and asked and the agent just stopped calling to collect and the phone calls to pay stopped. I wrote a 2nd time and nothing. So I presumed they’d realised they could no longer collect and I was happy that I no longer had nothing to pay hanging over my head. So why now do they think it’s fine for them to try and take the compensation and use it against this? It’s not inflated interest .. it’s the full balance they say I’m owed yet using it to pay it off … it’s all messy and a little under handed. They were called Fresh Start loans. If you google it you’ll find others who had the same loans.

Sara (Debt Camel) says

Put exactly this in your appeal.

Rik Bevin says

Emailed soa@provident.co.uk earlier today and asked for an update – replied within an hour and said :-

Thank you for contacting us about the Provident Scheme of Arrangement.

The claim is still under review hopefully this month you should hear something.

Faye says

My husband has had his response today. They have upheld two out of five loans (each being the two lowest value loans he took out, £100 and £150 – the other three were for considerably more) his “estimated” redress is between £8 and £13. Being on a debt management plan our credit file full of missed payments and late payments so he would like to appeal the decision. What is the best way of doing this please? Will he need to provide evidence? What evidence are they likely to want? What information should he ask for?

Many thanks :-)

Sara (Debt Camel) says

where were these two loans in the sequence of 5 loans he took out?

Faye says

Loans 2 and 3 have been upheld. On a positive, I have just recieved my email for the loans I took out and all three of the loans I had have been upheld :-)

Sara (Debt Camel) says

and was there a big gap between loans 3 being repaid and loan 4?

Faye says

I have requested these details, having just gone back through bank statements, from what I can work out:

Loan 1 taken 14.11.17 repaid 27.04.18

Loan 2 taken 11.05.18 repaid 27.12.18

Loan 3 taken 02.01.18 repaid 27.08.18

Loan 4 taken 03.09.18 repaid 27.09.19

Loan 5 taken 29.10.19 repaid in full but my laptop died. Judging by the monthly payments would definately say it was paid over the course of a year.

Marc says

Faye,

Would you mind if asked you if they are definitely suggesting you would be receiving between £8 and £13 as your redress as ‘cash in your bank’ and that are not indicating that they are going to use your redress to pay something else off resulting in you receiving nothing.

It’s just you might actually be the 1st upheld claim that I’ve heard of that is actually going to result in a pay out to the customer.

This could be the turning point where they actually start telling people they will get something out of scheme after they’ve closed all claims.

Faye says

Hi, yes, claim upheld will actually recieve money- albeit a pitiful amount! All loans were paid in full so there isn’t anything to pay off if that makes sense. Like you say…. hopefully this is a turning point and some clarification for anyone still waiting :-)

mark says

Well got my outcome tonight 15 loans in total I had 6 were unaffordable so I will get around £13-£20 back compensation put an appeal in straight away what a joke

Sara (Debt Camel) says

That sounds very odd.

Have they told you how large the loans were, the interest you paid on each loan and the dates the loans were taken out and repaid?

Evie says

My brother just got his email. They have upheld most of his loans to the value of just over £8000 but taken the amount of £8778 off as already received this in compensation. Which isn’t correct him and my dad both have same name and live at same address and my dad made claim via FOS in 2020. He asked for them to remove the amount of £8778 from their calculations as thats not correct information for his claim.

Marc says

I guess it was too much to ask to expect them to check the D.O.B. to make sure it was the same person. That’s a bit crap isn’t it, considering they are dealing with people’s credit files too.

Evie says

We personally think they’ve tried to make it look good they’ve upheld a few of his high loans with no intention of giving him anything because they’ve said he’s already received that amount. So now they should remove that amount as he’s appealed stating their error and remove that amount from his calculations. The loan information is correct so surely they can’t go back and say oh no we now think those loans were affordable.

Evie says

Sara

Do you think now as they have upheld his loans, and they are his loans as he has doubled checked them but the £8778 taken off was for my dad complaint, they will now need to honour the loans upheld?

So he should get £320- £480 if it between 4-6%

Sara (Debt Camel) says

I hope so!

Evie says

I hope so too, as it something. I told him to download and save the letter from the portal so he got it there, if they go in and look at full claim again. As we kind of think they awarded him the loans because they thought he wouldn’t be getting anything due to him already having successful claim via FOS but that’s wasn’t his.

