Can your house really be at risk if you get into difficulties repaying something like a credit card bill?

You might think the answer is “no”, but there are some very rare situations where this can happen. It helps to know the facts, so you can make good decisions about how to deal with your debts.

To be able to sell your house a creditor has to:

- start by getting a County Court Judgment (CCJ);

- go back to court to apply for a Charging Order; and

- go back to court again t0 ask for an Order for Sale.

This article looks at unsecured debts – credit cards, unsecured loans, catalogues, payday loans etc. It doesn’t apply to secured debts such as your mortgage, where the rules for repossession are very different.

Contents

Step 1 – County Court Judgment (CCJ)

Just because you have defaulted on a debt or it has been sold to a debt collector doesn’t mean you are going to be taken to court for a CCJ. And without a CCJ, there is no chance of a charging order or a visit from bailiffs.

If you don’t have a CCJ but a creditor is threatening this sort of thing then don’t panic, they are just trying to pressure you into paying them. But don’t panic doesn’t mean ignore them.

A debt collector is much more likely to go to court for a CCJ if you ignore them. So read Threats of CCJs – Is the Debt Collector Bluffing? which looks at what you should do.

You know a debt collector is getting serious about going to court when you get a Letter before Action/Claim. Read What to do if you get a Letter before Action to see how you should complete the Reply Form with the letter. There may be ways you can challenge this debt. or you could get the creditor to accept a payment arrangement.

If you don’t do that and get a Claim Form from the court, you need to take action, even if you can’t afford to clear the debt. See What to do if you get a Claim Form for details.

If you are at all unsure, phone National Debtline on 0808 808 4000 who can discuss the details of your case in confidence. National Debtline are excellent on everything on this page – CCJs, Charging orders and Orders for Sale.

Step 2 – Charging Order

I am assuming here that the CCJ was obtained after October 2012. If it was earlier, contact National Debtline for advice.

A creditor can apply for a Charging Order even if you are making the monthly payments set for the CCJ.

When a court grants a Charging Order, a legal charge is put on your house.

If you own the house with your partner, the Charging Order is only made against your share of the equity – your partner’s share will not be affected by it. This is sometimes called a “restriction”.

The order of charges matters. Say you already have a mortgage and a secured loan – this new charge will then be third in priority. If your house is sold your mortgage is paid off first, then the secured loan then (if there is enough equity left) this new charge.

It is not automatic that a Charging Order will be granted. You can defend this by arguing that it would be unfair to you, to other people that live in your house, to the joint owner of your house or to your other creditors.

You can also ask the court to add conditions – for example that the house cannot be sold until your children are over 18 say.

See this National Debtline factsheet for more information about the court process of a Charging Order and how you may be able to challenge it.

Step 3 – Order For Sale

An Order For Sale is a court order which forces you to sell your property – the creditor will then be paid back because they have a Charge over the property, see above. If you don’t pay the debt or leave the property within 28 days, your creditor can apply for a warrant of possession to force you to leave the property.

An Order for Sale will only be granted if there is already a Charging Order that has been made final and if the debt is more than £1,000.

If the CCJ was after October 2012, the Order for Sale will not be granted if you are up to date with the CCJ payments.

As with a Charging Order, you can defend an application for an Order For Sale on various grounds.

It is worth doing this even if you tried and failed to prevent a Charging Order on similar grounds – the judge may well decide that the Order For Sale is unfair to someone else as they would lose their home.

You can also make an offer of monthly payments at this stage and ask the court to suspend the Order so it won’t apply if you make the payments. See the National Debtline factsheet for more details.

How often does this happen?

You might think creditors will rush to get to Stage Three, the Order for Sale, as fast as possible.

This isn’t correct.

Creditors don’t want to go to court once, let alone three times. It costs them time, money and at any stage their court application may be refused, so it’s risky. And selling a house is even more hassle.

Creditors would much prefer to find an acceptable repayment solution and not bother with any of this court action!

Normal consumer creditors such as credit cards, banks, payday loans are very unlikely to go for a Charging Order.

The main exception here is guarantor loans, where lenders such as Amigo can be very fast to take a guarantor to court for a CCJ and then they often apply for a Charging Order. But Amigo don’t routinely apply for Orders for Sale.

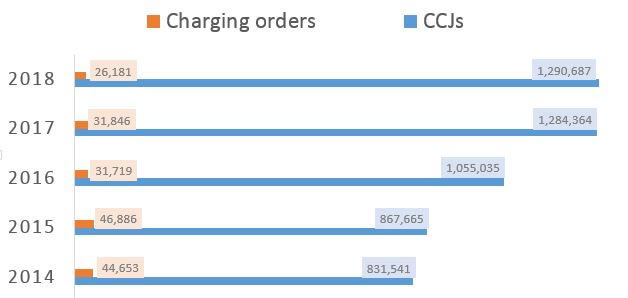

Look at this chart showing how the number of CCJs in England and Wales has gone up since 2014. At the same time the number of Charging Orders has actually fallen.

