Contents

Quick overview

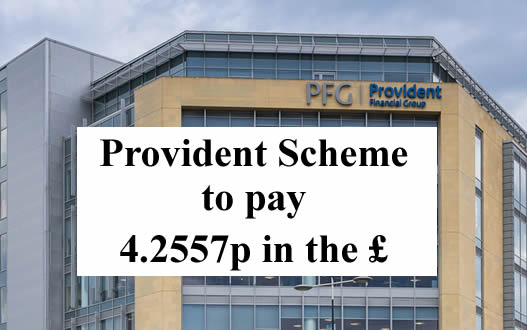

Provident’s Scheme of Arrangement is now in the final stages.

The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident.

The FCA, Provident’s regulator, said it did not approve of the Scheme. But as Provident has stopped providing doorstep loans, the FCA did not object to the Scheme in court.

It started officially on 5 August 2021 after it was approved in court. The deadline for claims was the end of February 2022.

Provident has assessed claims and informed customers of their decision. The large majority of appeals have been held.

Provident is making payments to bank accounts or sending cheques:

- it is paying 4.2557p in the £;

- so if your redress was £1,000, you will receive about £42;

- a final letter will be uploaded to your portal account setting out the payment;

- the first bank payments will be arriving in accounts on Tuesday 5 July.

Here is confirmation from one reader (see the comments below for others):

FUNDS PENDING!!!

Hi all, I’m new to this to thread but just thought I would give an update.

I have a Monzo account, it is showing my Bacs credit as going into my account on Monday, for most people with standard accounts this means you will be be paid Tuesday

I can also confirm it is 4.2557% as stated.

Glad it’s eventually been sorted.

But no-one should assume they will get their payment next week.

They may be going out in batches. And in any mass payment, some of them fail. Do not plan your July finances on the assumption that you will get paid early in the month.

Which loans were covered by the Scheme?

More than 4 million people were given a loan by Provident that comes under the Scheme.

These loans were given between 6 April 2007 and 17 December 2020.

The loans came from four different brands:

- Provident – often called “doorstep loans” or “home credit”;

- Satsuma payday loans;

- Greenwood – another doorstep loan brand that hasn’t been used since 2014;

- Glo – a very small guarantor loan brand.

If you have an affordability complaint about Vanquis or Moneybarn, these complaints are NOT included in the Scheme. You can still make a normal affordability complaint and get a full refund.

The definition of “unaffordable”

A loan is only “affordable” if you could repay it on time and still be able to pay your other debts, bills and living expenses.

You may have paid the loan on time, but it may still have been unaffordable.

If paying Provident left you so short of money you had to borrow more or you got behind with bills then it was “unaffordable”.

If you had several loans without a break between them, then Provident should have realised you were trapped in a cycle of borrowing and that these expensive loans were not affordable. Even a single loan can be unaffordable if it is large.

Provident pays out on old uncashed cheques

In 2018-20 Provident frequently made very poor offers to people that complained, sending a cheque. They frequently used to offer to refund just a few loans, often not the largest or the most recent. For example, in one case with a large number of loans, Provident upheld a loan for £1,000 but decided the next loan for £2,500 was affordable.

Many thousands of people didn’t cash these and instead sent their complaint to the Ombudsman, where they often got ten times as much! who had made affordability complaints.

When the Scheme was announced, people tried to cash the cheques but some cheques were too old to be bankable. Until now Provident has refused to send out a new cheque. In February 2022, at last Provident relented and refunded this money and people can also make a claim to the Scheme for the extra they should have had.

How much will you be paid?

The next stage is for Provident to divide up the £50 million in the Scheme between the people who have had their complaints upheld.

Customers who made a claim have been told which loans have been upheld and what the total redress for these loans is. You will be paid a percentage of this redress number, not all of it.

When the Scheme was voted on, many people thought they were being told that the payout would be 10%, or 10p in the £. I said at the time that that looked unlikely and it could only have been based on an unusually low number of people making a claim.

For several months Provident quoted a range, saying:

Based on the claims that we have received to date, we estimate that the pence in the pound rate of compensation to be paid to each customer will be between 4-6p.

Now it is known that Provident will only be paying 4.2557p in the £.

A final letter will be added to your portal account setting out what you will be paid.

Credit records will be cleaned

In other schemes and Administrations, some people say getting rid of a default was the most important result for them. Not the small cash refund!

For upheld loans, any defaults or missed payments will be removed from your credit record.

This clean up will be done at the end, when they can do everyone’s together. This is very annoying if you want to make a mortgage application, but there is nothing you can do to speed it up.

If your credit record is not cleaned in this process, there will probably be no-one to complain to about this. But there is process for resolving this sort of problem, see Correct credit records by “suppressing” them if the lender has disappeared.

Current loans

Loans that were sold to a debt collector

If your loan was sold to a debt collector, Provident is trying to get this settled. This seems to be taking some time, for example with Lowell saying they haven’t been given the right information from Provident. Several people are complaining about these in the comments below.

Loans that hadn’t been sold were written off in December 2021

In December Provident announced that it was no longer collecting any payments for existing loans:

There is nothing you need to do. You can stop making payments on your outstanding loans owed to PPC and if your payments are taken by the Continuous Payment Authority (CPA), we will stop these for you. Any payments made after 31st December 2021 will be paid back to you.