Roly says

That is terrible, though sadly not surprising that they’d conflate 2 different claims.

Odd question, but can I ask if the fact the payout to your father was higher than the accepted claim for your brother’s accepted loans, if they then ‘wrote off’ the difference, or if they assumed this meant your brother owed them money?

Sara (Debt Camel) says

If Provident’s new assessment is lower than the redress someone had been paid, you will NOT be asked to repay any of it.

Roly says

Thanks Sara, I submitted a claim as they did not include my payday loans in the complaint I made for the doorstep ones which were upheld by ombudsman and redress paid, so was concerned I might end up owing them money!

Evie says

He didn’t have anything outstanding but they have on his letter he downloaded compensation already paid £8778 taking him to 0 due as £8778 was higher than his upheld claim but he’s contacted them and appealed as this amount £8778 wasn’t paid on any of his loans but my dads. So in theory his appeal should be simple take the incorrect compensation already paid off and pay him his redress he is due.

Catherine says

Wow they seem to have a habit of doing this. When I first put my claim into provident in 2020 they sent me a breakdown of all my loans but included all my mums too which is a major data protection breach. I informed them on this and my mum put in a complaint about it. They apologised and gave her £100 as compensation. I wish I’d took it further cause that should never happen and seem it’s not a isolated incident.

Rik says

Just got mine and think its a standard type but im getting nothing :_

Your claim for compensation in the Provident Scheme of Arrangement has been upheld.

Good news! We have written off all loan amounts you have owed to us. Even though your upheld claim

won’t cover all your outstanding balance, we have written this off. You do not owe us any money.

All My loans were fully repaid and owed them nothing so this is a load of rubbish!!!

Sara (Debt Camel) says

reply saying that you didn’t owe them any money and ask them to explain why they think you do

Andy says

Just had the outcome of my claim, 1 out of 6 loans upheld with a claim value of £327.44. However they state at the bottom of the calculation that the estimated compensation to be paid to me will be £13.10 to £19.65. Just thought I share this to give you all an idea of what to expect.

Sara (Debt Camel) says

do you think the 1 out of 6 loans is fair? Was the uphold loan the largest one? The last one?

james says

they are giving between 4% and 6% as told in the claims outcome…for every 100 they are giving £4-£6

Helen says

That would prob be right , there will be no large sums for anyone 50 mil devided by 4 mil doesn’t leave much more then £10. They relying on wiping loans

People are assuming they will get £1000s or even hundreds but that’s not the case the pot doesn’t even allow for 6% if 70% win there claim

So if the interest was £100 6%. £6 in every £100 , individual cases will be based on what they still owe or if there loan was written off or sold there will be many out of pocket , yet the interest they are claiming on this money is huge every day people appeal.

They will want people to appeal as it gets them interest on this money daily that they keep …

The 6% was a guide only

They will be court outlined and checked it says appeals go to an individual party if someone isn’t satisfied it’s still not likely to be overturned because the court would have approved whatever they are offering. ( guidelines on approval would have been approved by the court) All a third party instructed will do is check they have followed the guide they put into the court.

They saying 6% of what’s owed that wasn’t a guarantee they have no idea as stated what percentage you would get they are guessing based on ombudsman figures that 75-80% of people will be approved so that’s 3 million bare in mind some had three loans to others having around 50 loans over that period hence Martin Lewis saying some may get a few hundred but for the majority it will just clear the debt they had .

Sara (Debt Camel) says

I think they are assuming a lot less than 10% of people will have made a claim

mark says

Hi Sara no it only gives me the loan agreement number the loan amount my biggest was £350 it it was affordable or not so each loan gers a tick if its affordable or a cross if its unaffordable then the loan balance no mention of interest or dates

Sara (Debt Camel) says

go back and ask them for the details.

james says

below is a partial part of the multiple page message i got

Your claim for compensation in the Provident Scheme of Arrangement has been upheld. If you had

an outstanding balance on your loan(s) as of 27

th August 2021, your total outstanding balance has

been written off in full. You do not owe us any money.

What else do you need to know?

● The claim rules are set out in the Explanatory Statement. You can find a link to the statement at

the end of this statement.

