Can your house really be at risk if you get into difficulties repaying something like a credit card bill?

You might think the answer is “no”, but there are some very rare situations where this can happen. It helps to know the facts, so you can make good decisions about how to deal with your debts.

To be able to sell your house a creditor has to:

- start by getting a County Court Judgment (CCJ);

- go back to court to apply for a Charging Order; and

- go back to court again t0 ask for an Order for Sale.

This article looks at unsecured debts – credit cards, unsecured loans, catalogues, payday loans etc. It doesn’t apply to secured debts such as your mortgage, where the rules for repossession are very different.

Contents

Step 1 – County Court Judgment (CCJ)

Just because you have defaulted on a debt or it has been sold to a debt collector doesn’t mean you are going to be taken to court for a CCJ. And without a CCJ, there is no chance of a charging order or a visit from bailiffs.

If you don’t have a CCJ but a creditor is threatening this sort of thing then don’t panic, they are just trying to pressure you into paying them. But don’t panic doesn’t mean ignore them.

A debt collector is much more likely to go to court for a CCJ if you ignore them. So read Threats of CCJs – Is the Debt Collector Bluffing? which looks at what you should do.

You know a debt collector is getting serious about going to court when you get a Letter before Action/Claim. Read What to do if you get a Letter before Action to see how you should complete the Reply Form with the letter. There may be ways you can challenge this debt. or you could get the creditor to accept a payment arrangement.

If you don’t do that and get a Claim Form from the court, you need to take action, even if you can’t afford to clear the debt. See What to do if you get a Claim Form for details.

If you are at all unsure, phone National Debtline on 0808 808 4000 who can discuss the details of your case in confidence. National Debtline are excellent on everything on this page – CCJs, Charging orders and Orders for Sale.

Step 2 – Charging Order

I am assuming here that the CCJ was obtained after October 2012. If it was earlier, contact National Debtline for advice.

A creditor can apply for a Charging Order even if you are making the monthly payments set for the CCJ.

When a court grants a Charging Order, a legal charge is put on your house.

If you own the house with your partner, the Charging Order is only made against your share of the equity – your partner’s share will not be affected by it. This is sometimes called a “restriction”.

The order of charges matters. Say you already have a mortgage and a secured loan – this new charge will then be third in priority. If your house is sold your mortgage is paid off first, then the secured loan then (if there is enough equity left) this new charge.

It is not automatic that a Charging Order will be granted. You can defend this by arguing that it would be unfair to you, to other people that live in your house, to the joint owner of your house or to your other creditors.

You can also ask the court to add conditions – for example that the house cannot be sold until your children are over 18 say.

See this National Debtline factsheet for more information about the court process of a Charging Order and how you may be able to challenge it.

Step 3 – Order For Sale

An Order For Sale is a court order which forces you to sell your property – the creditor will then be paid back because they have a Charge over the property, see above. If you don’t pay the debt or leave the property within 28 days, your creditor can apply for a warrant of possession to force you to leave the property.

An Order for Sale will only be granted if there is already a Charging Order that has been made final and if the debt is more than £1,000.

If the CCJ was after October 2012, the Order for Sale will not be granted if you are up to date with the CCJ payments.

As with a Charging Order, you can defend an application for an Order For Sale on various grounds.

It is worth doing this even if you tried and failed to prevent a Charging Order on similar grounds – the judge may well decide that the Order For Sale is unfair to someone else as they would lose their home.

You can also make an offer of monthly payments at this stage and ask the court to suspend the Order so it won’t apply if you make the payments. See the National Debtline factsheet for more details.

How often does this happen?

You might think creditors will rush to get to Stage Three, the Order for Sale, as fast as possible.

This isn’t correct.

Creditors don’t want to go to court once, let alone three times. It costs them time, money and at any stage their court application may be refused, so it’s risky. And selling a house is even more hassle.

Creditors would much prefer to find an acceptable repayment solution and not bother with any of this court action!

Normal consumer creditors such as credit cards, banks, payday loans are very unlikely to go for a Charging Order.

The main exception here is guarantor loans, where lenders such as Amigo can be very fast to take a guarantor to court for a CCJ and then they often apply for a Charging Order. But Amigo don’t routinely apply for Orders for Sale.

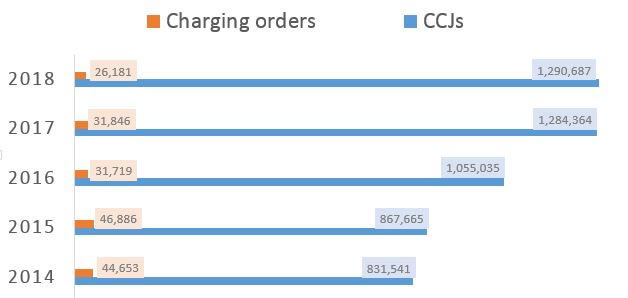

Look at this chart showing how the number of CCJs in England and Wales has gone up since 2014. At the same time the number of Charging Orders has actually fallen.

In 2014 there was about one Charging Order for every twenty CCJs.

By 2018, this had dropped so there was only one Charging Order for every fifty CCJs. That proportion remained the same in 2019.

So Charging orders are less common than they were.

The number of Orders for Sale is so tiny they wouldn’t show on that chart at all. In 2013 there were only 220 Orders for Sale.

