A couple of readers have asked about mortgage fixes when they have a poor credit record or simply a lot of other debt:

Ms A: We are in a DMP and we were told it would make it very hard to remortgage. So we are now on Santander’s SVR and it’s over 7%. Can we really just ask them for a new fix and they won’t say no?

Mr B: I’m worried about talking to Nationwide when our current mortgage fix ends. We have a lot of credit card debt from my wife’s maternity leave and now childcare costs.

I can’t say this will never be a problem.

But for the large majority of people who already have a mortgage, getting a new fixed rate will not be a problem unless they have mortgage arrears.

If you don’t get a new fix or another new product such as a tracker, you will be paying your lender’s SVR. In October 2023, the average SVR is over 8% and some lenders are charging over 9%…

Contents

No arrears? – most lenders don’t check affordability for a new fix

The Mortgage Charter

In December 2022 there was a meeting between the Treasury and mortgage lenders. The Treasury says:

At the meeting, lenders committed to help all their customers by enabling customers who are up to date with payments to switch to a new competitive, mortgage deal without another affordability test.

This isn’t just a few lenders. The Treasury says it applies to 97% of the mortgage market, where customers don’t have arrears and not seeking to borrow more or change their repayment type or term.

The Mortgage Charter, launched in June 2023, has repeated this promise and added further commitments as well. If you don’t have arrears, you will be able to:

- switch to paying interest-only for six months; or

- extend your mortgage their mortgage term to reduce your payments (with the option to revert back to the original term within 6 months if you want).

The Mortgage Charter has now (October 2023) been signed by 48 lenders – they are listed at the bottom of that page so you can easily check if your mortgage is with one of them.

Why don’t they check affordability?

When you apply for a mortgage, the lender is taking a long-term risk on you – 25 or more years. So they make detailed checks.

But when your fixed rate ends, your mortgage doesn’t end. the mortgage continues for the rest of the term at your lender’s Standard Variable Rate(SVR) instead. (some lenders have a slightly different name for their variable rate but SVR is the most common.)

A lender can’t decide they don’t want to lend to you anymore when your fixed rate has ended. They can’t ask you to repay it, or make you sell the house unless you have mortgage arrears. The only question is what interest rate they will charge.

And lenders have to treat their customers fairly. If you are paying £550 a month now, which would be £800 on a new fix, it makes no sense to say that £800 isn’t affordable so you will have to pay £1050 on the lender’s higher SVR.

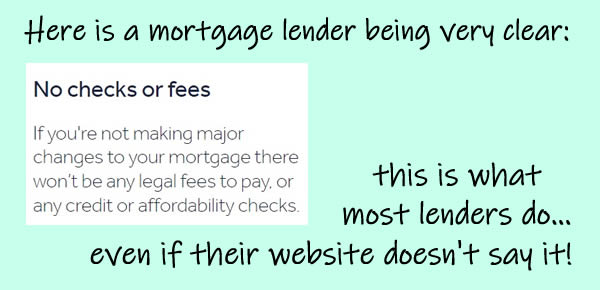

Some mortgage lenders websites are vague

Some lenders have clear websites – here is the Leeds Building Society – but many don’t.

I don’t know why lender websites aren’t all clear. If you are in financial difficulty at the moment because of the cost of living and this will be a lot harder when your fix ends, then mortgage lenders will want you to talk to them about your options. But I think being vague puts people off talking, rather than encouraging it.

Take the two questions from readers at the start of the article:

- despite her DMP, Ms A can probably immediately move to a new fix with Santander that will cheaper than the SVR she is currently having difficulty paying.

- Mr B needs to know that he should still be able to get a new fix with Nationwide.

“I’m worried this won’t apply to me”

Here is one case where someone who thought he may be rejected has got a new fix:

I’m with Halifax and my fixed term finishes on 30th Sept. Had very little, or possibly no credit card debt when I took this out and it’s now ball park 11k, plus frequently overdrawn.

I tried to fix for longer when interest rates started to spiral last year c. 2%. I was told then that the Early Repayment Charge going on to the mortgage meant I needed to undergo affordability checks which I failed due to the credit card debt (was around 3k at this time).

Naturally I was pretty concerned that my credit card levels being so much higher was going to make it almost impossible for me. Halifax have approved a product transfer for me, fairly automatically (no credit check etc).

Who will have problems?

Problems getting a new fix

The people who will have problems getting a new fix are:

- mortgage prisoners, where their current lender doesn’t offer new mortgages. MSE has a good round-up of the options mortgage prisoners have.