If you’re in arrears or didn’t pay your loan within the time we agreed when you got your loan, we’ll update your file with our Credit Reference Agency to show the balance as zero and partially settled.

Your credit record is being changed to show that the loan is partially settled or partially satisfied.

If you are a Provident or Satsuma customer, you should have been told about this by email or letter.

That is a pathetic payout

Provident is a successful company with the profitable Vanquis and Moneybarn brands which are still in business. It is a disgrace that the regulator has allowed them to structure their business in a way that has permitted Provident to abandon all its doorstep lending customers and not pay them their proper redress.

If you are feeling mad that Provident has got away with paying you so little, this is the time to look at whether you can make other affordability complaints, not just for loans but for other types of credit.

I have a separate page for each sort, as they need slightly different template letters to complain:

- refunds for large loans, including Moneybarn and other car finance;

- refunds from catalogues and credit cards such as Vanquis;

- refunds from overdrafts.

Ruth says

I did not realise that people are now getting decisions from provident. I only had one loan out which was for 2500 but looking back I feel I was vulnerable at the time. I had just had major cancer surgery and panicked because of large credit card debt. I also was on a dmp for other debt. I contacted them but they refused to reduce any interest so I added them to my DMP. However provident(Satsuma). did not agree that it was unaffordable lending. Don’t hold out much hope for them changing their mind now

Sara (Debt Camel) says

the first few people have started reporting getting decisions in the last few days.

I’m glad you have claimed – £2,500 is a large loan and Satsuma should have checked it would be affordable. If they reject your claim, ask for it to be looked at again. Do you have a copy of your credit record? And your bank statements from the time you took the loan?

What is your current financial situation like? Is the DMP still carrying on?

Ruth mulholland says

Yes Sarah I would be able to access them details to send on. My DMP finished 18 months ago. Thank you for your reply.

Sean says

I’ve started claim now there saying they want more medical information I have none and 0800 056 8936 won’t take calls won’t connect

Sara (Debt Camel) says

That isn’t good :(

how many loans did you have from them?

Stephen Harrison says

Yes, I sent all my medical records and they said conditions are not enough, they want signed letters and documents stating how my medical conditions would have affected my ability to pay. The records I sent were from my Solicitor concerning my health and Head inJury for the high Court, so Amigo and Provident want more than the Law.

Victoria says

Stephen that is awful. I have a feeling that very few of our complaints will be accepted. Provident are making this a very difficult process to win.

Gordon Bangs says

I used to be an agent and a customer for provident and have had roughly 12 loans through them and my mother has had roughly 8 but we have not been contacted and I know the practises of agents using windows or photocopiers to “add” missing signatures to achieve compliance or doctor figures for affordability how can we check

Sara (Debt Camel) says

You and your mum need to contact them urgently to ask for your Scheme Id so you can submit a claim. see https://debtcamel.co.uk/provident-scheme-claim-refund/ for details.

You only have until the end of the month to do this. With 8 and 12 loans you both may well get some refund back.

Doreen says

My claim was not sucessful. A little would have been better than nothing. Their reasons were ‘blanket’ reasons. Your claim was deemed not eligible to receive compensation due to one or more reasons. One size fits all.

stated below:

○ You took out fewer loans over a longer period;

○ There were longer periods of time between each loan you took out;

○ The amount of your loans did not increase by enough in a year;

○ You did not have loans with other loan providers at the same time; or

○ Your loan was not used to pay off a previous loan.

I was like Terri and will be appealing like Sarah… just for the sake of…

Sara (Debt Camel) says

Make sure you ask them for a list of your loans and the interest you paid on each.

Stephen Harrison says

They should not have been allowed to Police these claims, they are corrupt. Give it back to the Ombudsman.

Sara (Debt Camel) says

however much you would like that to happen, it isn’t going to.

Ray Nicholson says

My claim was unsuccessful, same bog standard reasons ;-

Your claim was deemed not eligible to receive compensation due to one or more reasons stated below:

o You took out fewer loans over a longer period;

o There were longer periods of time between each loan you took out;

o The amount of your loans did not increase by enough in a year;

o You did not have loans with other loan providers at the same time; or

o Your loan was not used to pay off a previous loan.

I appealed and asked for loan details, as I can’t remember dates and amounts. They sent me 5 loan agreement numbers and that is all. They also asked me to supply details of any defaults or ccj’s between 2007-220. How do I get those ?…I know I had some but too far back to show on my credit file now

Sara (Debt Camel) says

Ask for them to send you the loan details – how large the loan was, how much interest was paid and the date taken and repaid – point out you cannot make a proper appeal unless you are given the facts.

Ray Nicholson says

A week after requesting details, I’ve still not had a response……with the deadline being Monday, is there anything I can do or is that it?

Sara (Debt Camel) says

How short was this deadline to appeal?

I suggest you say that you are appealing and you will provide the details when they have given you a full list of your loans.

Ray Nicholson says

I have already appealed their decision and asked them for loan details, they responded with only loan reference numbers. Last week I asked for the details of each of those loans as I don’t have the agreements anymore….nothing yet, so do I assume that’s as far as I can go with it?

Lucy says

Sara

I am having the same problem with medical documentation issues. Im sorry but a letter that is sent electronically would not be signed by a doctor right? I cannot go back in time to get that doctor to sign letters that were sent electronically. Plus the doctor no longer works at that surgery they left 2 years ago. I dont even go to that surgery i moved surgery recently.