Ways to keep your house safe

So the number of Charging Orders is small and the number of Orders for Sale is incredibly tiny:

- if you talk to your creditors and don’t ignore them, you probably won’t get a CCJ let alone a Charging Order;

- if you do get a Charging Order, the creditor cannot get an Order for Sale if you are making the monthly payments on the CCJ.

So don’t be an ostrich. Debt problems get worse if you ignore them, they don’t go away.

Where it’s the added interest that is causing problems, talk to the creditor about a payment plan or talk to a debt adviser about a Debt Management Plan.

With impossible debts, get good debt advice on your options. It’s good to do this as soon as possible but it is never too late!

If your creditor goes go to court, respond fast, do not ignore it. There may be ways of contesting CCJs, Charging Orders and Orders for Sale that will work for you. If you do nothing, the creditor will get what they are applying for.

So get help!

National Debtline doesn’t just have a great set of factsheets, they can also give advice to individuals about their specific cases. Unless you are completely confident in what you are doing, give them a ring on 0808 808 4000 and talk things through with them.

Alice says

Hi

I have been paying my creditors via Step Change for the past 5 years and recently my payments were lowered because of a reduction in income. One of my creditors (a debt recovery agent) has written to me stating ‘whilst they are happy to accept my payments they will be serving me with legal papers in order to obtain a CCJ against me as they want to obtain a charging order on my property. The debt owed is now around £3,000 and was for a credit card, if I fight it is there any hope that a Judge will not grant the CCJ in view of my making continuous payments via Step Change or does everything rule in their favour?

Sara (Debt Camel) says

Hi Alice, you can’t defend the CCJ but it is likely the CCJ will be set with monthly payments that are the same as what StepChange is currently paying them.

it is possible to defend an application for a charging order. You could talk to StepChange about this, or National Debtline as I suggest in Stage 2 or this article. And it’s important to know that even if the creditor gets a charging order, they won’t be able to get an order for sale if you carry on making the CCJ payments.

I don’t know how long your DMP has to run now – it would also be good to discuss this with StepChange to see if you have any better options.

Carolyn Patton says

If I pay my debt in full before the court date can they still get a charging order

Sara (Debt Camel) says

Hi Carolyn, no – if there is no debt, there can’t be a charging order.

CH says

Help I have lost in court over a maintenance charge so I have a CCJ. I have a freehold property but there is a TP1. I have offered payment plan but they have just ignored me I have allowed them to contact mortgage company – they have now said we have 14 days to pay or they repossess can they do this as we have only been to the county court to decide if we owe the money nothing else? I have 2 children aged 12 and 8 and am very scared.

Sara (Debt Camel) says

Hi CH,

I’m sorry but you need legal advice as to what your options are. You could go back to the solicitor you used when you bought the house, go to your local Citizens Advice or Law Centre or phone Shelter’s excellent housing advice helpline see https://england.shelter.org.uk/get_help/helpline. The Shelter line is open at weekends but it can take some time to get through – keep trying!

Leslie says

Hi i have a charge on my home from 2004 i recently contacted the company that owns the debt which is £5000 at first they made me an offer of £1028 to settle the debt i agreed but before i paid the money i asked them how long it would take to remove the charge . On hearing this she put me on hold then came back and said they cannot remove the charge unless the debt was paid in full and this is law could you please tell me if this is true

Sara (Debt Camel) says

Hi Leslie, I think you can apply to the court for the charging order to be discharged. Before you make the F&F payment, I suggest that you ask the creditor to confirm in writing that they are accepting this amount as a full and final settlement of the debt and that they will not contest your application to the court for the discharge. As it says in this article, National Debtline are a great source of information on these matters so I suggest you phone them to discuss exactly how this should work.

Nicola says

I have a charging order as I thought I could argue my case at court but got told it was just to apply a CO. So is there anyway I can write to someone to remove it? The debt was bought by 1st credit and the debt is unlawful bank charges.

Sara (Debt Camel) says

Hi Nicola, to get this removed, I think you would first have to get the original CCJ removed. I suggest you talk to National Debtline about whether you have good grounds for having the CCJ “set aside”, whether it might be better to complain to the Financial Ombudsman about the charges or if there is some other route open to you.

Phil. says

I have a charge order placed on my house and also a CCJ.

The charge order is for around £1,900.

The creditor is now threatening me with an order for sale.

Therefore today I had my house valued with a view to selling it to pay back the charge order. My house valuation was £250,000 and I own the house outright.

Sadly you will loose your house for a small debt even if you own your house outright with loads of equity.

Sara (Debt Camel) says

It isn’t correct that you will lose your house for a small debt: charging orders are rare for small debts and orders for sale are even rarer as the statistics in this article show.

I think you need to take advice about what you can do about this debt – the creditor may not be able to get an order for sale. Talk to National Debtline about your options: 0808 808 4000.

John says

Hi I need advice. I have a creditor seeking an outstanding debt from 2004. They went to court and acquired a charging order on my house. My house is joint mortgage with my wife and I’m the only one who has the debt. We have children and my wife his registered disabled. They did not contact me for years and now they have added interest on the debt. They are now threatening to enforce the charging order if I don’t pay. I’m not working and struggling to pay every day bills, so I can’t make them an offer. Will this mean my wife and children will loose their home?