Are you owed compensation?

● Your claim has been upheld. This means that you are eligible to receive compensation.

● We are unable to tell you the exact amount of compensation you will receive until all claims have

been agreed.

● Based on the claims that we have received to date, we estimate that the pence in the pound rate

of compensation to be paid to each customer will be between 4-6p.

● This means on a claim for £100 in compensation, the customer will receive between £4 – £6.

SR says

Received my outcome, only 4 out of 10 loans were upheld so appeal has gone straight in.

They have said based on the claims they have received, they estimate that the pence in the pound will be 4-6p. So for £100 compensation they estimate you will get £4-6.

Absolute joke.

Sara (Debt Camel) says

that is what people voted for.

Gemma says

Ppl didn’t really understand what they were voting for did they? We all thought we were voting for a scheme to allow us all to be compensated lol … little did we know how little but again the reward for me was and is having my credit file sorted. Something once upon time none of us thought would happen

Sara (Debt Camel) says

No, Provident failed to explain clearly how little people were likely to get.

At least your credit record will be cleaned , that is something.

John Earle says

Same here.

Received notification today.

Total of 9 loans, no difference is circumstances, but only 1 loan upheld. A total of £10 to £16 awarded.

In answer to your questions Sara, yes for amount of loan, no interest indicated, no to when loans taken out and repaid. Only that they had been repaid

Sara (Debt Camel) says

so unless you think this is fair, i suggest you go back and ask for the details of the loans as without them you are unable to properly write an appeal,

Carl says

My brother got the same answer as me we are upholding your claim however you owe more than your claim but we are going to wipe your dept clear myself and my brother owed provident nothing my dept was squashed by the manager of the Warrington branch after I had a brain hemorrhage and was in hospital for four months which has left me disabled if he hadn’t of done that I would have claimed sooner like I did with all my payday loans what makes us both laugh they only show four loans I the time period 2007 to 2017 I think I know and my brother knows we had a lot more loans than that just in my time period 2007 to 2012 I have asked for this information twice and still not received it I put the appeal in but got exactly the same message as I got first time back to the word it’s a joke

Gemma says

So basically from

My point of view the biggest thing for me was having my credit file cleared because my outstanding loan was still £2,000 even though I had paid over £3,000 in interest. The pennies that everyone is going to get offered is ridiculous they know most ppl won’t even

Bother to claim

It. I’m not even remotely bothered waiting for an outcome I was until I’ve read what everyone is being offered. We are all released from the endless cycle of constantly chasing our tail to keep repayments up on loans that should never have been given to us. And this is the freedom in all of this.

Gemma says

Interesting that today being April fools day that we all start to get our decisions! 👏🏻👏🏻👏🏻👏🏻 Provident! Just about sums the company up.

Nic 51 says

I was really annoyed with the claims process and in the end gave up as the portal wouldn’t allow me to log in. In hindsight I don’t feel like I have missed anything significant as the redress seems to be so unfair

Diane says

Hi

I’ve been having the same issues so emailed them last week to let them know that the portal is stating invalid email address, I said well you’ve been emailing me fine on it. So they left the link to try again. And still having issues.

Ed says

I cannot log in to the portal either, it says the same thing, and everything is correct as I wrote it all down! I tried emailing them and that was returned unsent! what valid email can I use to contact them, please?

Laura says

I am gutted. I had 2 loans with Satsuma. The first one for £100 which they have upheld as unaffordable. However the second loan was for £2000 which went straight on to my DMP and they are not upholding it. Doesn’t make any sense. I will of course appeal but feel so shocked.

Sara (Debt Camel) says

can you get your bank statements for the 3 months before the 2nd loan. And a copy of your current credit record. Attach those to the Appeal.

Laura says

I will try Sara. I am rubbish at anything technical and don’t really know how to attach them to the appeal. Just can’t understand that they can’t see that it was placed on Payplan. But yes I will do all I can. Thank You

Kieron says

I got the same email only one of my 3 loans was classed as not affordable wich was 200 then my other 200 and then a 600 was xlassed as adfordable should i appeal to at keast get abit more compo back for the 200 and 600 ones ot confuses me

Sara (Debt Camel) says

what order were these loans (eg 200, 600, 200) and which one was upheld?