It clearly states on there site that they will accept other medical evidence but its blaitantly obvious they wont!

The stress is making me ill they wont accept the evidence i gave them so i’m going to just deal with this after the outcome.

The system is virtually impossible.

Sara (Debt Camel) says

Letters sent electronically may be “signed” but often may not.

I think Provident are being unreasonable here.

Sarah says

Looks like they are trying to get out of paying people. Mine has been rejected on the same list as others have posted. Can not be bothered to pursue this any more. Just another example of companies trying to deny responsibility for improper lending. It was bad enough trying to get anything out of Wonga. Doesn’t look like this will be successful either. :(

Sara (Debt Camel) says

A lot of people have won appeals in other administrations/Schemes.

It’s up to you, but why not ask how much interest you paid and how many loans so you have some idea about whether this is worth doing?

If not many people have complained, or a lot don’t appeal, those that do may get a surprisingly large payout…

Antony says

Same generic your claim was not successful letter for all the same reasons, not worth appealing for 4/5p in the pound it says you will get!

Sara (Debt Camel) says

see my reply to Sarah above.

Dominic says

Email 21/02/2022

Your claim has not been upheld, based upon the information you have provided. This means that you are not eligible to receive compensation.

● Your claim was deemed not eligible to receive compensation due to one or more reasons stated below:

– You took out fewer loans over a longer period;

– There were longer periods of time between each loan you took out;

– The amount of your loans did not increase by enough in a year;

– You did not have loans with other loan providers at the same time; or

– Your loan was not used to pay off a previous loan.

Interesting if the rules are basically hit one of those points above and you’ll be accepted as unaffordable.

I have 3 loans on live credit reports that were clearly open on the date I took my one and only Provident loan out. I have some missed payment markers that drop off in 2023 so I’ll appeal for sure.

Couldn’t care less about the minimal compensation, as the decision letter notes compo is expected to be 4p to 6p per pound and I only had 1 small loan with this lot.

Sara (Debt Camel) says

I think it is very unlikely that you will win a claim about one small loan.

Marie says

Hi sara how much are people like to get in the £ if they win their provident complaint in the scheme . Still waiting for my response

Sara (Debt Camel) says

this depends on how many people have made a claim! I don’t think Provident have done a great job of publicising the Scheme – it it’s a low number then payouts will be higher.

Lynne says

Same response I got except ice gone back and asked them to provide a list of loans I had and they’ve failed to do that, so I’ve made an appeal on that basis.

Kat says

Of the people receiving the outcomes, did you log your own complaint, or were you emailed by provident to prompt you to claim?

Lynne says

I got a letter Kat. Then set up an account on the portal and it happened from there.

Adreva says

Interesting so no ones had a successful claim as yet just rejections.

mr mark says

do any body knows when our claim has been upheld or not

Sara (Debt Camel) says

only a very small number of people have heard anything so far.

Ray Nicholson says

Their redress outcome was sent to me on 08/02/22 saying I had failed. It also told me I could appeal but had to do it within 30 days it also said “Please bear in mind your appeal against the decision will require evidence an error has been made to support it. ”

I got confirmation of my appeal on 15/02/22, saying “I can see you have appealed the outcome of your claim.

Please could you provide details of any Defaults or CCJs you held between 2007-2020.

Please ensure this information is provided before 28 February 2022 to allow us to review as part of your appeal….I replied with 3 CCJ ref numbers, they were the only things still showing on my credit report because some CCJ’s and defaults have gone from my report, presumably because they were too long ago. I also asked for loan details at the same time and that’s when they sent loan ref numbers only.

Sara (Debt Camel) says

I suggest you send them another email saying you will be able to provide further information when they supply you with the details of your loans which you have already requested. Say you would like the loan amounts, the interest paid, the date taken out and the date repaid.

Karen says

Hi, I have not heard from Provident yet about mine, but mine went to debt collectors so I doubt I will get anything back. I am actually here because I have received an email from Ingram Toft saying I urgently have to send them my scheme number, name address etc and I only have until Monday. I thought when I signed up for the scheme with Provident that was all I needed to do. Are Ingram Toft trying it on or are they part of the claim? Many thanks

Sara (Debt Camel) says

Had you previously asked IT to make a claim to Provident for you?

Karen says

No I haven’t. I went through the claims portal from an email Provident gave me. Ive just tried to log in though and have deleted the email with my scheme number on it. No idea why IT have emailed me, wasn’t sure if Provident had requested IT to do something

Sara (Debt Camel) says

Ingram Toft is a claims company. They should NOT have contacted you unless you had asked them to handle your Provident claim before the scheme… so it seems Ingram Toft has screwed up by contacting you even though you were not their client (which they should have been able to see from their records).

And Provident may have messed up by giving your details to Ingram Toft – which is a breach of GDPR. This can’t on;y be IT’s fault – IT did not know who you were so they could not have asked Provident for your details, Provident must have made an error in giving them to IT.

I wonder how many other people this has happened to?

You need to tell Ingram Toft that you have never instructed them, you are not their client, you have submitted a claim to Provident and you want Ingram Toft to tell Provident that you are not their client.

You also need to contact Provident, by phone if necessary, and tell them what has happened.

Mark says

Hi Sara,

I’ve been unable to join the SOA because Provident can’t find any of my previous loan details!