Sara (Debt Camel) says

Hi John, I think you need urgent advice on your whole situation, not just this particular charging order although obviously that is the most urgent. There may be other benefits your family could be claiming that could help, there needs to be a check on whether it is correct for interest to be being added to this debt and there needs to be a full consideration of what your debt options are. You could talk to National Debtline or visit your local Citizens Advice Bureau.

Chris says

Hi. Over the past 8 years I’ve been making nominal payments to various creditors. Over time the debt(s) have been sold on to the different collection agencies but I’m still on a low income and unable to offer anything at a reduced settlement. There is however one bank who has retained the debt and have asked me to go through an I & E interview. My house now has substantial equity in it, and my aim is to sell the property and go down the route of offering settlements, but I’m not yet in the position to do this. If this one bank applies for a CCJ, would they be given priority over my other creditors ?

Sara (Debt Camel) says

Hi Chris, if you are sent a Claim Form for a CCJ, you can admit the claim and make a monthly offer of payment, which should be one that you can afford. I suggest you talk to National Debtline as soon as a Claim Form arrives so they can help with this. The judge will then usually grant the CCJ but set a monthly payment which is very often what you have offered.

If the bank thinks this is insufficient, then they may apply for a Charging Order, as this article says. But they then won’t be able to get an Order For Sale provided you are making the CCJ payments.

But I think it might be good if you talk to National Debtline now 0808 808 4000 – they will be able to look at what your I&E should say which will help you in dealing with this bank.

CJ says

Hi

I had debt problems which have all dropped off my credit file now except for 1 CCJ. This drops off in December 16. They did put a charging order on my house though, which I am paying a monthly amount for. I have been paying since 2011. I have since obtained a better job and would like to change my mortgage to a buy to let mortgage and buy a bigger house for my daughter. Will this charging order stop me from being able to change my mortgage to a buy to let, and get about 10,000 equity out to put as a deposit on my new house? Thanks

Sara (Debt Camel) says

HI CJ, I think you might find it useful to talk to a mortgage broker.

It isn’t possible to get a buy to let mortgage for a house that you currently live in. And if you are hoping to get an interest only mortgage, these are quite unusual these days and require LOT of equity. And buying a second house will incur a big stamp duty penalty from April 2016. The charging order will make it much harder to do anything though – you really need to pay this off as rapidly as possible.

Phillippa says

My ex husband has been to court with regards to a charging order on the property we jointly own. I have no use whether a charging order was granted as I have been kept out of the loop completely and my ex won’t discuss it with me. He has lived elsewhere for several years now. How do I find out if a final order as granted ?

I am now selling the house so I no longer have to be financially linked to him. Will the estate agent and solicitor fees come out of the equity before the debt collectors take half of the remaining equity? Or will I have to pay the fees out of my share? There won’t be enough equity either way to pay his debts in full.

Sara (Debt Camel) says

Hi Phillippa, you can check if there is a charge on the Land Registry site: https://www.gov.uk/government/organisations/land-registry. I suggest you talk to your solicitor about the order in which things are settled.

Margaret says

I took a loan with my husband then he died, this was 13 yrs ago, I was told I would have to pay it but after a while I stopped as I took ill health and only worked part time so could not afford to pay what they asked for, the bank were terrible and would not accept what I could only afford to pay. I have heard nothing for nearly 3 yrs now from them and I have sold my house, but the solicitor has told me the bank have a charging order. I was told after 6 yrs I no longer have to pay this debt and I have never had any proof of the charging order so do they have to lift this as well.

Sara (Debt Camel) says

Hi Margaret,

I don’t know who told you “after 6 years you no longer have to pay this debt” – if this was just what a friend said, then I am afraid this was probably bad advice. To have a charging order, there must first have been a CCJ, then the creditor would have had to apply to the court for a charging order. You could ask your solicitor to find out the date of the charging order and the date of the CCJ. Alternatively you could phone National Debtline on 0808 808 4000 and ask for advice from them about whether you have any options at this point.

Amjad says

Hi, I have a charge put on my property fraudently for £53,000 and this was done 15 years ago, i have never took any loans or anything accept a mortgage, but suddenly i have received court summons that the second chargee wants £187,000 from me, is this for real? can this things happen in real world? can someone help!!!

Sara (Debt Camel) says

You may need to get legal advice, but I suggest your first call should be to National Debtline on 0808 808 4000.

Chetan says

My father has around 60k worth of debts split over 4 credit cards. He lost his job 6 months ago and has now run out of money to pay for the min payments. The letters have started and he is making token payments of around 120 pounds a card. I am paying all his s living expenses and mortgage.

His house that i also live in has a big mortgage but also around 600k in equity. Can the card companies force sale of the house.

I can’t afford to pay the card debts for him at the moment.

Sara (Debt Camel) says

As this article says, a creditor can only force the sale of your house through an Order for Sale if they first get a CCJ, then a charging order AND you don’t keep up with the terms of the CCJ.

With such a lot of equity, there is also the possibility that a creditor will decide to make your dad bankrupt – that is very rare but can’t be completely ruled out. This would be very very unlikely to be one of the credit card lenders, but at some point they may sell the debt to a debt collector.