In 2014 there was about one Charging Order for every twenty CCJs.

By 2018, this had dropped so there was only one Charging Order for every fifty CCJs. That proportion remained the same in 2019.

So Charging orders are less common than they were.

The number of Orders for Sale is so tiny they wouldn’t show on that chart at all. In 2013 there were only 220 Orders for Sale.

Ways to keep your house safe

So the number of Charging Orders is small and the number of Orders for Sale is incredibly tiny:

- if you talk to your creditors and don’t ignore them, you probably won’t get a CCJ let alone a Charging Order;

- if you do get a Charging Order, the creditor cannot get an Order for Sale if you are making the monthly payments on the CCJ.

So don’t be an ostrich. Debt problems get worse if you ignore them, they don’t go away.

Where it’s the added interest that is causing problems, talk to the creditor about a payment plan or talk to a debt adviser about a Debt Management Plan.

With impossible debts, get good debt advice on your options. It’s good to do this as soon as possible but it is never too late!

If your creditor goes go to court, respond fast, do not ignore it. There may be ways of contesting CCJs, Charging Orders and Orders for Sale that will work for you. If you do nothing, the creditor will get what they are applying for.

So get help!

National Debtline doesn’t just have a great set of factsheets, they can also give advice to individuals about their specific cases. Unless you are completely confident in what you are doing, give them a ring on 0808 808 4000 and talk things through with them.

A C says

Hi,

My wife had an IVA complete on 2011 and we’ve discovered that 2 of the creditors (northern rock & RBS) still put a charging order for the full amounts of the loans, despite being joint named against our property, even after accepting the IVA.

Is there any way we can get these removed / appealed and should she get in touch with both creditors and make an offer to settle or will they still require the full amounts to be repaid?

We are looking to sell the house soon and there’s not much equity and I’m concerned they’ll transfer the debt to the new house.

Any help would be appreciated.

Sara (Debt Camel) says

These were joint loans? And only your wife had an IVA?

A C says

I’m sorry, additional comment got deleted by accident. We both had individual IVA’s and my share of the loans was accepted and cleared upon completion of my IVA. Transpired that my wife share was accepted on her IVA, however they still put a charging order against the property for the total amount we borrowed, despite us making full monthly repayments before the IVA’s started a couple of years later.

Sara (Debt Camel) says

Can I ask for exact dates, because you seem to be saying slightly different things for each of your IVAs and I am not sure why.

When did your IVA start? complete?

When did your wife’s IVA start? complete?

What was the date of the CCJ for the NRAM debt? And the charging order for that debt? Was this debt included in both your IVAs?

What was the date of the CCJ for the RBS debt? And the charging order for that debt? Was this debt included in both your IVAs?

A C says

Thanks Sara,

I’ll dig the dates out and get back to you ASAP

The RBS and Northern Rock personal loans never went to CCJ. They were both included in the applications for the IVA’s.

My share was accepted and cleared upon completion, however, under my wife’s application, they were added to her IVA but with a charging order for both loans for the full amounts rather than just her share

A C says

Hi Sara,

Start date for mine was 27/10/06 and completed 20/03/12 and wife’s was 03/04/09 completing 22/09/14

Sara (Debt Camel) says

What were the dates of the charging orders?

A C says

Northern Rock – 05/01/2007

RBS – 25/02/2008

Sara (Debt Camel) says

I suggest you get all the paperwork you have together and talk this through with National Debtline.

1) It isn’t possible for there to be a charging order unless there has been a CCJ.

2) The fact that a joint loan is included in your IVA is irrelevant – the full amounts should also be included in your wife’s IVA. Your IVA completing means you no longer owe anything to the debts but your wife then owes the full amount.

3) although it is possible to include a debt covered by a charging order in an IVA it is VERY VERY rare. It would seem unlikely that both creditors agreed to this for your wife’s IVA.

A C says

Thanks so much for your help Sara.

We both applied at the same time and mine flew through, however my wife was told by the LLP that the above 2 banks were putting charging order on and there was nothing she could do about it.

I’ll get her to call the hotline tomorrow and hopefully we can appeal these.

I’ll keep you informed.

Teresa says

Hi

Hope you can help my husband got a ccj with egg in 2009 and a restriction was put on LR we are now selling our house which is joint name but the egg loan was his name only

My question is that is on the LR the restriction is to Egg Banking but he has received a letter from Shoosmith solicitor stating that they are acting for a debt collection company not egg banking

Who would i pay if I was to offer a reduced amount and can egg only remove the restriction

Sara (Debt Camel) says

I suggest you should talk to the solicitor doing your conveyancing about this.

adam Evans says

Hi, I have a debt of around 100K in total from various creditors, one is for approx 30,000 pounds. they have issues a final charge on the property which is jointly owned. The equity is approx 35,000 each. If I file for bankruptcy what happens, do I just pay the 35,000 equity? and what happens to the charging order on the house?