My wife and I took several overlapping loans and cards between 2010-2016.

My wife received her invitation to join the scheme way back last year but I didn’t which was odd as we had always shared the same address/loan patterns/agent.

When I phoned to query, they looked me up and couldn’t find any trace of me even though I gave them loads of details

Over the past weeks, I have emailed copies of numerous loan details, agreement numbers and even my collection book! These also contained my customer number and agent number.

The only thing that differs between me and my wife is she had no remaining balance but my final loan taken out in 2016 still has a balance and ended up being sold to Lowell (so I don’t even qualify for the loan ‘write-off!!)

So, whether they sold my details across and erased me from their own system – who knows!!

Anyway, I know tomorrow is literally the last day, and I feel their incompetence is going to cost me in so many ways, and if I still owed a debt on top of that, it would be an extra kick in the teeth. I just can’t believe they still ‘can’t find me’ in spite of me sending copies of original documents and loan agreements!!

Do I have any other options?

Sara (Debt Camel) says

I will try to find out.

Mark says

Thanks Sara

Lynne says

I’m getting nowhere with this. This is their response when I’ve asked (for a second time) to provide me with a list of loans I’d taken out.

Thank you for contacting us regarding the Provident Scheme of Arrangement.

We do not hold that information here however we can confirm its all loans April 2007 to December 2020.

Just to advise if you are appealing the decision without evidence to back up your claim the decision will likely stay same.

Sara (Debt Camel) says

I suggest you go back to them and ask if they do not have the information about loan dates and amounts, how they were able to assess and reject your complaint. Point out it is unreasonable for you to be asked to provide a lot of information over a long period when Provident should be able to be precise about the loan dates, amounts and interest paid.

Leanne says

So I’ve just had a message on the portal saying my claim has not been upheld.

It says I can appeal but I don’t know what to put

The claim rules are set out in the Explanatory Statement.Your claim is not eligible to receive compensation because your loan(s) were affordable. Some reasons why your loan(s) were affordable may include:You took out fewer loans over a longer period;There were longer periods of time between each loan you took out;The amount of your loans did not increase by enough in a year;You did not have loans with other loan providers at the same time;or Your loan was not used to pay off a previous loan.

Sara (Debt Camel) says

Reply asking for a list of your loans, their size, dates and how much interest you paid, saying you need this to be able to explaining why the decision is wrong.

Leanne says

Brilliant thank you, I’ll do this now

Tim says

I notice the claims portal is now closed and they have an update on the webpage. Looks like everyone will get a response by early April.

Linda says

Hi I just logged on and had a look on the portal as haven’t heard anything about my claim but got it in before the submission deadline. Can I ask where it said you hear early April as although I could see an update I couldn’t see any timescale or mention of April for getting back to people? Thanks

Kim says

A response has just been sent to say they are not upholding my claim and that it was affordable – I will be appealing this as they were def u affordable I had at times 3 with them at the same time plus with other companies abs normally took a new one out soon as one was paid off

Timbo says

Be interesting what they say about mine. In 16 months I had 11 different loans with them and never paid a loan off without refinancing it. Also had Morses loans at the same time.

Adreva says

With my loans written off by Provident all I’m waiting on is the decision that they were unaffordable or not to determine whether they get removed from my credit record after Provident added a default 4 years after my last payment. So will be showing on my credit record for 10 years!

I’ve complained to Provident who’s response is wait until the scheme has concluded and the Ombudsman who wont touch anything to do with Provident.

Anyone else in the same boat

Alyson says

I’m hoping I don’t get an email any time soon as it looks like their going through there decline list so they know the percentage they will give to others

Sara (Debt Camel) says

It is correct that they are only sending out rejections at the moment.

Why I have no idea – it won’t help them know what the % will be for many months.

Annie says

I have deleted emails with my ID number for the scheme by accident .Im not expecting anything as been refused in the past although never understood why .Is it email or letter decision is being sent in .I know all debts have been written off so if they now uphold any claims do you get all the money or do they deduct balance

Vah says

How do we know if what provident decide is the correct amount we had

No idea of how much we both borrowed individually an we are both registered on the portal but not bern told how much our claims were for ?

Quick quid wrote theirs were cancelled an we owe them nothing hooray an thanks to Sarah we claimed but privident we heard nowt except acknowledging we are complaint logged

Thankyou

Sara (Debt Camel) says

Provident will respond to each of your claims. So far a few rejections have been sent out, no acceptances.

With the rejections there is no list of loans, so if you get this, the first thing you need to do is ask provident to send a you a list of the loans including dates, amounts and the interest paid.

You may not have a complete list of your debts, but looking at the list provident has, it will often be clear to you if the loans are probably all there or they have missed off a lot.

When you have the list, if you aren’t sure if it is worth appealing, then come back here and ask?

Vh says

Thanks for this

The satsuma loans were at the same time so they would surely realise there was a problem already at satsuma in arrears an same company !

I will wait an see when I get an email

Thankyou

Joel jasilek says

Hi there,mine has all gone throu,now it’s the end of the dead line how long do I have to wait till I get anything

Sara (Debt Camel) says

do you mean you have been told all your loans have been accepted as unaffordable?

Joel Jasilek says

Yes I think so it’s not clear,I got a message saying it looks like I am able to make a claim,then I did it,they asked for dates which I sent and then I had an email saying I’ll hear back from them

Sara (Debt Camel) says

I don’t think this sounds like they have made a decision on your claim yet. If they had, they would have told you the amount in pounds that your claim had been assessed at.