- people with arrears. If you are already in arrears then a new fix at a higher rate is unlikely to solve your problems. See Worried about the cost of your mortgage? Find out the help your lender can offer for details. A new fix may be a part of the help you need but you may need other help.

- where you want to change some details about your mortgage – the amount, the term, the named borrowers etc. These are a new mortgage, not a simple new fix on the same mortage. Here the lender will usually do an affordability check although sometimes it isn’t necessary, for example if you want to extend the term but it will still finish before your retirement date.

- people who have an interest-only mortgage that is ending. You cannot get a simple new fix, you need a new mortgage and that will involve affordability checks.

Hard to choose a new mortgage product

It can be hard to choose a new mortgage product at the moment because no-one knows what rates are going to do in future. I have been talking about “fixes” here as fixed rates used to be much the most common option, but a fix may not be right for you at the moment.

Two year fixes are currently more expensive than 5 year fixes as the market thinks that interest rates may well fall. Would a tracker mortgage be a better choice as there usually aren’t any exit fees from them, so if rates fall you could later fix? How do you balance a fee for a mortgage and a lower rate against a fee-free, higher interest rate?

When you are buying a house or changing lender a broker can help you through the confusing options. If you know you will have to stay with your current lender because no other lender is likely to give you a mortgage, you can talk to your lender about their various options.

Problems paying the higher amount

There are likely to be hundreds of thousands of people who can get a new fix but who will find it difficult manage the higher repayments. They are paying less than their lender’s SVR but it may still be several hundred pounds a month more than their previous mortgage payments had been

One person who has just got a new fix from NatWest said:

We’re not in panic mode yet, but I don’t feel safe, It’s like a ticking time bomb, which month will it all blow up?

If this is you, then the sooner you talk to a debt adviser the better. You can do this before your current fix ends now that you know a poor credit record won’t stop you getting a new fix.

Or you can do it when you have got a new fix, to reduce your other costs so you can afford the higher mortgage.

If you aren’t sure, talk to StepChange about your options so you know what they are.

Have you had a problem getting a new fix?

If this article has made it sound like should have been given a new fixed rate but your lender has said No, leave a comment below.

DaiYanto says

Hi Sara,

My interest only mortgage expired over a year ago, my lender has been patient to date but has refused to extend the period even thought I havent missed or been late on a payment for over 12 years. I have no other credit and no adverse information. I have lived at this address for over 30 years and I’m a couple of years away from retirement. I cant prove my ability to pay other than my flawless payment record, my income is nowhere near the amount required, but I definitely can pay it. Do you know of any lender that would consider a remortgage on the basis of my payment record? The amount outstanding/required is about 25% loan to value.

Sara (Debt Camel) says

This is a very different sort of problem from “only” wanting a new fix.

You need a new mortgage and any lender will make full affordability checks. See https://debtcamel.co.uk/interest-only-mortgage/

DaiYanto says

I’m a very significantly lower risk and more profitable than the small deposit three months in a job discount mortgage brigade that have no difficulty getting a mortgage. There is no sound financial or logical reason why they cant just extend my mortgage. Having worked in corporate finance for over 20 years I would have seen this as incompetence.

Sara (Debt Camel) says

You do not have a mortgage to extend. You are applying for a new mortgage.

And it isn’t me that you have to convince.

DaiYanto says

They still have a first and only charge, they still have huge security, they still have a faultless payment record. I’m not trying to convince you, just point out the absurdity of their position.

Terence says

Keep me in the Loop

Joe says

Hi Sara

Hoping you can help please, we are on a fixed mortgage due to end March next year. Not looking for a new mortgage but just looking for a new fix.

I have foolishly racked up some debt due to gambling (this is now under control and blocks in place) I have had a few missed/late payments but never on the mortgage or priority bills. and the rest are now being managed.

Will I have any problems getting a new fix next year? The short term loans will be paid off within the next 4 months and as mentioned we have never and will never miss a mortgage payment.

Thank you

Sara (Debt Camel) says

who is your current mortgage lender?

Joe says

Hi Sara

Thank you for your reply. I am with Kensington mortgages , it is a capital and interest repayment mortgage.

I’m happy to stay with them just hoping they won’t cancel my mortgage or anything like that?

Sara (Debt Camel) says

They can’t “cancel” a mortgage – the worst that can happen is you have to pay the lender’s SVR. I don’t know what Kensington’s is – it may be pretty high.

I would hope that Kensington do not do an affordability or credit check. But they aren’t a mainstream lender (although they are now owned by Barclays.) If they say they have checked you and they are not prepared to offer new rate, come back here and I will suggest how you can complain.