Alison says

I couldn’t even open the downloaded letter to read about my outcome!!

Gemma says

I don’t even see the point in appeal it just adds more stress and how much extra are any of us going to get if any?a few extra quid. I would rather not put myself through it. We no longer have hefty loans to repay. And hopefully a lesson to us all not to enter such a dreadful cycle of debt again. I can safely say provident took years of my life through the constant stress of trying to make payments.It made me very Ill so not to have all that on my head is reward enough. Yes of course some decent refund would have been great wouldn’t it but in hindsight we should have all gone to FOS if anyone has unaffordable loans still in place make sure you pursue that process now. As you will have far better chance of getting a good outcome because they are fair.

Sara (Debt Camel) says

A practical view. The best way to get your revenge on Provident for this shambles is never to use any of their other brands that are still going – avoid Vanquis, Moneybarn and their new high cost loan brand, the delightfully named Sunflower.

But for other people, the difference between getting £15 and £50 back now is worth sending a few emails for…

Carl says

I totally agree with you the appeal is not worth the stress I have appeal and the reply I got back was the same email they sent me in the first place to the word asked for my loan list from 2007 to 2013 twice and received nothing back they are a joke they upheld two out of four loans I think and I know I had miles more loans than that wish I would have claimed back in 2013 but I had never heard of unaffordable loans until I seen it on debt camel I had claim ppi back and since seeing this on debt camel I got a few claims back off payday loans

Gemma says

I think a lot of lenders will

Now be worried as now ppl are more educated with all this, about FOS and ppl are also more likely to win awards now because of this. Ppl are starting to realise that if loans were Miss sold they have a case!

Sharon brombley says

Is everyone hearing now as my portal still says no statement yet under the redress tab

Debbie says

I still haven’t heard from them

Lisa says

No word here either.

Cathy says

Me neither

Paula says

I still haven’t heard a thing either

Simon says

I had 6 loans and says only 1 is unaffordable my mum used to pay most of my provident loans each week for me when she paid hers as I couldn’t afford them. Out of £3700 of loans they’re agreeing to 1 of £400 when there was £1500 £800 and others higher

Sara (Debt Camel) says

Were there any big breaks between the loans or did you normally have one from them?

Can you list the loans in date order with the size:

eg 200, 400, 800, 400, 1500, 610 etc

Simon says

They haven’t given me any data on the info they put on the portal other than the agreement numbers and the amounts, in order on the list £600(the one they’re saying is unaffordable),£1500,£400,£800,£400 I don’t remember ever having a break from them since I got my first one.

Sara (Debt Camel) says

I can’t see how the second loan of 1500 is affordable if the first one wasn’t.

Simon says

I don’t remember any of them being affordable think I only had a part time job for most the time of them

Sara (Debt Camel) says

ok so you need to get your bank statements from that time and send in an appeal.

Simon says

I’m not with the same bank as then so that’ll never work I don’t have a clue what bank I was with either

Richard says

I’ve just had a message in the portal that 45 out of 47 loans in this period have been upheld as unaffordable.

I had submitted medical (GP 11 Page letter) and social worker evidence .

If I get 1p back I will be happy.

Evie says

Well that great they’ve took responsibility that they were unaffordable. If it’s between 4-6% of the actual redress they’ve stated on others email you might do a bit better than a 1p payment.

I’m still waiting to hear, hopefully not too much longer now.

Laura says

I have decided that I am not going to bother anymore. My £2000 was taken out in panic as I had cancer surgery and panicked that I couldn’t keep up my DMP payments. However this made the situation worse and it too was placed on the DMP. Loan was paid off with full interest. This has got to be on their records and they are ignoring it so I do not trust them with bank statements or any more personal information. I understand for most people this is not an option but I have sent them a letter quoting all this and for me it is put down to a bad experience which I have moved on from.

Bobby Reds says

Sara, I kept telling all these people on here to all vote against the scheme.

Now you got numerous people coming back with results like this from the scheme.

Im actually irritated so many people voted for this foolish scheme, Provident said something like only 7% voted against it lol.

As far as I’m concerned this is what these people wanted so deal with it.