I haven’t yet heard of anyone having a claim upheld – I don’t think they have started sending out these decisions.

Joel Jasilek says

Yeah it just said I had a claim,and I had 3 seperate loans they just kept giving me more and more loans so I should defo be due something, just wondered how long i had to wait till I hear anything,I had 2 ccjs because of them

Sara (Debt Camel) says

you should hear something in the next few months. And payout will be quite a bit after that.

Lynne says

They said decisions sent out in Feb / March with payouts around August time. It’s interesting so far everyone has been declined compensation seemingly.

Kathleen Mason says

My claim against my loan provider( Satsuma) was disallowed for the same reason as others on these posts. Only took out few loans, gaps in between etc. This should go back to the court and all loans should be paid out. The very fact that one had to resort to this method of borrowing shows desperation and was for some people like me to buy food as all my money was going on other creditors. I have responded to Provident and told them this and also that I will take it to the Financial Ombudsman if necessary. This way I will get more money back and as I have already had a successful claim for irresponsible lending hopefully this will be upheld as well. I advise others to do the same.

Sara (Debt Camel) says

unfortunately you cannot take these claims to the ombudsman anymore.

How large were your Satsuma loans? Do you know all the details?

mr mark brooks says

hi question: has anybody one this site had there claims accepted or NOT

Sara (Debt Camel) says

so far they have only notified people about rejections.

Timbouk says

Random question!! As provident wrote off everyone’s outstanding loans I am guessing if I am due any redress they will take the ‘write off’ amount first or I that taken into account ?

Mark says

My Provident loan has been closed down and marked partially settled on the credit files but still showing as a default.

Anyone else got this?

Adreva says

Yes and it will continue to show as a a default for 6 years from the date of the default.

Particularly annoying as the default was added four years after the las payment.

I’m hoping my claims get accepted and the entries then deleted

Sara (Debt Camel) says

Even if your claim is not accepted, that default date is wrong. It may well be you can get the whole record “supprrssed” in a year of so if provident do not correct it, see https://debtcamel.co.uk/correct-credit-records-lender-administration/

Lynne says

And still vague – why won’t they just send me the loans list!

Thank you for contacting us about the Provident Scheme of Arrangement.

The team who investigated your claim have access to all of your account information.

They have assessed all loans which were taken from Provident, Satsuma, glo or Greenwoods between 6 April 2007 and 17 December 2020.

Sara (Debt Camel) says

I have no idea. Tell them you want to make a complaint to the Scheme Adjuicator about their failure to provide you with the information about your loans that you have asked for.

Lynne says

‘Assessed all loans which were taken out’ so it’s not like I only had one. I’ll take it further.

Vh says

I can’t even access the portal

Won’t accept iD or password an reset password doesn’t work

My husband had r mail saying a reply in portal but he can’t access it either same reasons

Tried to ring but no answer ages so emailed now

Is anyone else having trouble getting into the login portal

mr mark brooks says

im having the same issues

Lynne says

It’s ridiculous I’ve now get a separate email asking for any previous addresses I had so they can locate my account – Something I provided them with weeks ago when they first said my claim was rejected. Just feels like they’re stringing things out deliberately.

Vh says

Emailed to say can’t log in to read thd letter sent an can’t reset password

Reply says if claim upheld they will ask for bank details

But I dunno if claim upheld as can’t read the ruddy letter !! An if they ask for bank details u can bet be via the portal which I can’t access

What a dreadful company

Husband has same problem an response so a standard one size fits all

Annie says

Why don’t you phone the helpline You get through very quick

Vh says

Strangely just had emai

Partially upheld £9812 but will get peanuts when they know amount left

It also has a number of details incorrect as says I have to update bank info by fran 2021!!! Says similar dates in other parts also

To be honest I can’t even remember I borrowed as much so that was a shock an any refund better than nought I suppose

Lessons learnt !!!

Thanks for al your advice

Now we just wait for payment which will prob take forever never mind

Sara (Debt Camel) says

Hopefully you will get a few hundred back – they have suggested to some other people it may be 5 or 6%, but i don’t know if that is just a guess.

Have they supplied you with a list of your loans, saying which were upheld?

Vh says

Hi yes they have thanks

All seems in order

6 loans an only one rejected so fair

Lynne says

Update (although not really)

Thank you for raising your appeal with us, we have now had the opportunity to review this but our decision remains unchanged.

Under the Scheme your claim will be a Disputed Scheme Claim and will now be referred to the Adjudicator for an independent review to take place. Once the Adjudicator receives your appeal they will have up to 60 days to review the information and determine an outcome. If any further information is required from you we will be in touch.

In the meantime no further action is required from you.

Regards,

Steven says

Hi Sara,

I have just received an update for Provident that my appeal has gone to an Adjudicator, there is a lot of information missing from the initial complaint, eg. bank statements that show huge amounts of gambling and that at the time of taking both loans out I had £36k of debt against my name during the 1st Satsuma loan in July 2019 and over £37K during the 2nd Satsuma loan in September 2019. Would the Adjudicators look at my Credit Report during this period? Or even 3 months before taking the 1st loan out, or would I have to provide my credit file as well?