There is no need to panic or rush but in 6 months to a year you need to be considering the family’s options if dad or you can’t start making significant payments to the cards. Remortgaging or selling and downsizing May have to be looked at.

angie says

Hi…. I have paid of my charge order but the charge order was made buy a collection agency that has now gone bust..I now need to get the charge order removed from land registry so i can complete on selling my house, can you please tell me how i can get this done ?….Thankyou

Sara (Debt Camel) says

Hi Angie, you need to apply to the court for a Certificate of Satisfaction using this form https://www.gov.uk/government/publications/form-n443-application-for-a-certificate-of-satisfaction-or-cancellation. Ask your solicitor if you need help to complete this.

Chris says

Hi

I had a debt of 7000 with HSBC

I foolishly started to over pay the ccj

60 a week instead of 20,then got behind with c tax and other bills

However,I have got to debt down to 2000

They applied to put a charge on my home on Monday and I’m waiting some sort of letter from

Them

I’m slightly worried they’ll make me sell the house, as I have 80k in equity

I think it’s ridiculous to make me sell for the sake of 2k,I can raise almost all of that if I had to,but do you think they will Accept some sort of payment plan instead?

Sara (Debt Camel) says

If the CCJ was after 2012 and you have kept up with the payments, then it is unlikely they would be able to get an Order for Sale. I suggest you call National Debtline 0808 808 4000 to talk through the charging order and your concerns. You also need to talk about your other debts – council tax in particular is a priority debt and you should not get into arrears for it – and national Debtline can help with this.

Chris says

I kept up with until just before Xmas,then buckled,had 800 pound worth of council tax to cover

I’m straight with that now,I should have picked up the ccj repayment but I just kind of gave up

I’ll wait until Monday and see if I have any correspondence from them

The ccj was brought into action as of March 2013..

Of the order of sale was put in place,I’d have to just throw money at them and hope I’d clear it up,maybe miss a mortgage payment to do it,it can be a difficult ride when you live on your own..

Fingers crossed it won’t come to losing the house

Ray hayden says

Hi. I had a charge put on my property five years ago by a debt collection agency for a credit card debt that is now seven years old , I have heard nothing from them in that time and when I contacted them on two separate occasions recently to make a reduced offer of the original £5500 in full and final settlement they said they could not trace the co on their records. My wife and I are considering selling our house which is in joint names ( the debt is mine) but will need as much as possible left from equity to make a mortgage free move. What is the best way forward to a solution when the creditor cannot trace the debt history etc?? Ray.

Sara (Debt Camel) says

I’m not sure who you have contacted, the debt collector or the original creditor? In whose name is the charging order?

It is however unlikely that a partial settlement will be accepted.

Sharon whitfield says

A debt company is saying they have secured a charging order on my property I have checked my credit file and there is none on it. Without a ccj they can’t get a CO can they. I have received no paperwork in relation to this from court and neither has my partner who i share the mortgage with.

Sara (Debt Camel) says

You should check the Land Registry to be sure: https://www.gov.uk/search-property-information-land-registry.

When you have that information, I suggest you contact national Debtline 0808 808 4000 and talk to them about how to reply to the debt collector.

Pete simon says

Hi, there is a charging order of my wifes on our house from 2012 but this debt was then sold on to another debt collector in 2013 does the charging order still carry over to the new debtor as we have no contact from them for 3 years.

Sara (Debt Camel) says

Yes it does.

A charge will never become time barred through there being no contact.

Bette D says

Dear Debt Camel

i am just worrying myself through all scenarios at the moment as i cannot find the answer to my point.

CCJ obtained by creditor in maiden name, but sole owner of property in married name at land registry.

Can a creditor obtain a charging order if the CCJ name is different from the name listed as owner on the land registry?

Sara (Debt Camel) says

Yes.

Is the creditor threatening a charging order? Are you making the monthly CCJ payments?

Bette D says

Hi Sara

No threat of CO at the moment. However best to be prepared.

you have answered the question, in that if maiden name on land register, and ccj in married name CO can still be obtained.

could you explain how the creditor would work this?

Thanks

Sara (Debt Camel) says

If you talk to National Debtline (0808 808 4000), they can explain the mechanics of charging order applications. They will also be able to talk about debt repayment. If you are keeping up with the court-ordered CCJ monthly payments, your creditor will be able to get a charging order but will not be able to get an order for Sale.

Ali says

Dear debt camel,

My father and mother own a property which has 2 charging orders on it. The ccj’s were applied around 2007, the ccj is against my father. The situation is that my father does not know the exact amount of debt he owes, we have recently tried to find out this information by obtaining title register through land registry but on this document it displays the date in which the ccj was applied and the creditors name which hlcf ltd but it does not display the the amount owed. I have tried other methods such as experian credit report and trustonline.org but they display no details of the ccj as it has been over 6 years. I have tried to find out details about hlcf ltd but there is very limited details about this company on the internet, all i know is that they are based in jersey. I have even contacted the court where the ccj was issued from but they only have details of when the ccj was issued. My dad has no other paperwork with details of this ccj so now running out of options, would appreciate if you can point me in right direction pls

Sara (Debt Camel) says

If your dad remembers the debts and the CCJs and just hasn’t kept the paperwork, try writing to HLCF

If he doesn’t know anything about this charge or the CCJs, contact National Debtline 0808 808 4000 and ask them for help.

