Update:

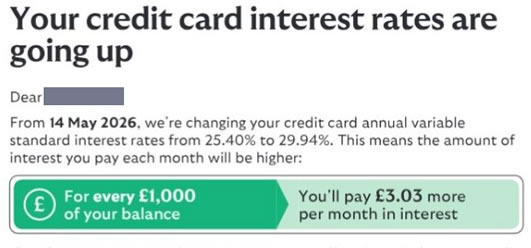

- in March 2026, Lloyds, Halifax and MBNA (all card lenders in the Lloyds Banking Group) started sending out emails saying that card interest rates would be increased in May 2026.

- most of the increases are between 4.25% and 4.5% a year.

If your credit card says it is increasing your interest rate, often you can simply reject this change and stay on the old rate. If you do this, you do NOT have to repay it all immediately

But you have to act fast to do this, so this article explains what you need to know. It also applies to catalogues, store cards and accounts such as Paypal.

There are two situations in which a credit card can increase your interest rate:

- your credit card decides to increase the rate

- the Bank of England base rate goes up and your credit card tracks that rate.

Contents

1) The lender decides to up your rate

These rate changes tend to be larger than a quarter or a half a per cent Here are some examples:

- Halifax have increased my rate from 24% to 28%

- Jaja are putting my credit rate up from 29.2% to 41.2%!

- In 2023, PayPal moved its lowest interest rate from 21.9% to 23.9%. And some customers were also moved into a higher rate category, so their rates went up to 25.9% or 29.9%

- I got a notice of credit card interest increase from 118 Money, from 29% to 41%.

- We are writing to let you know that the annual interest rate on your Zable Card is increasing from 38.9% to 48.9% .

These jumps are legal. But you have the right to reject them. The regulator sets this out in CONC 6.7.13.

The email or letter you receive states this, but many people don’t notice it. Or they misunderstand it, as the card company hasn’t said clearly how it works.

The letter often says something like “you can reject the increase and close the card“. And you may think you would have to repay the whole balance immediately, which you can’t afford to do.

But if you reject the increase and the account is closed, you carry on repaying the card as before at the old interest rate. You just can’t spend any more on the credit card.They can’t make you repay it all immediateley.

This doesn’t show as a payment arrangement or a default on your credit score. You are simplying choosing to stay on the old rate and are repaying the card as the T&Cs say.

Clearing the card when the interest rate is higher will take much longer and be more expensive. So if you are trying to clear the card, it’s usually sensible to reject the increase.

To reject the increase, you just need to phone, message or email the lender to say you want the card closed and you will carry on repaying it at the old rate.

2) Base rate changes

NB if you get a notice of a credit rate increase in 2026 this is NOT because of a base rate change, as the base rate is falling! The lender has just decided to hike your interest rate, see previous section.

Some credit cards now track the Bank of England base rate, but not all do. Your credit card T&Cs will say if your card does.

Here the standard interest rate on the card will increase automatically as the base rate changes. The new rate will be shown on your next credit card statement.

The Bank of England base rate was increased several times between January 2022 and August 2023. Each of these changes was small.

You don’t have the right to reject an increase caused by a change in the base rate. But see below for what your options are if you are finding it difficult to pay the card each month.

Very low interest rate?

Be careful if your interest rate looks very low – less than 3%.

Here you are probably looking at a monthly interest rate, not an annual one. There is a converter here you can use to change a monthly rate to an annual one.

This makes any increase look tiny, not worth bothering about.

So if your monthly rate is going up from 1.9% to 2.7% that may sound like less than 1%… But it is actually an increase in the annual rate from 23% to 33%.

Already difficult making the card repayments?

If your credit card repayments have been causing you problems, this gets worse when the interest rate goes up as it makes the minimum payment a bit larger.

So this is a good time to think if you need some extra help:

- was your limit was set too high, so you have little hope of clearing the balance? Read make a credit card affordability complaint which has a template you can use to complain;

- if this card is your only problem debt, talk to the lender about a payment arrangement, where interest is frozen;

- with other problems as well, or if you don’t feel up to talking to a creditor, talk to StepChange about a Debt Management Plan.

Payment arrangements and DMPs can both harm your credit score, but they are practical ways of clearing too much debt with the interest being frozen. And then you don’t have to worry about any more interest rate increases!

S says

Are catalogues allowed to increase your interest rate? I got several letters from JD Williams saying because of my change in credit score I’m a risk and increase the interest rate, then I for another letter saying I’m eligible for a credit increase also, I have complained recently but they haven’t upheld the complaint.

Thanks in advance

Sara (Debt Camel) says

Yes they can. Did the letters say you had the right to reject the interest rate rise?

If a lender has increased your interest rate because you are at a higher risk and then offered you a larger limit, that doesn’t sound like the action of a responsible lender… Have you sent this complaint to the Finacial Ombudsman? this has to be doen withing 6 months of the rejection from JD Williams.

Gareth parry says

Honestly I,we,us should not be penalised for asking for help I find it completely unfair that the people who monitored our accounts ie the company and its employees could not spot and essentially stop people from increasing their burden. Its all there to see on the CRA reports(but these days they encourage you into debt) equifax,transunion and experian are meant to be record holders not credit brokers for hire!.

Millie says

I submitted an affordability complaint to NewDay, after years worth of unwanted credit increases resulting in interest charges that were half my monthly income. My account opened in 2018 and I finally paid off the card in 2023, only due to receiving some money following a car accident. They have rejected my complaint obviously, going by the fact they said my account with them opened in 2018 and I could have rejected these increases. To be honest I was so under it, I didn’t keep up with any letters notifying me of an increase (my bad). Anyway, I was missing payments, behind on even the minimum and despite these they kept increasing my limit. They have rejected my claim based on the fact my account was opened more than 6 years ago, but I only closed the account less then 3 years ago. Shall I escalate to the FOS? I knew about the 6 year thing but thought that was 6 years following account removal etc.

Sara (Debt Camel) says

yes I suggest sending this to the Ombudsman.

Who have you banked with during this period?

Millie says

Thanks so much Sara. I bank with TSB, I had a dreadful overdraft with them for years but have finally got out of after 7 years of trying. However because I requested an increase on 2x occasions (£50 each time – at the time of requesting an increase it was £500. By the end I’d been in it 7 years, at £1500 even though I definitely couldn’t afford it and my monthly salary was only £1200). They rejected my complaint on this basis which I understand so I haven’t submitted that one to FOS as it was a silly move at the time to think I could have afforded it.

But my NewDay one is what bothers me. Constant increases that were not asked for and an awful lump of interest charges. That’s the one that I feel strongly about lol. I only managed to pay it off because I was unfortunately involved in an RTC and had a bit of money from it, would have been life changing but it cleared the card. They are saying they have no record of missed payments but I have physical copies of letters I received of defaults. Ahh!

Sara (Debt Camel) says

I would send the TSB overdraft to the Ombudsman if the rejection was less than 6 months ago. the lender has to make exactly the same affordability check if you asked for a limit increase as if they offer one.

Definitely send the Newday to the ombudsman.

Millie says

Oh really! I didn’t know this. Okay, thank you so much. I will absolutely send this today. I guess I have nothing to lose! I will keep you updated – thanks again for your words and templates available. :)