If not, how would I get this information to these people as the online form only allows you to send messages and I cannot see anywhere to attach this information.

Thank you very much in advance.

Sara (Debt Camel) says

Have you told them you want to supply envidence?

Steven says

I have emailed the soa@provident.co.uk address asking how I should go about this and also sent a message in the secure portal.

If they do not respond, would any appeal be upheld by the Financial Ombudsman as supporting documents were missing?

Thank you.

Sara (Debt Camel) says

no, the Finacial Ombudsman cannot get involved in anything to do with a Scheme.

Steven says

As an update to this, it appears I cannot submit any supporting evidence! I received this from Customer Services:

“Thank you for contacting us regarding the Provident Scheme of Arrangement.

We are unable to take on any new evidence after the bar date.

I can see you submitted an appeal on the 01/03/22. We will be back in touch in 30 days. If no agreement is reached within 30 days of your initial appeal, we can refer to the Scheme Adjudicator, who will assess your claim within 60 days of receipt. They have 60 days to reach a decision.

Please let us know if you wish to withdraw your appeal. Once the appeal is escalated to the Scheme Adjudicator, the appeal cannot be withdrawn.”

I think this is absolutely outrageous! Can they do this? It’s like they expect you to turn up to court but you cannot bring evidence… You’re clearly setup to lose.

Sara (Debt Camel) says

are they saying you are after the bar date?

also have they sent you a list of your loans?

Kathleen Mason says

Hi Sara, I think you will find that once the scheme has thrown out ones claim under “the scheme” it is no longer under ” the scheme” it is just a refused claim for compensation from a company for supplying unaffordable credit.

Go to the Financial Ombudsman for a claim against Provident for unaffordable lending.You just have to ask them for help.

Sara (Debt Camel) says

No, that isn’t the way a Scheme works. A Scheme is an arrangement under Part 26 of the Companies Act that allows a firm to vary the rights of some or all of its creditors and/or shareholders. When the Scheme has been sanctioned by the court, you only have the rights set out in the Scheme – you cannot go to the Ombudsman.

Stephen Harrison says

They refuse I sue, simple.

Sara (Debt Camel) says

not simple at all. The approved Scheme has changed your rights as a creditor.

If your claim is rejected, go through the appeal process. People do win these appeals. You do not have any other practical option.

Kathleen Mason says

what if you did not agree to enter The Scheme ?

Sara (Debt Camel) says

You don’t have that option – the Scheme was approved by the high Court after considering the customer voting on the Scheme.

I want to say that I hate all of this – I think Provident has behaved despicably and the FCA is at fault for letting them carry on lending unaffordably for so long and not insisting that firms have adequate capital to pay redress to consumers. But as a matter of practicality, there is nothing anyone can do apart from go through the Scheme processes.

Stephen Harrison says

So the courts and the UK Government have given a licence to rip people off yet again. Why did people vote for this Scam.

Sara (Debt Camel) says

because they were told it is a small percentage or nothing. See my reply to Kathleen above.

Sarah says

Soooooo I initially made a complaint against provident maybe 2 years ago it was upheld and I agreed to there offer and received the cheque etc I have since entered this scheme thing total unsure what it is if I’m honest but I received the email and filled it in etc. Is there any point in me doing this if I already had a settlement?

Sara (Debt Camel) says

Quite often provident’s cheques were very poor offers.

In the Scheme they should make a fair assessment of what your redress should be.

Let me give an example with invetned numbers.

Say provident sent you a cheque for £400. And now they assess your total redress should have been £2000.

They will take away the £400 you have already had from the £2000 (fair enough!) reducing the redress you should get now to £1400.

But you will only get paid a percentage of that – so if they pay out at 5% then you would get 5% of £1600 = £80.

In this example, if they assess your redress at £400 or less, you won’t get any payout. They can never say they have paid you too much – you can’t lose by having made this claim.

Rik says

I emailed last week and got the following reply but not hoping for any payment as I have already taken them to FOS and they upheld the majority of my loans so I was paid in full.

Thank you for contacting us about the Provident Scheme of Arrangement.

I can see from our records that your claim has been submitted.

We expect to be back in touch with the outcome of your claim around March/April 2022. If your claim is upheld, we expect to confirm the amount of compensation you will receive around June/July 2022.

If you have any further questions please give us a call on 0800 0568936.

Linda says

HI I logged on the online portal today, I could see the update about the deadline date being passed 28/2/22, and details of the claim I put in but nothing else really. I was going to email to ask for an update but cant even find the correct email address I should be contacting is that somewhere on the portal too? Just wondered where you found the email address on there. Thanks

Rik Bevin says

the email is soa@provident.co.uk just make sure to include your portal reference so it speeds up their reply :)

Lynne says

Are they saying I only had one loan and it was with satsuma? Doesn’t sound right to me.

I am unable to locate any loans issued with Provident, however you had a loan issued with Satsuma . Agreement number xxxxxxxx issued 16th May 2015 for £300.00.

Sara (Debt Camel) says

yes that is what they are saying.

Do you have any proof (emails, bank statements, agents’ books, credit records, loans sold to debt collector, DMP, etc etc) of Provident loans? Have you moved? changed your name? changed your email address?

Lynne says

Yes I’ve changed emails and also addresses. I won’t have bank statement going back that far though.