Joe says

Hi Sara

Thank you for your help and the help your provide others , I’ll be in touch if needed

Lauren says

hi sara, i need to take out an smi loan to help with the mortgage, but im worried that when my fixed rate ends in jan 2014 they will not give me a good fixed rate as they will know im in financial difficulty , are they more likely to do a credit check if im claiming smi?

thanks x

Sara (Debt Camel) says

who is your lender? are there any mortgage arrears?

Lauren says

Hi with nationwide. Started dmp last December

No missed mortgage payments x

Sara (Debt Camel) says

I assume your fix ends in Jan 2024 (you wrote 2014)

The Treasury statuement (see the article above) says they shouldn’t.

If they did, you could reasonably complain that by refusing to let you have a new fix, they are not treating you fairly as this it makes no sense to refuse you a new fix as it is unaffordable but then charge you more on the their standard variable rate. You could talk to your DMP provider about this and see what they think?

Rob says

Hi, we have been on a DMP for 4.5 years now. We have just sale agreed our house and when I contacted my current lender (HSBC) about porting the mortgage to a new property we were interested in, they declined. This is despite being with them for 6 years, never missing a payment and renewing twice. It baffles me how/why they could do this when we will be paying them the exact same amount for the rest of the term whether we move or not. We did this on the advice of HSBC. When we asked them more than a year ago about this, they said that we would have to be in a position to buy a house and provide them the details before they could do an affordability check. Needless to say, we’re in a dire situation now and my anxiety is running high. Now we have to try and find another lender with an absurdly higher rate and hope they will take us on, despite the DMP. As a side note, our intention was to pay off the DMP fully with capital from the house sale, but at the moment our own house sale could fall through because of this. I’d really appreciate any advice. Thank you!

Sara (Debt Camel) says

Have you asked to them explain in writing why they have to do an affordability check when you just want to port your current mortgage?

What information were you given on your right to port the mortgage when you took it out?

The property you want to buy, what is the price? And how large is your mortgage?

Rob says

I spent 45 minutes on the phone with them and they went through what I think is called an affordability check. At the end, they came back and said it had been declined. I did ask why we had to do this, even though the payments were the exact same. Absolutely nothing is changing in the current deal. The advisor somewhat agreed with me but said there was nothing she could do.

Do you think it is worth asking them to explain in writing why they came to this decision? I’m guessing there’s no way to change their mind. I’m really not sure what course of action to take now.

If you mean when we started the mortgage with them 6 years ago, I don’t recall a port ever being mentioned. It’s certainly something I didn’t know was possible. We’ve renewed twice with them now. Not just for convenience, but they were pretty much the best rate available at the times of renewal.

Our property sale agreed for 250k and the property we were considering buying is also 250k, so it’s pretty much just a change of address. Having said that, we’ve seen a few properties come up that are considerably cheaper, round 200k. This would allow us to clear the DMP completely. The house at 250k was only a consideration and we needed to find out if we were going to be able to port the mortgage. Thanks!

The mortgage is around 110k, so there’s about 140k of capital and an LTV well under 50%. Thank you!

Sara (Debt Camel) says

A lot of mortgages are not portable. Unless you think yours was, then HSBC are just treating this as a new mortgage application, not related to your current one.

Rob says

Thanks Sara. They did explicitly say it was a port of the existing deal so I’m not sure. They said that they have to go through an affordability check. As I said before, if everything falls through which is possible, we’d be paying them the exact same amount anyway and given our 6 year history without missing a payment, we’re extremely unlikely to miss one going forward. I just can’t make sense of it.

Do you think it’s worth reapplying with a 200k property and a 90-100k mortgage or is it more likely to be a waste of time? Thanks again!

Sara (Debt Camel) says

So the question whether this is a port… I think you should dig out your mortgage paperwork and see if this is mentioned. Also if you are in a fix are they proposing to apply an early repayment charge?

If this is a port, they you could complain to HSBC that they are not treating you fairly by doing an affordability check. I am not saying you would win this complaint but it seems worth a try.

The house you want to buy – if it costs the same as the one you are selling and you want the same mortgage, where is the money coming from to repay the DMP?

Rob says

Thanks Sara!

I will hoke out the paperwork and see what it says about a mortgage port. There was no mention of an early repayment charge during the application. This might apply if it was a higher amount but certainly in this case, it didn’t.

Sorry just to be clear on the situation here. The house we were valuing against was also 250k which we initially considered. Obviously that won’t leave any capital however, as I mentioned in a previous comment, there are a few smaller properties around 200k that we were looking at and this would allow us to pay off the DMP with the remaining capital.

I’m going to submit a complaint to them anyway to see how I go. I guess the worst they can do is say no again. Thanks Sara!