Sara (Debt Camel) says

I suggest you discuss your option in detail with National Debtline on 0808 808 4000.

kerry says

Hi. my husband and I have a joint interest only mortgage that was taken out in 2005. The property was bought as a buy to let investment. There was no arrangement made for saving for the equity payment at the end as we had hoped that the value of the property would increase enough to more than cover the outstanding loan with a little left over. Unfortunately due to the housing crash the property value plummeted and has never fully recovered. Still currently just around the amount actually owed. The main problem is that we have just been notified that we cannot sell the property as it is subject to defective external cladding (as in the Grenfell Tower incident),with a potential cost of arounf £10,000 per unit, rendering the property currently unmortgageable. The responsibility for the cost of the repair is still under debate. My question is this, if at the end of the interest only mortgage term the above issues have not been rectified thus meaning that we cannot sell the property in order to repay the loan, can my family home become subject to a payment order if we end up having to hand the property back to the lender? Our family home has only recently been purchased and so has little if any equity in it, but this is on a repayment mortgage. Thanks

Sara (Debt Camel) says

is the rental income more than the mortgage at the moment?

kerry says

No its breaking even. The rent is more than the mortgage but with all usual fees deducted it’s basically just wiping its face.

I think there is approximately 10 years left on the mortgage.

Sara (Debt Camel) says

Then I would hope this cladding issue is resolved long before then!

kerry says

I hope so too. However the query that I really have is that if it comes down to us having to pay for the cladding to be fixed then it is looking at a cost of approximately £10,000 which we do not have, nor will there be that much equity in the property to be able to re-mortgage it to raise it, even if we could. It would potentially mean that we could no longer keep the property as we would be unable to pay this bill and may end up having to hand the keys to the mortgage company and/or declare bankruptcy. My main question is would we be forced into selling/losing our family home if we cannot pay for the cladding to be done?

Sara (Debt Camel) says

ah ok, originally you asked what would happen at the end of the mortgage term.

It is hard to predict what could happen here. A mortgage lender may be slow to repossess if they will end up with a loss and you are paying the mortgage. But the freeholder may have rights if you do not pay the cost of the works through the service charge.

As a piece of common sense advice, you should view saving up as much money as possible for these works as your top financial priority. If that sounds impractical and/or you have unsecured debts it would be a good idea to talk through your whole financial situation with a debt adviser – ring National Debtline on 0808 808 4000. You may have more options now, even if they are not nice ones, then later on.

Turhan says

Hi,

I got a CCJ against someone who owes me a figure between £1000-£500 and having exhausted all other ways to get my money back i thought my only option now would be to place a charging order against this persons house not to be sold immediately but to wait until it did sell. I am guessing there were a lot of CCJ’s against this person because before i could do this he left the country and went to live abroad. This was back in 1996 and this person has now returned to the country. Is it possible to take out a charging order on his new property or has too much time elapsed.

thank you

Sara (Debt Camel) says

You can’t enforce a CCJ – by a charging order or any other means – that old without permission from the court. I would be very surprised if you can get this but I am not a lawyer and you would need to take legal advice on this.

Annom says

Hello I have been separated from my ex for 12 years and in process of divorce. I have had notice of of a interim charging order for a debt in his name on our joint property. I responded by email disputing this but heard nothing back. Since then my ex said that he had arranged to make repayments but I suspect he isnt doing following covid19.i wish to remortgage with my new partner and remove him from the deeds. How can I best sort this? And ensure the charge isnt going to effect me?

Sara (Debt Camel) says

Talk to National Debtline on 0808 808 4000 about what your options are.

Dave says

Hi there

I am in the process of extending my lease but can’t because of a charge on my property by my sister who use to live there. The charge has been on the property now 10 years but I can’t wait another 2 years for it to be officially removed. What is my best bet in this situation.

Sara (Debt Camel) says

why is it being removed in 2 years?

Don says

Hi, many years ago I got into debt with Creation which resulted in a ccj and charging order on my house. At the time I was in a bad place and suppose I tried to hide from my problems by not opening mail so was never aware of the ccj/charging order until many years later when I came to sell my house. The ccj had long vanished off my credit record but the only way to sell the house was to pay the order, which I did. I requested statements from Creation as I believed the balance was too high and after looking at them could see at the time my account was active I was on a dmp and making a small monthly payment, however they were still adding interest and charges which meant my balance was just increasing and I had no chance of paying it off. I complained to Creation and they offered a small redress however I took the complaint to the ombudsman nearly 2 yrs ago now. The adjudicator originally ruled in my favour, however Creation have now come back and said because a ccj was issued they believe the court dealt with the matter and therefore the for have said they can’t look at my complaint. I’m completely confused by it all. The way Creation has dealt with my complaint is appalling to say the least but why did they not raise this when I first complained or should it not have become apparent when I complained to the fos? I don’t understand how the court could have been expected to deal with it when I wasn’t even there or submit any defence? Any advice would be appreciated.