Vh says

Well yesterday email from cash euro neg my claims partially upheld total £9000 so all fine an wait for percentage

Today another email same cash euro net but a different ID an says thanks for my claim and it’s been logged

What a confusing time

I had one claim an logged on portal long ago

Never changed email

Husband had one claim different email to me an can’t log in to portal to check a letter they say in there

So we wait

Sara (Debt Camel) says

email from cash euro

Casheuronet? That would be about a QuickQuid/OnStride claim.

Nothing to do with the Provident/Satsuma Scheme.

Vh says

Thankyou

Now I’m totally confused lol as three days before QQ went bust they agreed owe me £2065

Nowits suddenly £9000

Well I’m blowed

Might be a nice surprise might not

And as for provident can’t log in at all an all I get is If claim upheld they will check bank

Thanks Sarah

chris says

Did the Fos agree the £2065 or qq theirselves ?

I had a claim agreed for £2100 as quick quid would not look at loans over 6 years old?

Vh says

QQ themselves agreed

Emma Daniels daniels says

sarah how come some people are getting their redress outcome before the deadline date I was under the impression that they would not be looked at until this date ?

Sara (Debt Camel) says

provident can decide claims at any point – and the sooner the better.

Kathleen Mason says

So, this gets worse by the day. Some borrowers made claims through The Financial Ombudsman before “the scheme. ” And will now get more money under “the scheme” as the previous compensation wasn’t enough, but because they went to the FO then there second claim will be upheld. Have I got that right ?

Sara (Debt Camel) says

I am not aware of the Scheme deciding that more redress should be paid than FOS had?

Was is happening in several thousand cases is that Provident made a poor offer and sent a cheque for it. Some people cashed the cheques but are now making a claim for a fairer assessment – that amount of the cashed cheque will be deducted from the amount now calculated so people won’t get paid it twice.

And some people did not cash the cheque but took their case to the Ombudsman. If their case had not yet been settled by FOS, they too can cash the cheque and make a claim to the Scheme.

This all seems pretty fair to me.

Debbie Yardley says

Hi Sara

I still haven’t heard anything about a redress.

I have logged in onto the portal and clicked on “claim redress outcome”. It’s saying ‘You don’t have any statements to view at the moment ‘

Any idea when I will know?

Sara (Debt Camel) says

Sometime in the next few months – sorry, not very useful.

Carly says

I am also anxiously awaiting an outcome but have prepared myself for it not to be successful. It seems to me that very few people will get pay outs. But I am so glad that they are now out of business. The worrying thing is that so many other lenders are still paying out unaffordable loans and the cycle continues. Let’s hope someone soon posts that their claim has been upheld

Darren Mallinson says

> But I am so glad that they are now out of business.

Unfortunately, Provident are still in business. They only closed down the doorstep loans business in order to protect the rest of the company. They’ve moved most of their ‘new’ lending now to their Vanquis Credit Card business, offering a new product ‘Vanquis Loans’. And they’re still using predatory tactics on vulnerable customers and those who are in a desperate situation, just not on the doorstep any more.

Sara (Debt Camel) says

yes. But it is very good to see the doorstep lending end. It was a very invasive, pressured form of selling. And hundreds of thousands of people ended up owing the Provy constantly for many years.

Moneybarn belongs to them too, charging horrible interest rates on old cars. They are now losing quite a lot of affordability complaints about these – see https://debtcamel.co.uk/unaffordable-car-finance/

But Vanquis are now starting to lose complaints that they increased the limits on their expensive credit cards too high – see https://debtcamel.co.uk/refunds-catalogue-credit-card/

For complaints about Vanquis loans and their new Sunflower loans (don’t they sound delightful? APR of 65%!) see https://debtcamel.co.uk/refunds-large-high-cost-loans/

Annie says

Hi can you advide financial ombudsman ginal. Decision is tjat loan company have to pay me 2592 plys 8 percent intetest per annum. I got this in writing and accepted on Friday when should i get tje payment from log book loans limited

Sara (Debt Camel) says

I assume this is a Final Decision from an Ombudsman? not the initial decision from an adjudicator?

It should be paid within 28 days. But don’t make any firm plans for the money until it arrives!

Vh says

Thought I’d let you know this as some wondered why they heard an others haven’t

It looks like they doing all the rejections first

Maybe so they know what’s left ? Just a thought

We had two claims

Hubby reject as only two small loans so fair

Mind about 14 so much larger

I’m aware of two couples I know exact same as us

All the small rejected an had emails

All larger not heard a word so hopefully going on

It could be they are just wading through the small claims first ?

Hopefully we will get a return if even a small one

The collector fudged my income twice so I’d get money an I know she now has several claims herself it’s a pity they didn’t vet the collector more thoroughly really but there you go

Good luck everyone this site is very helpful the only one I know of

I’ve had five refunds in the past 18 months so thanks Sarah I’d never had known

QQ an first response left plus provident then I’m done

Bern a journey

Retire October an fresh start thank goodness

Sara (Debt Camel) says

It could be they are just wading through the small claims first ?

So far as I know they have only sent out rejections so far.

Sue says

Hi Sara I am awaiting a reply from provident not expecting to here for a while. Also Sara is there any advice as to what to do about morses. I have had lots and lots of loans of them around 60 in the press it’s saying put a claim in are they going into liquidation I still have 3outstanding which I can’t afford to pay now they are sending letters

Sara (Debt Camel) says

I don’t know what will happen to Morses – from the experience of payday lenders, the last one or two big firms that survive can make a nice living and still payout to people who make claims for years.