Gary McIntosh says

Help my wife’s ex who is still on the mortgage has charges against the property in his name only we want to move but don’t know where we stand in regards to the debt we can not find out how much the charges are an her ex says they don’t show on his credit rating , we have had no contact from the finance companies involved , an they won’t talk to us what can we do many thanks

Sara (Debt Camel) says

Any charges should show up on a land registry search: https://www.gov.uk/search-property-information-land-registry. If there was an agreement as part of the divorce/seperation about what should happen to the property, I suggest you should discuss this with her solicitor.

Stuart says

I have a credited who has a second charge on my property. I have been paying him through an attachment of earnings order. I have now had a letter threatening to force a sale of my property. I have : children & my partner living here. Can he force a sale?

Sara (Debt Camel) says

Hi Stuart, Orders for Sale are very rare but you need to take advice on what you can do to challenge this one – call National Debtline on 0808 808 4000.

Stuart says

Many thanks for your prompt reply. I am up to date with my payments as they are taken at source. Is it usual for a person with a second charge to be able to force a sale, especially when there are 3 children living at the property?

Sara (Debt Camel) says

As I said, Orders for Sale are rare, but that doesn’t mean you can just turn up in court and say it’s unfair and expect to win. You need to discus the details of your case with an expert – call National Debtline.

Ken says

My wife made a charging order against 3 properties I own in my name and 1 jointly owned, when we separated in 1980. We divorced 1983 and she remarried. She never had any debt, and neither did I. Are the orders still standing, if so how do I remove them.

Sara (Debt Camel) says

Sorry, this predates any electronic land registers. You will need to consult a solicitor about this.

helen says

Hi a second charge was placed on our property in 2012 for a debt owed by my husband, although i signed the papers under pressure the debt has nothing to do with myself. we have now received a letter from thier solicitor informing us that they are going to start proceedings to force the sale of our property, would i be able to contest the sale on the grounds that its not my debt?

Sara (Debt Camel) says

Orders for Sale are very rare, but you can’t ignore these letters. I suggest you talk to National Debtline on 0808 808 4000 about the letter, the debt and your possible defences if it does come to court.

helen says

Thank you this has been very helpful i will ring them and also seek legal advice

Craig says

My wife was made bankrupt in Feb 2014. She has been making monthly payments towards the total owed since that date. We jointly own our home although i’m the one who pays the mortgage. We now have the official receivers asking for half the equity in the house, currently around £5000. We have no children or elderly people living with us.

I have been given the option of paying the whole lot off in one go, which I cannot afford, or a charge can be placed on the house for the amount (plus 8% interest per annum). As my wife has been paying the debt back monthly is there not a way for that arrangement to continue? 8% per annum doesn’t sound a lot but if I end up not moving for 10/20 years that interest soon turns an already worrying amount into something petrifying. Any advice would be very welcome!

Sara (Debt Camel) says

I don’t know if your wife took advice about bankruptcy before hand – I am surprised she didn’t expect this to happen. The fact that she is making monthly payments to an IPA doesn’t affect the fact that she owns a property with some equity in it. The Official Receiver is right to be claiming the equity and the monthly payment.

Yes the 8% would add up, but you should be be able to start paying this charge off, you don’t have to wait until the debt is sold. If you can only pay say £50 a month, then that will cover all the interest and start chipping away at the debt. Then when your wife’s monthly payments finish after 3 years you should be able to increase the amount to pay to this debt? The sooner you clear it, the less interest will be paid.

Blake says

Looking for advice on what to say on a N244 in regards to setting aside on “Charging Order” Apparently the order was done in Jan 2012 and I was only made aware of this charging order by my mortgage company, when I made a general inquiry.

So this leads me to believe that all the communication was sent to an old business address that I left over four years ago?

Any suggestions for a resolving?

Sara (Debt Camel) says

I suggest you talk to National Debtline 0808 808 4000. obviously it’s annoying not having received the papers, but would you actually have had a defence if you had received them? That is what you need to establish.

Blake says

Hi Sara

Thanks for reply.

I could perhaps of settled the debt or come to some monthly payment arrangement had I been informed

OWEN says

Hi Sarah

I have numerous debts of over £35k which I have neglected for nearly a year. I have serious financial problems due to my failure to secure a meaningful job. I have in the past years made token payments of £1 to each of my 20 creditors. My problem is that I have just been served with a change order without ever receiving aCCJ.

Sara (Debt Camel) says

You can check to see if you have a CCJ on Trust Online, https://debtcamel.co.uk/do-you-have-ccjs/. I suggest you talk to National Debtline 0808 808 4000 about what you should do about this charging order – and also your other debts as you don’t want to get more CCJs.

OWEN says

Thanks Sarah

I have contacted National debtline and have submitted an objection to the order being made Final

I now realize I should have responded to their threat to take legal action.

Doesn’t the Court have a legal obligation to inform a person when they put a CCJ in place?

Reading through the Charge Order paperwork revealed that a judgment (CCJ) was awarded on 5/10/16 and they moved quickly to get a Charging Order on 25/11/16.. Where do I get the full terms of the judgment (CCJ ). I need to know what the Court said regarding paying the debt. Who do I contact?

Sara (Debt Camel) says

Yes, you will have received a Letter which said Judgment for Claimant at the top.