Sara (Debt Camel) says

FOS can look a complaint where there has been a CCJ. They will not normally do so if the subject of the complaint had been argued about in court, but yours was not.

You can go back to the adjudicator and say this. Say that you were unaware there was a CCJ or a charging order until [the date you found out] and the matter you are complaining about was never considered by the court [assuming that is correct of course!]. Say that you would like the complaint to be looked at by an Ombudsman if the adjudicator does not change their mind.

BUT there may be a difficulty in practice if all this happened a very long time ago, but if you have all the statements from creation that may help.

mark says

Can u help please ???

I am bankrupt and my wife ccj both through separate businesses but as guarantor my wife’s ccj put a charging order on our home. It has zero equity and we can’t renew our mortgage to add the home help to buy on it. We have to sell the home and the charge will get absolutely nothing as the house will only cover the mortgage and home help. To buy. My bankruptcy have waved there interest in the house and we must pay the help to buy this year. What will happen to my wife’s charging order now ? She’s worries they will try chasing her again but she’s on maternity now and the stress this company is causing is ridiculous. We’ve offered payment before it got to this stage but they refused and took an aggressive approach instead with the charge. We have a buyer already what can happen from here any help please we’re desperate

Sara (Debt Camel) says

How long ago did you go bankrupt?

Your wife has a CCJ as she was the guarantor for a loan? Who was the lender?

Does your wife have other debts apart from this one?

Where are you planning to live?

Mark says

Hi Sara

Thank you for the comment, my bankruptcy put on me 2018 and my wife’s debt was 2018 for a rental agreement to a brewery for a pub they called EI Group.

She has one debt for the car due to finish in two years and we are going to live with her mum until we find a rental property somewhere

Sara (Debt Camel) says

It’s good you have somewhere to go as it can be hard to rent privately. Are you in work?

How large is the CCJ debt? Why did your wife not go bankrupt at the same time as you?

mark says

Yeah I’m working in a temporary contract tho so can be finished anytime. The debt now is at £90k she didn’t go bankrupt as she wanted to try and not let both is us be bankrupt and have a chance at a future and we needed a car on finance basically

Sara (Debt Camel) says

That was probably a poor decision. If she had gone bankrupt then you would be two years nearer a clean start. Creditors owed 90k don’t go away quietly…

You two need debt advice urgently, I suggest you phone National Debtline on 0808 808 4000 tomorrow. It’s not clear to me that you will gain anything except a lot of hassle from trying to sell the house. It may be simpler for you to stop paying the mortgage so that you can save up the money for a very cheap car and she can save the money for her bankruptcy fees.

mark says

Thank you I will do that tomorrow very much appreciate

Natalie says

Dear Sara ,

I had a cap quest debt of £1400 which I accrued in 2013 . They sent me paperwork from Northampton court that said they had got a charging order on my property however I do not have any ccjs listed nor have I ever had any paperwork to confirm this? So do they need a CCJ in place before applying for an order ?

Do you think these are a mock up in order to scare me into paying, I have heard no more since until last month I received a cap quest letter saying that despite the charging order I have not made an arrangement to pay and to fill in monthly expenditure sheets etc.

During the time this was going on I had made arrangements to pay with all my creditors apart from these set up via the local CAB. Due to a bereavement and loss of job. Thank you

Sara (Debt Camel) says

Yes they need to have a CCJ before they can apply for a charging order.

Why wasn’t this debt included in the ones you have been paying through CAB?

what sort of debt was the original debt? Have you made any payments to it since 2013?

Claire says

Hi, we’re looking for help please. My husband had a charging order issued by a bank for a personal guarantee on a business account he was strongly encouraged to sign. We cannot pay off the CO in full so Bank have now issued a claim for an OFS on our joint home. Again, we can’t pay off the debt in full. Case has been adjourned for 6 months to find a repayment solution (requested by the Bank). My husband was made bankrupt in 2018 so further lending is none existent. We have made 7 offers of monthly repayments and all have been rejected and the Judge wasn’t interested in any of our arguments to protect our family home ie. one debtor, children, etc. Another offer to pay monthly was sent 2 weeks ago with no reply. Desperately anxious to find a way out of this mess without putting us in a dire situation of losing the house. Any help is most welcome, thank you.