Sara (Debt Camel) says

Find out about the porting first as it can affect how you word your complaint.

Rob says

Hi Sara,

I called to ask how I make a complaint about it and apparently they changed the rules a matter of weeks ago whereby if you were porting a mortgage but weren’t borrowing any more, they don’t carry out an affordability check. So it seems the affordability was an error on their part. They said that it will still need to be approved by an underwriter and once we have an offer accepted, they will set up an appointment. Fingers crossed we have better luck with the underwriter, which I understand will be decided by a human rather than automation. Here’s hoping!

Thank you for mentioning a complaint because I probably wouldn’t have called them otherwise!

Sara (Debt Camel) says

oh that is good news – fingers crossed for you and let me know what happens

Rob says

Hi Sara,

Just to update you on this. We booked a 2 hour call with a mortgage adviser at HSBC because apparently this has to happen first before it is passed to an underwriter. We gave all the details we could and we, as well as the mortgage adviser were expecting a decline, before being passed to an underwriter for a final decision. To our absolute surprise, they approved it! In the end it didn’t even have to go to an underwriter. Needless to say, we are both delighted with this. It has saved us an awful lot of stress. Thank you again for recommending complaining to them, otherwise this may never have happened. Really appreciate it!

DD says

Hi Sara,

Apologies if I’m posting on the wrong page, I’m looking at remortgaging now our fixed rate has just ended, was hoping rates would have started to go down but looks like they will head up for a while yet.! Getting my paperwork sorted and finishing off paying of some credit cards so I have nothing outstanding, I’ve used my savings account to pay for my wife’s credit card, will this be something that’s questioned? I’ve also paid one of her credit cards using my current account, again will this be scrutinised? The cards are in her name but I just pay them as it’s how we split some bills. Just wondering if there would be questions raised at application. Also, and I know you don’t have a crystal ball, but, if I got a discounted tracker at x%, is there the likelihood that rates could increase say a further 2%? We have some financial wiggle room if rates went higher but obviously wouldn’t want rates to jump up another 2,3,4% for example.

Sara (Debt Camel) says

Who is your lender?

I assume you don’t have mortgage arrears?

Do you just want a new fix/transfer to a tracker? Or do you need to borrow more or change anything else about the mortgage?

DD says

Hi

It’s Precise mortgages, I had to get a specialist lender 2 years ago after a default from 2018. No mortgage arrears. Just a new fix or tracker, no other changes such as borrowing more etc. The term of mortgage will be down from 25years to 23 but nothing else.

Currently Precise SVR is 9.9%!!!

Charlie says

Hi Sara,

With Santander and our 5 year fixed ends in May 2025.

Since getting this mortgage, I have built up debts with defaults and am now in a DMP.

When our fix ends, will we be able to just move onto one of Santander’s other fixed mortgage deals with no further credit checks or anything?

I think remortgaging with a new lender will be out of the question due to my DMP and debt now?

Sara (Debt Camel) says

will we be able to just move onto one of Santander’s other fixed mortgage deals with no further credit checks or anything?

yes.

I think remortgaging with a new lender will be out of the question due to my DMP and debt now?

That sounds likely to be correct. How long until your DMP ends?

How large is your DMP payment and how much will your mortgage go up in 18 months time if rates are 5%? 5.5%

Have you looked at making affordability complaints about some of the debts in your DMP? See https://debtcamel.co.uk/tag/refunds/ – winning ay will speed up your DMP.

Charlie says

Hi Sara,

My DMP is not likely to end anytime soon, I currently owe around 30k and am currently making payments of £400 per month through my DMP.

My mortgage is currently £585 per month. When we move onto a new fixed, if its around 5%, I imagine we will be paying around £800 – £1000, which is affordable for me but will make things tighter.

Thanks

Sara (Debt Camel) says

That larger mortgage will be very difficult, you may need to reduce your DMP monthly payment a lot.

One think that may help is affordability complaints. This is the time to look at them. The longer you leave It, the older the things you are complaining about are… nit impossible but harder. Also you need to get those debts down now if possible!

Charlie says

Thanks Sara,

I am with Santender and on their website, it says when it comes to remortgage with them (product transfer), they will not carry out any credit or affordability checks.

Obviously this is great news for me, but our fixed doesn’t end until early 2025 – Is there any way they might change their policy by then, do start doing credit check, from your experience?