If you didn’t defend the case (and it sounds as though you didn’t) then the judgment would have been for the full amount to be payable “forthwith”, which means immediately. National Debtline can talk about the details of your case and who you should contact.

john says

Help, I was made bankrupt in December 2012 when my business folded. Before the bankruptcy went through 5 companies put charges on my house totalling 27k this along with a mortgage of 180k and a second secured loan for 30k. I would like to know if I sell up and there is insufficient funds left when the mortgage and second secured loan are cleared , what would happen to the 5 charges on the house.

Sara (Debt Camel) says

The charges will be paid in date order until there is no more money left from the sale: mortgage, secured loan is presumably the second charge, the third charge etc

benny says

Hi,

I got really sick some 9 years ago, i was only expected to live 3years at most, but I am still here,

I had a huge amount of depts, loans credit cards etc, the majority was not in fact taken out by me but my partner in my name, but that said I allowed this to continue so I am fully responsible for it,

at the time I came out of work,I sought advice, and was told I should go bankrupt immediately as there was a huge negative equity in my house,

I know this sounds insane , but I am bound by my own honour to pay off these depts so chose to agree for the cab to arrange payment plans,

I have been making the minimum payments which they agreed to, I have increased several over the years so I could actually see some progress all be it small, I have around 5 charging orders on my house which will very soon have enough equity to make it viable for these banks to enforce the charge, but at the same time I have been doing work on the house so my wife can open a small business, had we not paid as much as we could to depters, we would of started the business many years ago and most probably cleared the dept by now, but unfortunatly they also increased on a regular basis as well as our own increased offers, but I worry now as soon there will be equity, will the banks force the sale, at her current business growth we expect to clear all the depts within 5 years, but now for some reason I feel really worried ,

Sara (Debt Camel) says

If you are increasing the amount you pay to the debts it is highly unlikely that any of them would bother to try get an Order for Sale.

Siobhan says

Hi,

I have recently paid off my CCJ and still have the charge on my house ( I have checked with the Land Registry). I have got a certificate of satisfaction from the court but am unsure of where to go from here. Can I send my certificate of satisfaction to the Land registry to have the order removed or do I send to the county court?

Sara (Debt Camel) says

You should ask the creditor to inform the land registry and get the charge removed. If they refuse or say you still owe money, contact National Debtline on 0808 808 4000.

Chris says

Hi

In 2006 I took out a loan to start a business that failed, the loan was for 5k I paid 2k off and then hit problems the company took out a ccj then charging order ( I was in a bad place couldn’t cope with the debt and didn’t open letters) I was paying them £10 a month then in May 2010 payments were returned to my bank account as the company went bust. I didn’t know where to send payments to and no one was answering the phone. 4 years later I have contact from the liquidation company demanding payment I asked for bank details and offered to pay £50 per month but none were forthcoming I then had a heart attack and being self employed didn’t earn anything so decided to sell my property I felt bullied by this liquidation company I did have a sale in 2015 but I pulled out as I couldn’t find anywhere to rent because of bad debt. They then threatened to force me to sell my house,I started to make payments in April 2016 of £100 per month ( more than Iam paying on my other charging orders) I was shocked to find out that they are charging interest and owe over 10k, I feel this is totally unfair by the time the charging order was in place it was about £6700 which was over double the amount I originally owed.

Where do I stand is this debt still enforceable even though the original company went bankrupt

Can they still keep charging interest

For 4 years I didn’t know where to send payments and even when they contacted me I ask for bank details and they were not forthcoming surely interest for this time shouldn’t be charged.

I am now getting back on my feet is it worth taking out a loan for 4K and offering this as full and final settlement (it’s around £5474 now plus interest but I dispute the interest) the payments on the loan would be less each month then I could increase the payments on the other charging orders.

I’m glad I stumbled on this site thank you in advance for your advice.

Sara (Debt Camel) says

Hi Chris, you need someone to help you look at the details of this situation. National Debtline on 0808 808 4000 or go to your local Citizens Advice.

Jay Deeh says

I’m half the owner of a house with my ex partner who is being threatened with a legal charge on our house together. I read that as I am not liable to that charge because it’s his debt but I wonder where I stand if in case he is issued a Order for Sale? It’s my house and I am the rightful half owner and paid cash for my half although my name is on the mortgage because it’s the only way the lender Nationwide will give him the mortgage when we bought the house. Please explain. Thank you kindly.

Sara (Debt Camel) says

Hi Jay, technically this should be added as a restriction not a charge as it is a jointly owned property. I suggest you talk to National Debtline 0808 808 4000 about your options. It may be possible to argue that your ex has no equity in the property.

Paul says

My name is Paul, I was made bankrupt in 2010 I separated from my partner in 2006 it took around 4 years to go through the court process, as part of my settlement I had to loan an amount of money so she could re-house her self and the children, i now have a legal charge for the amount of money i lent her, the sale of the house and the legal charge was settled before I was made bankrupt, I fully complied with the insolvency and declared the legal charge, I was discharged after the standard year, I am now at the point where I can enforce the charge as she has an obligation to myself to dismiss the debt. my question is do they have any claim to the charge and how do I find out if they have.

Sara (Debt Camel) says

I think you should either talk to a solicitor (preferably the one you used at the time the loan and charge were set up) or talk to your Official Receiver’s office.

Mike says

Hi Sarah,

Is there anyway of fighting this grossly injust system?