Sara (Debt Camel) says

Can I ask how much your house is worth? How much your mortgage and any other secured borrowing is? How much the charging order is for? How much are you offering to pay each month?

Claire says

Hi, the house was valued at £350k by the creditor and is decreasing in value as it it leashold. Its freehold value is £500k+. The joint mortgage is £202k, 2nd joint secured loan £22k and 3rd charge (CO) is £33k approx. We have offered £1000 plus £200 increasing up to 450 per month over 6.5 years until debt is paid off. The increasing value is when the 2nd charge is paid off in 2.5 years time and an unsecured loan is paid off in 6 months time. The 1st charge mortgage and 3rd CO is the same bank but will not consolidate them both to repay. Thanks.

Sara (Debt Camel) says

OK, I suggest you talk to National Debtline on 0808 808 4000 about your options.

Claire says

Ok thanks for your help, I will give them a call.

Maria Roberts says

hello i am wanting to remortgage a joint interest only mortgage following a divorce.however my ex has a charging order for a unsecured loan being put on the property. Can I still remortgage if this goes through and take his name off the property?

Sara (Debt Camel) says

are you trying to get a new fixed rate? or a new mortgage? Will your ex agree? Do you have to pay your ex anything?

John says

Hi there,

I wondered can a solicitor put a charging order on a property for a high court judgement after bankruptcy??

I’m petrified. I just want a break. I don’t own all the home but the debt is around 300k and we have little equity and a child and a baby on the way.

Sara (Debt Camel) says

No.

But if you are thinking of going bankrupt, you must get advice first, even if you think it’s your only or best step, talk to National Debtline on 0808 808 4000. Especially if you own a property.

John says

I read something on the insolvency site (https://www.insolvencydirect.bis.gov.uk/freedomofinformationtechnical/technicalmanual/ch1-12/chapter9/part7/Part%207.htm) that said they could and it made me worried. Said solicitors and only solicitors could do it after. I can’t ever pay back the court costs so I have no choice.

Worried this will happen after bankruptcy to be honest and after reading the paragraph about it, I thought I could be. The costs are related to losing a high court battle and being ordered to pay the other side’s bill. They can’t decide that their bill is- it keeps going up. However I just want to save my own home now from a charging order. I know bankruptcy is hideous and it might not save it but if my other half can buy me part at least the children would have a roof over their heads.

Sara (Debt Camel) says

ok the paragraph you mentioned says “Prior to the making of an insolvency order, a solicitor can make an application for a charging order under the common law or statute [note 2] over a debtor’s property. ”

That is true, but it was talking about a charging order BEFORE bankruptcy

A charging order before bankruptcy will normally continue to be effective afterwards. This doesn’t matter to you as there isn’t yet a charging order

A creditor can’t normally get a charging order after bankruptcy, and an interim one can’t be made final

.128 says there is an exception if the court and the applicant were unaware you had gone gone bankrupt. So if you go bankrupt, tell the creditor this in writing. And if they are so mad as to apply for a charging order despite this, you tell the court that you are bankrupt, there won’t be a charging order and the creditor will have wasted their time and the court fee.

Sara (Debt Camel) says

BUT

this is not a reason to rush into bankruptcy right away without taking debt advice. Seriously, it is worth an hour of your time to talk your whole situation through with National Debtline on 0808 808 4000.

Here https://debtcamel.co.uk/tell-official-receiver/comment-page-1/#comment-381388 is an example of someone who rushed into bankruptcy without taking debt advice and who as a result is now in a very difficult situation. Her case isn’t relevant to yours but she went bankrupot without taking advice in the intereest of saving her house, please don’t you make the same mistake.

I am not saying that bankruptcy is “hideous”. It rarely is and it may well be your best option, it may prove to be a lot less trouble than you expect.

Most people regret they needed to go bankrupt but do not regret taking the bankruptcy decision – it gives most people the clean start they need, But you do need to go into it with your eyes wide open, having taken advice.

John says

I have spoken to them and Step Change. The debts are so high I would never pay them off in a million years and the amount is never going to be reduced. I am so so stressed and anxious about it all and it’s affecting my health massively. It just looks so complicated. It’s been going on so long and I don’t think I can cope with it all any longer. We borrowed money via a remortgage to pay the barrister and both been working ridiculous hours to pay the solicitor. I can’t do this anymore.

Sara (Debt Camel) says

If StepChange and National Debtline have both said that bankruptcy is a good option for you after you have gone through your situation with them, then you can trust their advice.

It isn’t usually that complicated in practice. Reading the Insolvency Service Technical Manual and looking for possible pitfalls isn’t normally a good idea as you can spend a lot of time worrying about stuff that isn’t relevant. StepChange and National Debtline will have highlighted any problem areas. If you can afford to pay the mortgage and your partner can buy your half of the equity you may be able to keep the house.