Im waiting on my results from this silly scheme right now…

Sara (Debt Camel) says

As far as I’m concerned this is what these people wanted so deal with it.

the problem is that Provident did not describe it in a simple way and many people thought this was a good way to get some compensation.

Marc says

One point that I understood when the scheme was offered is that if the scheme didn’t go ahead, insolvency was the next option, in which case there would have been even less redress money available. Don’t forget, the £50mil has been offered up by the mothership ‘Provident Financial Plc’ because Provident SPV Ltd didn’t have it, either in cash or total assets. So in an insolvency situation there would have been less money to share out.

I have to say, I also found information on the scheme of arrangement site pretty useful. I signed up for the scheme with my eye’s wide open. I don’t normally read the instructions for anything, but in this instance I actually read pretty much all of the documents and found them useful. There’s a load of stuff covered in there, like the criteria they use for assessing claims etc.

I agree that the situation we’re all in sucks, but for me personally I think it sucks a little bit less when doing it this way instead of just letting them go bust.

I’ve been through the unaffordability claims process with other company’s that did become insolvent and I have to say, the process is pretty much exactly the same as this scheme from the customers point of view, just with less money left in the pot at the end. Seriously, you’re not missing out on anything by voting for the scheme.

Evie says

I think aswell not all customer were notified about scheme and voting I know my parents and brother weren’t until I mentioned it to them to register and vote No to the scheme.

Laura says

No This is not what people wanted. If we are guilty of anything it is trusting these people to be fair

David says

I’ve had my claim assessed and they’ve agreed one loan that I then defaulted on was unaffordable, and I can expect between £4 and £7 pounds to be refunded!

To be honest, I don’t even care about the refund, the big picture for me is getting this default off my record and being able to access credit at a reasonable rate rather than having to turn to sharks like these. I’ve spent years repairing my credit score, its hard work but it can be done, and these companies going to the wall and having to remove their adverse marks make a huge difference.

Lucy says

Hi Sara

I have been following what people have been saying on here I have not heard a thing I am not understanding why some people at the start of this scheme ( when the scheme date closed) , were offered more compensation we are talking 5k to 20 k and now people are only receiving 5 to 10 pound back.

What changed?

Sara (Debt Camel) says

Before Provident announced their Scheme, people could complain and take their complaint to the Ombudsman. 5-10k was a pretty common refund and many people got a lot more.

In the Scheme people were always going to get a lot less – possibly 5-6% of the amount calculated.

So far hardly anyone has commented saying have had a large amount calculated. That could be for several reasons:

1) if someone was happy with the number, they may not have found this page and so never commented

2) Provident may be dealing with low amounts first

3) Provident may not be assessing the loans in the same way the ombudsman would. Some of the comments from people saying they have had small loans upheld and not large ones suggest this may be happening.

L says

Hi Sara,

Provident have upheld one loan out of four. However, one big one I wasn’t working. The online portal really confuses me. I looked at appealing but it doesn’t give me space to write anything. Is there an email address you know about for me to request the dates of the other loans.

Also, annoyingly, I paid off £100 to the last loan (which was most the interest) last summer. Now, for the £147 they owe me, I’ve been quoted as getting £8 back. Frustrating.

Thanks

L says

Hi Sara,

I’ve found this – soa@provident.co.uk thanks

KENNY says

13 loans in total over 4 years. totalling almost 11,000.. with interest total interest aprx 13,000 total £24,000.. had no word from provident or SOA as yet..asked for hard copy actual letter, put in claim ..claims have been accepted on full amounts…as have not heard anything, made complaint to FINCIAL OMBUDSMAN..AWAITING THEIR REPLY..

found myself strugling to repay the loans n Provident KEPT PAYING OFF PREVIOSE LOANS WITH ANOTHER LOAN . WHICH MADE ME FALL BEHIND WITH RENT CONCIL TAX ETC.. THEY DID NOT DO A FULL CREDIT CHECK AS WOULD HAVE FOUND i WAS NOT CREDIT WORTHY.

their interest rates of 181.4% was crazy. Never letme finish loan had me take out another loan to pay of previouse loan but added the sum to the next loan was amzed they are allowed to do that. made a bad situation worse..

meanwhile as provident take their time paying out compensation. the 50 million is sitting in their banks making them interest.

has to be a simple solution.