How can people be at risk of losing their homes for an unsecured debt?

It was a lot fairer when you could only have a charging order if you didn’t pay your CCJ

There must be somewhere we can all complain to about this?

Sara (Debt Camel) says

Try your MP.

Burnsy1978 says

Hi,

I’m wondering if you can clarify something for me. I have recently applied (jointly) for a secured loan for home improvements. The lender has flagged up a “charge” on my property. I downloaded the title deeds and in the proprietor list there is a “restriction” in my name from a car finance company from 2011. This is not in the charges list and it says it’s an interim charging order. I did go to a hearing for this and argued against a final charging order as the house is in joint ownership. I never heard anything else whatsoever after this hearing and I don’t believe this charging order to be a final order. I’ve not heard anything else in the previous 6 years up to present day. How can I get this restriction removed please?

Sara (Debt Camel) says

It sounds to me as though the charging order was made final – you should have followed up what happened at the time :( I suggest you contact the court and ask.

Burnsy1978 says

It’s not a final charge though as they couldn’t make it final due to the house being in joint ownership. In the charge list there is only our mortgage company and nothing else. It actually says interim charging order so could it be that the court has not informed land registry?

Sara (Debt Camel) says

It is correct that a charge over a jointly owned property is entered as a restriction. But I am not clear why you think it should be removed – unless you have paid it?

Burnsy1978 says

I think it should be removed if the court hasn’t made the order. Surely that’s the law? If it’s a final order then surely it would be in the charges list, which it isn’t thus making it extremely difficult and quite unfair on my wife and her credit report. I’m asking for advice and clarity on a subject I don’t understand.

Sara (Debt Camel) says

It’s hard for me to guess what has happened, that’s why I suggested you ask the Court. If you don’t understand what the Court says, I suggest you talk to National Debtline about the problem.

It is normal for a restriction to be added where there is a jointly owned property – you may feel this is unfair, but that is what happens.

I don’t think Restrictions – or indeed Charges – show on credit records at all.

Sarah Kobbs says

Hello, we’ve put our house up for sale and realise a company called hlcf has a charging order on the property for a ccj I knew nothing about back in 2004.

It seems the hlcf company is no where to be found or is no more, and therefore there’s no company to pay.

Can they get a final charging order on a joint property for a debt that is mine and do you’ve any details for this hlcf company

Sara (Debt Camel) says

The current HLCF Ltd https://beta.companieshouse.gov.uk/company/10386494 is a recent company and has nothing to do with this old debt collector. Nothing else shows on the English Companies House website – you could contact them as it’s possible that very old information is held that isn’t searchable on the internet.

There was an Isle of Man company https://services.gov.im/ded/services/companiesregistry/viewcompany.iom?Id=146555 which then seems to have become a Jersey company but is now dissolved. I suspect this may be the one that has the charge, it was a financial services company.

Normally with a CCJ you know nothing about the first step is to set it aside. But this was so long ago I have no idea if there is any chance of this succeeding. You could talk to National Debtline about this 0808 808 4000. (This is more obvious route than to try to say there should never have been a final charging order for a jointly owned property which seems a more complicated argument with exactly the same problems about it being ancient history.)

If this can’t happen, then you have the problem about how to pay this charge. If the charge did belong to a company which has been dissolved, it is possible that the ownership of the debt will have reverted to the Crown, see https://www.gov.uk/government/organisations/bona-vacantia. Googling suggests that for Jersey companies there is an equivalent procedure.

I hope your conveyancing solicitor is good… the solicitor may find the Land Registry Customer Support helpline useful 0300 0060411.

Sarah Kobb says

Thank you very much for this, my solicitors contacted the Treasury in England but they objected to receiving the payment as they claim the judgement was made in 2004 and the first hlcf on records was formed in 2005 in the Isle of Man.

However the Isle of Man hlcf was dissolved in 2010 however according to court records another attempt to get me to court was in 2012 via their solicitors GPB which was subsequently closed down by the SLA. So perhaps an address for hlcf in 2012 would help. If it is the same one in Jersey can a payment be made to the Jersey receiver company.

The lawyers have decided to proceed to court to have the order removed as we’re unable to locate who to pay. How long do these normally take.

Sara (Debt Camel) says

I’m sorry I don’t know.

Sarah Kobb says

Thanks, but it does turn out that it is the Jersey HLCF they filed a discontinuance from Isle of Man and moved the business to Jersey. My legal team did not search because they told me they found no HLCF in all the companies house records including Jersey. They’re currently dissolved Oct 2016, so I’ve sent a request to the Receiver General for Jersey to receive the payment and that should satisfy the Land Registry and take the restriction off.

I’ll enquire what the CCJ was for after all this, it’s gone on since January.

many thanks you solved a great mystery for me. Lawyers were going to charge a fortune and not produce any results.

barry says

I am in a token payment plan a debt charity for credit card and loan creditors (all unsecured) totaling £50,000. These built up over the past 4 years when I lost my job and was unable to find work. I am self-employed now with a very small income and still unable to pay any increased installments. I run this as a limited company and my home address is my registered company address. My question is would my home, which is owned outright, be protected from any potential charging order in view of it being a registered company address?

Alternatively, would my home be similarly protected if I transfer ownership solely in my wife’s name? It has always been solely in my name and all the debts are solely in my name.