Thanks

Sara (Debt Camel) says

No I wouldn’t expect this to change. (With one obscure exception, see below)

For several years now there has been a trend towards making it clearer what a lender should do when it has already made the lending decision and the only issue is a new fix (or “Product Transfer” as it’s sometimes called). It is illogical and fundamentally unfair to make someone pay a higher SVR than a new fix because checks show that the new fix would be unaffordable… as that would mean the higher SVR is even more unaffordable.

(The obscure exception is that you can construct situations when interest rates are falling when the SVR would be cheaper than a new fix. I wouldn’t expect this situation to last for long. But if it did, you wouldn’t want the new fix anyway!)

Charlie Molden says

Thanks Sara,

This is really helpful. So just to confirm, my current debt/DMP should not cause an issue if just remaining with our current lender, and will only cause me a problem if we eitherlook to move lenders, or when we come to sell, is that right?

Thanks

Sara (Debt Camel) says

Or if you want to borrow more from your lender, or change the mortgage in any way apart from a new fix.

frogman says

Hi Sara, I wonder what your assessment of my situation would be. Current 2yr fixed rate mortgage runs out in June 2024. I am ok on the affordability side, however, I have a total of 15 derogatory marks on my credit file listed below. One of the options I am thinking is to move on to variable ( circa 9%) for 7 months until Jan 2025 when all defaults drop, this would also make my missed payments older and give a better chance with high street lender. Other option is to re-mortgage again with a poor credit lender for another 2yrs. In both of the cases, I still have the 247moneybox arrangement to pay to deal with. Can I get credit reference agencies to supress the entry now that they don’t exist anymore? House value is around £360,000 with equity of circa £120,000. Thanks

Virgin phone D in Jan 2019 not settled balance £684 Virgin phone D in Jan 2019 not settled balance £684

Virgin phone D in Jan 2019 not settled balance £684 Capital one CC D in June 2018 settled Sept 2020

PRA CC D in June 2018 settled November 2021 Barclay CC Din June 2018 settled Nov 2018

NatWest CC D in Jan 2019 not settled balance £1300

Metro Bank – Missed payment Feb2020. EE phone – Missed payment May2020. Virgin Media – Missed payment Jan 2020.

United utilities – Missed payment June 2017. Shelby finance – Missed payment Dec 2019. BMW – Missed payment March 2019

247moneybox arrangement to pay – Settled in Aug 2021

Sara (Debt Camel) says

Who is the current lender?

frogman says

Vida Homeloans

Sara (Debt Camel) says

Why haven’t you settled all the defaulted debts?

Have you settled All the debts with missed payments?

Have you spoken to your broker?

You probably remember me suggesting that you shouldn’t take out this mortgage last year as there was no guarantee that you would be able to remortgage more cheaply at the end of the fix…

frogman says

Thanks Sara,

Yes, I remember what you said about taking out the mortgage but I was so desperate at the time, especially because of kids school and the area we lived which wasn’t great for them. On not settling the default, after taking out the mortgage, I subconsciously made up my mind I was going to wait till all defaults go away from credit file and agree a token monthly repayment with the lenders. We got 4.5% ish from Vida then and variable would have been 5.5% all things being equal which I would have been ok with., but with BOE interest now up (You warned against this), Vida variable is 9.2% which would mean my repayment going up from £1220 to around £2000. My preference would be to wait out the defaults so what I am really looking for is a way to reduce the massive jump. for those 7months I was always going to pay more anyways because of interest rate. Yes, all missed payments have been settled so credit file has been clean since. I haven’t spoken to a broker yet as I am still around 9 months way.

Sara (Debt Camel) says

On not settling the default, after taking out the mortgage, I subconsciously made up my mind I was going to wait till all defaults go away from credit file and agree a token monthly repayment with the lenders

This may well not work.

First the creditor may go for a CCJ before the default falls off – this is common.

Second, a mortgage lender will see the token payments on your bank statements and ask what the debts are. Lenders don’t care about your score so much as they care about problem debts.

You need that defaulted debt settled now, partially or in full.

Your choice is to pay the absurdity high SVR for 7 months, hoping you can get a low fix at the end. Or move on to another fix, Which may have to be with a bad credit lender. Not sure what else could be possible? You really need to talk to a broker, not me.

frogman says

Thanks Sara, this is very much appreciated. 3 of the 7 defaults have been settled and the natwest CC, I am already paying to debt collector through a different bank account of mine. The other 3 defaults are virgin mobile phones which they’ve recently transferred to JJC international. JC have messaged me recently to set up a pln which I will now do. I very much doubt these will lead to ccj once I get in an agreement with them. I will get in touch with my broker. Once again, thanks very much.

Do you by any chance know what I can do with the 247moneybox one? the account is already settled.