Thanks

KENNY says

have no objection to repaying the loans I had n no objection to paying interest at a reasonable rate.. banks charge% 6 so even if PROVIDENT took 10% TO %15 ALL I want back is the interest I over paid.. its been said any interest we paid will be repaid in full with interest.. , then its to be repaid in full at 8% per year.

interest on mine aprx £13.000.. so original loans lil over £11.000..

If took out with bank would have to pay back £15711.58 only £2711..interest.. huge difference. from £13.000.

Time somone did something to curb companies charging such high rates.

Wonder how many of the 4million + have till not heard back from SOA or provident.

Really angry at how they are delaying and getting away with earning interest on the 50 million. And then trying to offer complainants like us very little compensation..

Sara (Debt Camel) says

Any interest being earned on the £50m will be tiny. At this point they are dealing with things as fast as I would have expected. The compensation is rubbish, but i am afraid that is the way the Scheme has been set up.

Catherine says

I’ve still not heard anything back. I had around 11 loans and the interest is about £11000. It’s just so annoying that they’ve done this as my claim was with the FOS. Just not looked at in time. Same as amigo loans. I kick myself that I didn’t know about getting money back a few months before cause it would’ve all been sorted. I know I’ve got a good case. Recently took HSBC to the FOS for overdraft interest and charges and won my case against them. Do you know if we will get the 8% internet back in full from provident if we win.

Sara (Debt Camel) says

The 8% part is just a part of your full redress and you will be paid the same low % on all of it I am afraid.

Hayley B says

Sara,

Is there any recourse action at all that can be taken if the SOA does not admit to the prior existence of loans for which you hold irrefutable evidence (credit reports, dates, amounts, missed payments etc).

The High Court approved the SOA based partly on the customers vote, with no objection from the FOS. Surely this High Court Judgement is based on trust that claims will be assessed fairly by adjudicators and with full details of the dates, amounts, missed payments, overlapping of refinanced loans etc.

So, if the SOA does NOT consider all of the evidence available to them (if they can be bothered) and further declines to consider it at appeal, what then? If they can’t play ball fairly within the scheme, then perhaps the High Court should have set a condition of monitoring unsatisfactory resolutions, which should then be decided outside of the scheme by FOS.

I did vote against the scheme, if only to avoid them wriggling out of their responsibilities, which from what I’ve read they are still attempting to do.

What I’m basically asking advice regarding is: If the SOA computer says no, then on appeal says no again …… is there any scope at all to challenge this further?

Sara (Debt Camel) says

If you have evidence of the loans then I would expect they will be taken into account at the appeal stage.

Melanie says

My portal is still saying I don’t have any statements to view. Any idea why this would be as it seems lots of people have received emails

Paula says

I’m the same ,

Geraint says

Hi all! Just had an email from provident saying theres an update on my claim about redress! When i login and try to download the pdf it brings up an error! anyone else getting this ? Anyone able to view their outcome?

Jo says

Hi I didn’t open mine from the email I logged into the portal downloaded from there and it worked

Geraint says

Ive tried this but unfortunately its not working for me :( ive emailed them to see what they say!

MrsR says

I managed to login on Saturday. It was a bit of a faff. Redress of £12.73. Whoop!

Andy says

Morning I got email them today they say between 4-6p to the pound hope this helps you it also tells you should be paid some point after July 1st also tells you what to roughly expect

Catherine says

So I’ve had my decision. Out of 13 loans they’ve upheld 1 and that was one in the middle of all the loans which is crazy. They said the value was £843 and I’ll get between £33-£50. It’s a joke. I’ve appealed their decision.

Adreva says

Received my outcome tonight it’s um interesting

Will post full details later this week but

Loans 1, 2,3 accepted loan 4 not even though taken out when I already had loan 3 running with Satsuma.

I suspect each loan is going through an algorithm and done in isolation and not looking at the full picture.

Sharon brombley says

Just had my redress, 3 out of 7 loans have been marked as unaffordable, with an amount receiving between £32 and £47 better then nothing though

T says

Hi I had a redress payment in April 2020 , it was calculated over the phone by the head of complaint’s Neil Iverson. I have just had my statement from the scheme and it states a further £998. 00 was due in redress after taking off the original redress payment in 2020 for which I am now going to receive between £37 -£57 . Do I have a case to go back to the head of complaint’s and ask why the full amount was not calculated correctly in 2020 because this doesn’t seem fair that because they didn’t pay the correct amount and do their job properly I lose my redress.