John says

This is the section of concern:

My house was not part of their work but I don’t really understand it:

“A solicitor will also have the right to a charge over property in the hands of the liquidator or trustee where the solicitor’s work led to the property coming into the estate, even if he/she did not apply for a charge prior to the insolvency order. The charge may be for an amount relating to his/her costs in obtaining the property either before or after the order.”

Sara (Debt Camel) says

That means that if you had just bought a house before bankruptcy and hadn’t yet paid your solictor for the work involved in buying the house, the solictor’s bill is a charge on your estate.

It isn’t relevant to you at all. it only refers to solicitors costs when you were buying a house. Not all solicitor’s bills for other reasons.

John says

Ok thank you, I really appreciate your time. I’ve always been brilliant with money until this.

Thank you so much for your help. We know we may have to start again and it’s not going to be easy. Randomly, I haven’t got my dad a gravestone yet. I’m an only child. Can that be something I speak to the OR about if I do go through with it?

Sara (Debt Camel) says

Honestly no. It can wait a few years or ask your partner to pay for it. In the big scheme of things this is very minor,

Annie says

There is a final charging order from 2010 that is being chased up by Drydensfairfax solicitors and not the bank that the original loan was from. I have had no contact to them in a decade regarding this as I don’t even remember the debt.

Does Drydensfairfax have the right to chase this up ? I have been reading it’s usually sold on to companies that continue to chase?

They keep sending income/expenditure forms. My mortgage is joint with my husband and I have been made redundant and have no means of paying this: I don’t even remember the loan as it’s been so long and we have only just returned to the property.

Can anyone please advise as this is causing me to fall sick from worry. Thank you

Sara (Debt Camel) says

I think you need debt advice asap because you cannot pay the mortgage. The charging order is just a small part of this picture. I suggest you contact National Debtline on 0808 808 4000.

colin says

Hi Sara

I am Losing the plot , I have a charge on a property in Joint ownership ,The other owner has paid the remaining mortgage balance and has infact being paying the Mortgage for some years ,The charge or Restriction is on a personal loan I had with Hitachi O/S balance is 5000 , I recent made an offer of 3600 as a final settlement ,Which I sent in writing (was received, to the solicitors who dealt with the debt Addlestone Keane) on Contacting

Hitachi today it appears that the offer has not even been forwarded to them ,the solicitors have had the offer 21 days as of tomorrow ,How can it take them 3 weeks to forward my offer ? Only I want is a yes no or a counter offer NOTHING is happening ,any advice appreciated .

Colin

Sara (Debt Camel) says

Ask the solicitors? Or send the offer directly to Hitachi?

Kim H says

Hello, looking for some advice. I still own a property with my ex-husband. There is a CO on the property for 7k in my ex-husbands name. The debt was originally owed to Fortis Lease UK Retail Ltd, however the restriction on the title deeds state ‘disposition was given to Fortis Lease UK Retail Limited at care of Salans’. Does this mean that the debt is owned by Salans? Fortis Lease UK have ceased trading a few years ago. Salans also sold on their ‘debt processing business’ to Solex Legal Services. Basically how do i find out who owns this debt now as I would prefer to negotiate a settlement prior to the house sale.

Sara (Debt Camel) says

If the 7k is coming out of your husband’s share of the equity, why do you care?

But I suggest you talk to National Debtline on 0808 808 4000 about this.

James Burry says

If a charging order is on my property and the original loan has been sold and the new owners of loan can’t locate the original agreement is this still enforceable

Sara (Debt Camel) says

Once there has been a CCJ, a creditor doesn’t need to produce a CCA if you ask for it. Talk to National Debtline if you are unsure about the charging order now the debt has been sold.

Rachael Clements says

Hi, I have been divorced since 2012 with an order in place that the ex pays the charging order for child maintenance from a previous relationship. I have requested statements and tried to inform CMS he is not a beneficiary of the property and I need to know when it’s paid but I’ve had nothing. I want to remortgage and get his name gone for good but I don’t know if the charging order is still live. Can you advise how I can find out?

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000 about your options.

Clair says

Hi, I have a ccj which is 7 years old. I paid monthly Payments for 6 years. The debt collector is now saying they will use a charging order. I have offered full and final settlement on the debt. They have offered increased payment plan. I thought they have to go back to the courts for a variation request on the installment amount. Is this correct? As for the charging order, can they do this after 6 years. I understand a ccj is not statue barred, however, will the debt collector not have to answer as to why they have not settled the debt within 6 years?

The original debt was credit card debt.

Thanks

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000 about your options. A debt collector that hasn’t contacted you about a debt fir 6 years has to go back to court to try to enforce it, but that isn’t what has happened here.

Sara Knight says

I have equity release. Can a charging order be put on my house?