Sara (Debt Camel) says

I repeat you need to settle these debts. Not hope to conceal them by paying them through a separate bank account. You need to face up to reality. And talk to a broker.

Mandy says

I am currently in a DMP and have been for 3 years now, I switched to a new fix last year with the Halifax with absolutely no issue at all – I hope someone finds that reassuring

Sara (Debt Camel) says

Thanks for sharing this. It means so much to people reading this to know this wasn’t just possible but straightforward.

Jay says

Thank you so much for this , been filled with worry about the fix ending but this has calmed my nerves.

Thank you

Mandy says

I know what you mean, I felt the same, but honestly, it was a breeze!

Charlie says

Wow thanks for sharing. Can I ask, was Halifax your existing lender? Or, do you mean this was a new remortgage with a new lender?

Thanks

Mandy says

Yes, they were my existing lender so not a new lender or remortgage, but I was very lucky and managed to fix at 2.69% for 5 years in April 22 and it started on 01/06/22 so still have almost 4 years left at that rate – massive relief!

L says

Hi Sara,

This isn’t relevant but I really encourage you to look into Monzos Trustpilot. As a user of monzo for 4 years they’ve suddenly decided to close my account with no answer as to why – something they seem to be doing to the older users. Out with the old, in with the new it seems to them.

Sara (Debt Camel) says

Who are you going to move to?

C J says

Hi Sara

My partner, perfect credit rating who owns a flat on mortgage. We have sold the flat and purchased a new house. The chain is now complete. We had a mortgage in principle with Natwest, following further checks they have mow declined this.

This is because of my and my credit report. I recently come off a debt management 2-3 years ago. I am now debt free and building my credit back up but understand that some lenders dont want to get near me.

So much so that our current mortgage advisor has checked 150 high street lenders to which none will offer us a mortgage.

We are now in desperate need as the chain is complete and we are ready to exchange but now have no mortgage.

Please can you recommend anyone to assist with maybe someone with debt management history, who has improved his credit since it being closed 2/3 years ago whose partner has a clean record and owned a flat since 2014 on mortgage.

Any advice would be great.

Sara (Debt Camel) says

Have you exchanged on your purchase?

What does your mortgage broker say?

Have all the debts in the debt management plan been settled – how long ago?

CJ says

Hi Sara

The chain is now complete. Next step is to exchange. Originally NatWest gave us a Mortgage in Principle but then after further checks declined 3 weeks later as i had a closed account in 2020.

All debts on my Step Change were cleared and closed in January 2021.

Our mortgage broker is struggling and tried 150 high street lenders who are all a no.

There must be specialist companies out there that can help?

Sara (Debt Camel) says

There aren’t 150 “high street” lenders. That will already have covered almost all of the market and I wouldn’t recommend going to the rest…

How large a deposit will you have?

CJ says

We have a 15% deposit. Which works out at £65k on the £420k purchase. So we need a mortgage of around £365k.

I am not sure if the mortgage broker, who is SJP, may have access to all the specialist companies that may be able to assist.

Any advice or any direction you can point me in would be greatly appreciated.

Sara (Debt Camel) says

I had no idea SJP did mortgage broking. Have you signed any contract with them?

CJ says

No contract has been signed. We only have to pay her once she finds us a mortgage and it goes through.

But thats not the issue. The issue is we had a MIP with Natwest which was later declined and we now have to find a new mortgage ASAP so we can exchange on the new property.

But with coming off a debt management plan 3 years ago i am struggling to find one.

We are waiting for her to come back on one final company who may be able assist but after that she can assist us any more.

Please can you advise anyone or point me in the right direction of anyone?

Sara (Debt Camel) says

Oh good, SJP have had a poor reputation for making it expensive to move to a different adviser.

See MSEs list of mortgage brokers here – and read the article – https://www.moneysavingexpert.com/mortgages/best-mortgages-cashback/

CJ says

Thanks Sara

I was hoping there would be a list for specialist companies offering mortgages for people with Bad Credit (Defaults, CCJs) and in my case being in a Debt Management plan in the past 6 years.

Just worried the link you said will be going to the same companies my mortgage broker has already spoken with

Sara (Debt Camel) says

There are but I wouldn’t recommend any of them and I am not aware of a list. And I would personally prefer to go to a proper mortgage broker who specialise in this. Unless there is something you haven’t mentioned (payday loans? self employment?) your case doesn’t seem particularly complicated and the broker should have been aware if NatWest’s underwriters were likely to decline – that is what you pay a broker for.

CJ says

Ive had a payday loan this year but was settled that month i obtained it. Will that cause issues then too?

Other than that i have nothing to disclose.