60 loans is a lot. there is no reason not to make a claim right away. If they go into administration, well you gave it your best shot.

Matt S says

I’d actually forgotten all about this.

I had a complaint in with the FOS when this all kicked off last year and was told they wouldn’t take it any further and they advised that ‘We will forward your details to Provident and you will be automatically included in the Scheme process. Provident will inform you if your complaint has been accepted in the Scheme and what compensation you are entitled to.’

I hope they have done as i’ve not heard anything at all since August last year.

Sara (Debt Camel) says

I think you should contact Provident and check that this has happened.

Matt S says

All sorted, got my login details and the claim has been submitted. No outcome as of yet so will hopefully hear some positive news soon.

Leanne C says

I lodged an appeal on the portal last week and now had the following reply –

I can confirm when we were locating loans we used your date of birth with your first name to ensure all addresses were taken into account as well as other surnames. All loans were reviewed. If you have any evidence you believe will assist with your appeal please provide this by 31/03/22.

Sara (Debt Camel) says

Have you been sent a list of your loans?

Leanne C says

No,I asked them to in my appeal as to told me to

Sara (Debt Camel) says

I suggest you phone them up and ask why you cannot be sent a list of your loans.

Sara (Debt Camel) says

if that doesn’t work, come back and I will suggest what to do next.

Leanne C says

OK brilliant, this is the message I sent last week:

I wish to appeal with your decision as i feel that my loans with Provident were unaffordable.

Please supply me with a list of all my loans, their size, dates and how much interest I paid, I need this to be able to explain why your decision is wrong.

Leanne C says

Just had this message, once again they havent provided the informationi requested. Lets see what happens next:

Claim has been re-opened with the following message: Thank you for your message and note you have logged an appeal.

Your appeal will be reviewed by us within 30 days. If we cannot reach an agreement with you, your appeal will be escalated to the independent Adjudicator, who will assess your appeal within 60 days of receipt. Once we receive an outcome, we will be back in touch with you.”

Kind Regards

Sara (Debt Camel) says

really phone them up and ask why they cannot send the list you have asked for.

Timbouk says

Has anyone had a complaint upheld yet from the provident scheme?

I’m guessing they are sending out the rejections first?

Rik Bevin says

heard nothing as of yet, but will post in here once I do

Paul hunt says

It seems to me that they seem to sending out rejections before working out true settlement figures !

As surely they need to know how many complaints are upheld before working out how much they will receive as if not what happens if they get to to total amount they set aside but have not settled all the claims.

It’s frustrating as hell as they have had so long to work on 99% of the claims whilst waiting for the deadline to pass but seems they aren’t been very quick with responses.

All I have in my portal is a comment saying no settlement statement as yet ! Let’s hope we get some good news soon enough

kim eyre says

I still haven’t heard anything. I’m genuinely hoping I can get some form of compensation. my loan was 8 years ago while I was unemployed. received 120 a week and my loan repayment was 64 per week!but after a while I simply couldn’t pay it and fell behind with other Bill’s so for years I paid only £10 a week. it’s all really confusing. if I receive compensation does that amount get taken off what I still owe provident?I’ve never been in this situation to know.

Sara (Debt Camel) says

Has your debt been sold to a debt collector?

did you only have one loan from them? how large?

kim eyre says

No it wasn’t sold. I had 2. one for 100 and one for I believe 600. the interest rate was way more than double so owed nearly 2 grand

Sara (Debt Camel) says

then the balance owed should have been written off by Provident in December – was it?

kim eyre says

yes that’s correct

Sara (Debt Camel) says

ok so suppose Provident calculate your refund at £800 (I am just making numbers as as an example) and they wrote off £300 in December.

then they will reduce the £800 by £300 – as you have already had that bit – giving a redress due of £500. Then you would get a small % (perhaps5-10%) of that £500 back in 6-9 months or so.

Hayley B says

Good evening Sara, seeking some advice please.

No response to claim filed within the scheme (as yet), and hopeful that as each day passes it may fall into the right pile.

I have 13 Provident loan’s recorded, dating between 2015 – 2020 (the last two have been written off) that are showing on my Experian (Via MSE) report. Over £16k in total.

Q1. I’m very sure I had loans from Provident many years prior to 2015, do earlier ones ‘drop off’ such credit reports? If so, where might I go to see these? Reading comments it seems provident are reluctant to release details and show their hand.

Q2. It appears looking at the dates of opening the accounts, and the closing dates that I have had 2, and sometimes 3 running concurrently. Most of the final or settlement payments made on each are LARGE sums, which seem to overlap with new accounts being taken out (generally for larger amounts). This to me shows evidence of a debt (with high interest already being applied), being refinanced, again with more interest added.

Would the scheme adjudicators tend to view it this way also?

Q3. Although I do not have any CCJ’s, Defaults, or a DMP in place, I do have frequent missed payments. Is this accepted as a symptom of the unaffordability?

Many thanks in advance.

H

Sara (Debt Camel) says

Settled loans drop off your credit record 6 years after the settlement date.

Provident should have a list of the earlier loans – there is nowhere else you can get them from.

Refinancing your loans a lot does suggest you were in trouble. As does 13 loans in 5 years.

The odd missed payments may not matter but a lot suggests you ere in difficulty.