Sara (Debt Camel) says

Yes. Do you have a CCJ you cannot pay?

Paul says

Hello, I have a charging order issued against my house for£11,000 in 2012 by motormile finance for a car purchased for about £2000 can lantern still enforce this. Thank you for your time.

Sara (Debt Camel) says

Motormile finance changed their name to Lantern – it is the same company. I have no reason to think this isn’t enforceable – if you need advice on this, talk to National Debtline on 0808 808 4000.

Denise says

Hi Sara

my debt has been sold by my bank to another company which I have reached an agreement for payments with – but the bank still has a charge on my house for the original debt is this legal if they have received the payment for my debt?

Sara (Debt Camel) says

The charge will probably be transferred to the debt purchaser.

Denise says

The charge is still in the name of the bank on the land registry

Sara (Debt Camel) says

Yes but it may be transferred. Does this matter to you at the moment?

Ian says

Hi

My wife and I are selling our house.

We are downsizing to a park home to be near her dying mother. We are going to use the remaining equity in our home to do this.

Our solicitor has found two charges on our land registry that we new nothing about. These appear to be from credit card debt more than 15 years ago. The companies either don’t exist now or have been bought by other debt companies. We are in a DMP and have been for years and have continued to make payments on time and never missed. Are these charges going to stop us selling the house if we can’t track down the creditors. We have no reference numbers or anything like that as all our debts have changed hands that many times.

We are very worried that this is going to cause big problems.

IM

Banbury Oxon

Sara (Debt Camel) says

how long has your DMP been running – who is it with? a charge can’t be set up if unless there was a CCJ – or in this case, two CCJs. And you obviously haven’t moved.

Monica says

Dear Sarah,

Good evening. I didn’t know under which category I should ask this question so I decided to put it here.

I had a letter this afternoon and I need advice on what to do.

My late husband and I owed our residential property together. I have received a letter this afternoon from a solicitor for an Interim Charging Order on the property for £3,000 owed on a credit card my husband was paying until his demise. One of the letters was addressed to him and one to me.

From the letter and I quote ‘ On 11 January 2003, the court officer considered the application of the claimant (the judgment creditor) from which it appears:

a) a judgment or order given on 10th June 2022 by the county court Business Centre in claim no…. ordered the defendant (the judgment debtor) to pay money to the judgment creditor; ‘

My question is what do I do about this as the house is now in my name at the mortgage lender but the land registry details attached to the letter still bear my husband and my name. Does that mean there was something I should have done initially that I didn’t do? I am at my tethers end. Please advise me. Thank you.

Sara (Debt Camel) says

I am sorry you are having to deal with this at what must be a very difficult time for you. I think you need to talk this through with a debt adviser, I suggest you phone NAtional Debtline on 0808 808 4000.

Alison says

I’ve received a letter from Overdales claiming they have secured a final charging order on my property against an unpaid CCJ awarded in January 2018. I do not own any property and have received no prior notification regarding a charging order. The mailing address they use is my mothers (same surname as me) and she owns the property outright. I’m worried that they may have charged it to her property, in which I have no registered interest, or is it just bluff on their behalf as we’re approaching the end of six years? Their letter had left a blank space where they should have said the address of the property the charging order had been confirmed against, likewise the date of action was also blank. Nothing received from the court.

Sara (Debt Camel) says

is that where you live? Might your mother have opened post addressed to you?

Alison says

It’s used as my ‘registered address’ for bank and legal stuff but I don’t live there anymore. She would definitely have told me if she’d opened anything addressed to me (we have different initials and she’s a Mrs) and even more so if it was anything relating to debt or legal action.

Sara (Debt Camel) says

Well one option is to simply reply saying you do not own a property.

But as this is so close to the 6 year point, I think you should talk to National Debtline on 0808 808 4000 and ask for their advice.

Alison says

Yes, I’m reluctant to open a conversation with them at this stage – will contact the Debtline – many thanks for your help.

Lynda says

Help required. My ex partner has not lived with me for over 10 years. We have a joint mortgage and he hasn’t contributed towards the repayments in that 10 year period. He doesn’t want anything from the property but does want to come off the joint mortgage. I was happy with this course of action, however I have now discovered he has a charge on the property for an outstanding debt, this is in his name only. I had absolutely no knowledge of this. I haven’t approached my mortgage lender at this stage. Any advice greatly appreciated. Many thanks

Sara (Debt Camel) says

How large is the charge?

Lynda says

Around 25k.

Sara (Debt Camel) says

Ok so one thing you could try is to say to your ex that you will not co=operate in getting your ex’s name removed from the mortgage unless he has settled that debt and had the charging order removed.