No defaults, CCJS. Just a debt management plan closed in January 2021 and the above payday loan i mentioned (which i didn’t think would matter).

The NatWest thing was out of the mortgage brokers hand as although i passed original checks, when it come to it they declined as they realised i had a debt with them 10 years ago which was only closed off when StepChange was closed.

Its all to confusing for me. Just dont know where to go from here once my existing broker exhausts all their options. Just doesnt seem to be any point going to another broker with the same marker access.

I thought there would be a specialist broker out there that would look at finding a mortgage offer based on the above issues.

Sara (Debt Camel) says

That payday loan is almost certainly going to cause you problems with almost all mainstream lenders. Did the broker not mention this?

Did you tell the broker the names of the lenders that you have had problems with in the past? You need to avoid them even when your credit record looks clean. Brokers can’t guess about info which isn’t on your credit record – you need to tell a broker about all your previous problems, even the ones no longer on your credit record, so they can help you find the best lender.

Carol says

I have got a question regarding a mortgage porting. I have got a joint mortgage with my ex partner. We have decided to part our ways, sell the house and one of us would like to keep an existing mortgage (as the rate is very low 2.4% – it’s with Virgin Money).

My credit score is low (49 points away from fair), my ex partner’s score is an excellent.

I know I will be struggling with getting a good mortgage rate or getting a mortgage in general (if I ever get a chance to get any mortgage deal with my current score), so we have agreed that I can take an existing mortgage with me. And I have got a question – would this be possible in my case? Will Virgin Money do a hard search on my credit? Can they say no to me keeping an exisiting rate? Are the lenders very strict with rules?

I would like to avoid getting a new hard search, but I am not sure if this is possible?

I would be grateful if you can help me understand the whole process and tell me about the steps I need to follow in terms of getting a mortgage and buy another property on my own.

Thank you in advance for all of your tips and help.

Sara (Debt Camel) says

There isn’t an easy answer to this – and getting a hard search is likely to be the lest of your problems to worry about.

This article is sensible: https://www.thisismoney.co.uk/money/mortgageshome/article-12402241/My-partner-separating-one-joint-mortgage.html

You are unlikely to just be able to agree between yourself about who gets the cheap mortgage. A “port” requires most things apart from the house to stay the same… a lender is essentially going to be giving you a new mortgage and at a cheap rate… when the lender may feel that you cant afford that mortgage even at the current rate.

I think your first step has to be to talk to a good broker who will know what Virgin are likely to do.

What are the problems on your current credit record?

Carol says

Thank you for your reply Sara.

I got in to some financial troubles in 2018, because my ex-partner was unemployed (for 5 years), we were struggling, so I started using my credit cards, couldn’t pay them off on time and got defaulted on three accounts.

One default was paid off past year, the other one will be paid off in June this year and the last one probably at some point this year (I have got a monthly instalments set up on my account).

If I could turn back the time, I will not do the same thing, but it’s too late now and I am paying for my stupid mistakes now (as it’s not that easy to build up the credit score).

What will happen if I ask Nationwide/Virgin Money to give me an agreement in principle to see if I can acctualy borrow the money?

I have sent an email to Virgin Money this morning and asked them if they can check if I could take the the mortgage with me without doing a new search, but I am not sure if they’ll be able to give me that kind of information yet?

Sara (Debt Camel) says

I think it would be better for you to talk to a broker, not make applications without knowing what is likely to happen.

Carol says

Thank you. This is what I will try to do.

(I acctually thought that porting a mortgage would be easier than taking a new one. We have been paying our mortgage on time (always) and we never took a time off. And we have been with VM since the start (2012)).

James says

Good morning,

I have been with my partner for 6 years now, she had the mortgage on the property before we met and I have contributed to half the mortgage since moving in over 5 years ago ( help to buy scheme ).

Her fixed rate is now coming to an end in the coming few months and we want to put myself onto the mortgage now too.

She will be starting a new job in 2 weeks which is a 40% pay cut ( down to circa £26k ) – does this have to be declared ? Will they re-check her income/expenditure as she has never missed a payment or been in arrears ?

My credit score is hovering around 600 and I have had problems with gambling and debt over the past few years ( currently £4000 credit card debt in total ). My income is £43k. In your opinion what are the chances of me being accepted to be put onto the mortgage and if I cant will it affect my partner getting a new rate ?

Thanks

Sara (Debt Camel) says

Who is the mortgage lender?

James says

Leeds Building Society

Sara (Debt Camel) says

if she is asked for her employment details, she needs to give them.