Sara (Debt Camel) says

The whole Scheme is unfair. As were the offers Provident often made before. There is nothing you can do about this – apart from decide never ever to have any dealings with provident’s other business, Vanquis and Moneybarn.

T says

Thank you Sara. I have sent a direct email back to Neil iverson to ask him why he didn’t Calculate it correctly. , I’m not expecting to receive a reply but felt I needed an explanation from him. Like others on hear I am thankful that I no longer have to deal with these undercover loan sharks as I am in a better place now but its sad to see they are still ripping their customer’s off in the form of making offer’s of redress that were no were near the % in just the interest alone that they charged vulnerable people.

Gemma says

So I’ve just had my outcome. All my loans bar one was repaid the only one that was remaining was until held the amount of the loan that was owing was £600 they said loan has been wiped etc and I should expect to get back £25/35. I’ve just accepted it. For me the real result was having my loan wiped and the credit file erased. So I wasn’t even bothered about the pennies we was likely to get back. The sad thing is I had six loans over the years with provident I only thought I had two. When ppl are in such a sorry state of affairs in that horrible cycle of debt you forget how many loans you had. Because your constantly snowed under trying to pay them. The day I was released from that was a good day. Lesson learned and I will never be going down that miserable road again. Sara was obviously right there approaching ppl with updates the higher the payments are. So the ppl who will be due a few quid first and upwards. I wish the rest of you who are yet to hear luck of hopefully getting a little bit more. But one thing we can all be glad of is that we are released from this dreadful company. And the extortionate rates of interest.

Daryl says

I’ve heard back from Provident and they have found that one of my four loans was unaffordable.

However, two of them I previously successfully claimed against Satsuma who agreed they were unaffordable and issued redress.

Provident have listed those two loans and stated they *were* affordable, rather than stating they were unaffordable and deducting previously issued redress off.

It won’t affect my outcome, but I’m going to appeal the decision to see it works as it may help others.

Sara (Debt Camel) says

These Scheme decisions get more bizarre every day.

Daryl says

They state that the decision remains unchanged and they will refer to an independent adjudicator (who knows who that is) who has up to 60 days to review my appeal.

I have no idea how they have rejected it. My appeal is not for additional amounts, it’s that they list the the facts correctly. They listed two loans as affordable when they have previously stated they were unaffordable and paid me compenstion. I don’t know how they can’t acknowledge that?

Sara (Debt Camel) says

I am not sure why you care about that?

Daryl says

I am not per se, however in the interest of procedure, I would think they should be clear and accurate with their information.

C Robb says

So I received my dad’s upheld form (sadly he passed away last week)

3 out of 11 loans upheld. No details on interest rates or dates of loans to show that he was in cycle of debt to highlight the unaffordabilty. I am also unsure how they calculated the Gross Claim Value as in one it is less than loan Value,could anyone point me in right direction.

He was offered £28 – £46

Sara (Debt Camel) says

I suggest you go back and ask for a list of loans, their dates, the amount borrowed and the amount of interest paid. without this information you can’t make a decision about whether to appeal the decision.

C Robb says

I submitted an appeal and I will ask for those derails.

I assuming by these posts that there low offers are consistent.

When my dad put in claim the phone handler was appalling wouldn’t listen, blunt and if information didn’t go with the box he had on his screen it was excluded. It was that bad that i requested a copy of the call audio.

I am just not sure this is worth the fight anymore with my dad not here

Joe says

I got my email today, £1500 came to the unaffordable section and they said compensation between £21-£32.

Not sure on how to feel about this, it was very affordable for me and led me to default.

Sara (Debt Camel) says

it was very affordable

I assume that was a typo for unaffordable.

Did you have other loans that they say were affordable? Do you agree with that?

Bonnie says

My claim was upheld. I had only 1 loan for £1,000.

Does anyone know about how they are going to deal with credit reference agencies?

Sara (Debt Camel) says

is this loan marked as defaulted or with missed payments?