Another thing is to talk to National Debtline on 0808 808 4000 about your options, as you should have been informed about the charging order and it should have been registered as a restriction, see https://www.nationaldebtline.org/fact-sheet-library/charging-orders-ew/

Rachel says

I am not on the mortgage but I am on joint secured loan could they apply a charging order on me

Sara (Debt Camel) says

No

koo says

mortgage with the Northern Rock in 2006. I fell into arrears with the unsecured loan. They obtained a CCJ in 2007 and court torder was pay £26 a month until cleared. ln 2020 I paid off the unsecured loan in one lump sum . I was remortaging last year when the solicitor advised there was a interim charging order on the deeds under the we could not proceed until removed. I rang NR now landmark mortgages and requested they removed this as the ICO was no longer valid given the debt it related to was satisfied. They advised twice, they would not remove this ICO until the mortgage was redeemed. I made a complaint to them before they Relented and removed the ICO. I wrote a formal complaint -offered me £75 compensation plus any costs incurred by my solicitor. However my solicitor did not charge me additional fees for this extra time .complained to the FOS,who after months have concluded that they cannot help!The reason they say is because it involved a CCJ an this involved court processes and things that they have no control or say over. It so if FOS cant help, who can?!

Sara (Debt Camel) says

The charging order has now, correctly, been removed. What were you asking FOS to make a decision about?

Koo says

The fact their delay in removing it, should of been 2020 and they did not remove until we wrangled with them-Solicitor and I last year, they said twice they wouldnt remove it until mortgage was redeemed, despite the ICO relating to a debt that was repaid 3 yrs before and fully satisfied. This delayed my mortgage going trough and caused so much hassle and stress and they ONLY offered £75! I also disputed with Landmark about the ICO, I was never made aware of it, and actually never defaulted either, they incorrectly apportioned the payments for the CCJ. They Landmark/NR also acknolwedge internally they went to remove the ICo for some reason in 2009 and it was never actioned. My new lender was then made aware of the ICo and subsequent CCJ-They should never have known ahd NR/Landmark correctly removed the ICO from my deeds in 2020.

Sara (Debt Camel) says

if this a FInal Decision from a FOS Ombudsman? Or a decision from an investigator/adjudicator that you case cannot be looked at.

Koo says

They have said its their decisison it cannot be looked at due to it being about court related stuff (CCJ), but said I have until 5/4 24 to appeal with them, for another adjudicator/worker to look at the case again….

Sara (Debt Camel) says

So if you want to dispute the charging order “I also disputed with Landmark about the ICO, I was never made aware of it, and actually never defaulted either, they incorrectly apportioned the payments for the CCJ.”, FOS will not look at this.

But if you are prepared to drop that and just complain about the Go back and say you are not disputing the court decision and the debt has been cleared, but you are complaining about the way they refused to remove the ICO despite the debt being paid, then the Ombudsman should be prepared to look at that. In this case say go back to the adjudicator that you understand that they cant do anything about the ICO, but you are complaining also about the failure to remove it when it was paid. If you have any evidence that you have incurred extra costs or are paying a higher mortgage rate because of this, you should say so.

Jacqueline says

Hi, My husband had a virgin credit card put on the house as a charging order in 2008, we have been paying Drysden fairfax monthly . I got cancer in 2022 and my husband had to close his business to take care of me , our mortgage company also at that time sold our mortgage to Mars Capital, from Dec 2022-June 2023 we were living off £400 a month which was working tax credits , we didn’t pay the mortgage as had to buy food and keep warm , we were in contact with Mars Capital all the way through , they accepted £400 a month in July 2023 when we got benefits through and we get support for mortgage interest . We have accrued £14,000 arrears on the mortgage , we now pay the full contractual amount , but we need to get away from Mars Capital as they charge a lot of interest . So MacMillan put us in touch with some mortgage brokers and we have one company who are going to look at remortgaging us , but the charge is for around £4,500 I don’t know exactly as we never get a yearly statement , we were wondering whether we could make an offer to get rid of the charging order as we know it will stand in the way of any potential mortgage offer . Hope you can advise as we would like to get rid of this charge asap , the money is gifted from a good friend if it is accepted .

Sara (Debt Camel) says

You could make an offer. Emphasise that you have no spare money to pay it and the money comes from a friend. I don’t know how likely they are to accept.

The other option is to remortgage for more to clear the charge as well.

Fiona says

Now in a similar situation. What happens in the case of no money from the sale of the property? Do you then become liable for the debt again?

Didn’t think that was the case, however, charging order on property around 2007, Bankrupt 2008, discharged 2009. Bank repossession of property in 2022, with sale in 2023. Not even enough money to pay off mortgage.

Company now with charging order on property saying because of shortfall I’m now personally liable for debt, they state the fact that I have been made bankrupt since charging order is irrelevant, and are now threatening to start process of recovering the debt

Sara (Debt Camel) says

Have you made any payment to the debt with the charging order since your bankruptcy?