But I do not expect that they will do an affordabiltiy check on her as Leeds BS have signed up to the mortgage charter (https://www.gov.uk/government/publications/mortgage-charter/mortgage-charter).

If you want your name added to the mortgage, there will have to be a full affordabilty and credit checks on the two of you. If your credit record problems are recent, you may not pass. And because of her lower income she may not pass. Putting two names on that each have difficulties means the paid or you may not jointly pass.

As a further complication, I don’t know if it is possible to remortgage into joint names while there is a Help To Buy portion.

If she got the mortgage originally through a broker, i think she should be urgently talking to him about her options.

Andrew Gossage says

Hi, not sure if can help.

I have a Right to buy, max discount 96k. house is worth in region of £250k, I understand the 96k can be used in place of a deposit.

However, is it possible to get a mortgage for 190k and use 36k to pay off ALL other owed money, ie remaining car loan, and also redecorate/kitchen etc, as we all know councils don’t do good jobs on these and ours is in dire need?

Ive been working hard from advice on this site for years, managing to finally get myself into a better position, however time isnt on my side, my partner is 52 and looking already a short mortgage needed now, so its either we do it now or it wont ever happen.

Question is just on whether the above is ok, I am not at the stage of yet having a firm valuation so not spoken to a broker, but want to get my info first.

Sara (Debt Camel) says

You should talk to a mortgage broker but I do not think that will be possible. If the house is in dire need of major works, you may want to consider if you can actually afford these.

Ross says

Hi there, I have a mortgage for 25 years with nationwide, I’m in fixed term until 2027. I’ve been in dmp for a year and will still be in it by the time my fixed rate ends, will I have any problems getting a new fixed rate with my provider when the time comes?

Sara (Debt Camel) says

this shouldnt be a problem – Nationwide have signed up to the Mortgage Charter https://www.amigoscheme.co.uk/ and they shouldn’t do an affordability check before offering you a new rate

Gemma says

Hi Sara,

I’m hoping you can help/ advise me. I have been with my current mortgage provider since I brought my shared ownership home in 2019. My mortgage was a variable rate first charge capital repayment loan. I had very few options because I was a sole applicant and young female. Because of the variable rate I am now paying a ridiculous amount for my mortgage and I am finding it hard to pay, leading to my credit score being poor now. I want to fix my mortgage to try and reduce the payments. Is this possible and how do I go about this?

Sara (Debt Camel) says

who is the mortgage lender?

did you go through a broker?

have you missed payments to unsecured debts? which?

Gemma Powell says

The lender is together mortgages.

I originally went through a broker.

I haven’t had missed payments for some time but have made late payments

Sara (Debt Camel) says

I think your best option is to talk to the broker again. They will know if it is possible to get a fixed rate.

If they say No, then you need to consider whether you can carry on like this.

James Haldon says

Hi Sara,

I have a mortgage with Pepper Money. My 2-year fixed is about to expire and I want to move lenders. Mostly because I am selling this house and want to move, so I don’t want to be on a fixed rate. My payment is due to jump up by £900 a month though.

I have 6 defaults – they all hit 6 years between Jan 2025 and Aug 2025, so they are all at least 5 years old and all the debt is now gone.

Do you think I should try for a mortgage with a bigger lender (Nationwide etc.)

I have has no money problems for years now and everything was settled via a DMP or negotiated settlements. We have also never missed or been late with a payment on this or any other mortgage.

Sara (Debt Camel) says

Do you mean try now? Or when you move?

James Haldon says

I’d like to move lenders now, as Pepper can only offer a new fixed with a high ERP. I’d like to move to either a variable (with a better rate) or a mortgage I could port when this house sells. There’s nothing to say this house will sell soon.

Sara (Debt Camel) says

“they all hit 6 years between Jan 2025 and Aug 2025”

I assume those dates were wrong

When were the last of these debts settled/cleared/

James Haldon says

I cleared them all between 2019 and March 2021. Through a DMP at first (started in Deb 2018) with StepChange and I negotiated settlements when I had some inheritance to clear the rest. I final one was cleared in March 2021.

Default Dates:

Default 1: 22/04/2019

Default 2: 1/05/2019

Default 3: 01/08/2019

Default 4: 01/08/2019

Default 5: 03/01/2019

Default 6: 29/04/2019

So they will all be 6 years old between Jan and August next year. Default 3&4 had tried to default mine later (in 2020) but I complained and they changed the dates for me.

Sara (Debt Camel) says

So those old, settled debts shouldnt be a problem for most lenders.

But wanting a mortgage that is portable or a variable rate, so early repayment charge, is important for you. So I think you should talk to a broker about this now. It doesn’t have to be a “bad credit” broker.