Bonnie says

It is not marked as defaulted but it is marked with missed payments

Sara (Debt Camel) says

then the missed payment markers should be removed, or they may simply delete the record.

Nicole says

Hi called them as I wanted to know and I was told my credit file will be cleared in July when they release the compensation.

Not sure if thy helps any.

Geraint says

Has anyone actually received any money from provident yet or have you just been told the amounts you are getting? Be good to know how long they take to pay out.

Sara (Debt Camel) says

No one will be paid until after all the claims and appeals have been resolved.

Geraint says

Oh so that could be a while then! Thanks for clearing that up :)

Caroline says

They are say 4-6p for every £1 abs payment around july

Mark says

Purely based on these comments, the amounts being offered seem to be gradually increasing. I wonder if it’s safe to assume the longer it takes to receive a reply, perhaps the larger the offer might be? Optimistic I know, but one can hope!

Tink says

I hope so… I don’t really care about the amoount I just want the loans removed from my credit file.

Sharon brombley says

My letter says by 1st July 2022 we should all recieve the payment

Jack says

Well received outcome from provident out of 8 loans said had upheld 4. But I really had 14 loans, I rang this morning told 6 were sold and ANY LOANS CUSTOMERS loans that were sold between 2007/2019 ARE NOT COVERED in scheme. So anyone loans sold to any of moorcroft, Cabot, etc these will not be wiped off

Sara (Debt Camel) says

That doesn’t sound right. Go back and ask for that to be put in writing and say you want to appeal it.

Gemma says

All being well we will all be able to get an ice cream each on Provident! 😂😂😂 bottoms up!

Evie says

I’ve always said anything I get I’ll use on my wee ones. I’ve been optimistic about a wee day out so looking like a wee day at the park with some ice cream is on the cards.

Lisa says

Cheers! 🍦🍦 😅

Gemma says

For the ppl asking about credit file when they closed in December and sent out the letters saying don’t make anymore payments your loans have been cleared etc shortly after that my credit file with Experian was cleared all provident loans showed 0 and said in good standing. So check with Experian

Clair warwick says

I have had over 17.000 in loans from greenwood’s and provident between 2000 and 2018 not sure which were between 2007 and 2020 however not sure what ile get back if anything at all . All loans were for between 600 and 1500 each

Chris says

I had mine back, they say 1 loan was upheld but I have an outstanding balance from another of £644 from an initial £900 loan(total loan with interest was £1908) this was passed to DCA and received a CCJ, still have a balance of £217 but still have to pay this off. so not sure where the £644 balance is from, they said I wouldn’t receive anything as the outstanding balance was more than the redress, appeal sent, not holding out much hope.

The 1 upheld was the one that didn’t get me a CCJ, the ones that did were apparently affordable, the CCJ was my main reason for claiming. so after all the messing about back and forth, then the waiting game, it looks like I will get nothing back and still have the CCJ :(

Julie Gardner says

Having been a provident customer since the late 90’s up to 2017 I had a lot of continuous loans some breaks too, I was also a customer of greenwoods probably not for as long alongside provident and also shopacheck, I’ve still heard nothing, I don’t know how many loans I’ve had or the interest I’ve paid my hubby got his email yesterday he’s been between £38-£56 we plan on day out we did owe money when they shut their agent left we had a new one who came a couple of times at wrong payment time and never came back, I’m glad we never paid they wrote off between us £4.4k I’m disabled husband is my carer it’s been that way for 14 years I should of been owed thousands, it’s a relief I’m out of the cycle.

Kev says

Hi all. For those who have received their outcomes. Does it say when they will be paying out? Can you ask for it to be paid straight again if you agree with the decision or do you need to wait until a certain date before they are paying out?

Thanks

Sara (Debt Camel) says

Everyone will be paid at the same time when all complaints and appeals have been decided. Possibly in July. You cant ask for it to be paid earlier as they can’t work out what % everyone will get until all complaints have been decided.

Georgia-Mai says

Was going to ask this too so am glad someone asked thanks Kev.

How are people receiving their outcomes also? Is it by email or by letter? Does it also appear in that ‘Redress Outcome’ tab in the portal?

Joanna says

Hi I received abs email with a link to the redress part of the portal. There was a letter in there