Sara (Debt Camel) says

“My question is would my home, which is owned outright, be protected from any potential charging order in view of it being a registered company address?” I think that sounds completely irrelevant, no protection against a charging order.

“Alternatively, would my home be similarly protected if I transfer ownership solely in my wife’s name? It has always been solely in my name and all the debts are solely in my name.” That sounds like a good reason for your creditors to make you bankrupt! Because this “transfer” to your wife would be very likely to be overturned in bankruptcy.

Mrs. R. A. Balboni says

I have been issued a notice to enforce a restriction on my property. The CCJ belongs to my husbands ex wife and I need urgent assistance if you can, to respond and stop the restriction at once.

The address I live in is the address she has lived in too, and in April 2017 I opened a claim form and acknowledged it!

The court issued a CCJ without her presence

What a mess … Please help me if you can

Sara (Debt Camel) says

You need to talk through all the details with a debt advisor. I suggest National Debtline on 0808 808 40000. Good luck!

Paul M says

Hi DC,

The care home my partner’s Mum moved to a few years ago had a charge on her Mum’s property. The house has since been sold (without any claims or orders having to be made) but apparently the charge was not discharged. Should the solicitor dealing with the sale not have done this?

Sara (Debt Camel) says

I would have thought so, is the care home now asking for the money?

Paul M says

Thanks Sara. No, all payments were made. It just doesn’t seem to have been discharged. It was hard to work out when it should have been done and by whom as my partner is steeling herself for another solicitor bill. The form provided by land registry is unfortunately incomprehensible.

Sara (Debt Camel) says

Well my starting point in talking to the solicitor would be “you should have done this, please do it now and I do not expect to be charged for it.”

Paul M says

Excellent. Thank you Sara!

Sara (Debt Camel) says

Well I can’t say it will work, but that is what I would be saying at the start… good luck…

David says

Hi Sara

I have a debt from car finance been managed by Mortimer clarke I currently pay £40 per month, i have had a ccj granted for this, I missed a payment due to a bereavement but have caught it up and put all payments on a standing order. Mortimer are hounding me threatening a charging order on property and asking me for income and expenditure forms to be filled in when I have already filled them in for the court and they agreed 40 a month. I am currently paying 40 every 4 weeks. Can they get a charging order and do I need to fill in more forms this has me worried sick.

Sara (Debt Camel) says

Hi David,

This article https://debtcamel.co.uk/debt-collector-income-expenditure/ covers this situation.

Did you tell Mortimer Clark about your bereavement? If you did, it doesn’t change the fact that they can ask you for an I&E but it should mean that they are more considerate and your reference to ‘hounding’ is worrying.

You might consider putting in a formal written complaint to them… title of email “Complaint about treatment when vulnerable”, yiu could say that you aren’t trying to avoid paying them, you missed a payment due to a death in the family, you told them about this and have caught up, but you are still fining it difficult to concentrate on your financial affairs and their repeated contacts and threats ( you could list them) are making you more anxious at a difficult time.

David says

Thankyou Sara will do that.

Lea says

I’m asking on behalf of a friend who is worried. When she got divorced she had a lot of debt and decided to move away, she was granted by the judge in the divorce that she could have the equity in their matrimonial home and her ex was to give her an extra £75000 so altogether she had approx. £160000. She was to buy a house of £130000 minimum and pay off her debts. She bought a house for £153000 and then had a charging order put on the property for £75000 which she has to repay her ex when their son finishes full time education. Will she have to sell her home to repay the money or can she get out of it in some way? She doesn’t work and has been bankrupt in the past so is unlikely to get a mortgage.

Sara (Debt Camel) says

how long ago was she bankrupt?

Lea says

It was as least 10 years ago. She is 46 years old and hasn’t worked for the last 10 years.

Sara (Debt Camel) says

Well it’s not being bankrupt that will stop her getting a mortgage, after 10 years that won’t be a problem, it’s not having a good enough income. Why can’t she get a job?

Lea says

She has suffered with depression in the past that’s why she’s not worked.

Sara (Debt Camel) says

If she is now over that, she needs to be finding a job. She has 20 years until she retires, what does she want to do with it? How long until he son is 18?

Lea says

To be honest I don’t think she thinks that the order will be enforceable and she’ll be able to keep the house and not give the money back. Her son is 10 this year.

Sara (Debt Camel) says

Why doesn’t she think the order will be enforceable? Apart from wishful thinking? With 8 years to go, she only has to be able to earn 15k a year and save 5k of it for her to be in a great position in 8 years tome to pay off half the charging order with her savings and get a small mortgage, only 12 years, for the rest. If she waits around and does nothing for 8 years, she is going to be in a much worse position.

Lea says

I think she is burying her head in the sand and thinks because her ex is well off she won’t have to pay it back and he won’t see his son homeless. I have tried to tell her she needs to do something.

Abi says

My husband took out a remortage on his mothers house to help her out some time ago, she has recently sold her house to a builder who did not carry out searches etc.. with his solicitor. A previous potential buyers solicitor had found an old interim charging order for £1,000 on the house. Now that the house has completed and the mortgate has been paid off in full, what happened to the old interim charging order please? Has it disappeared – it is not on my husbands credit report, or would the builder now have issues when selling the house on again to a new purchaser? Thanks

Sara (Debt Camel) says

Sorry I can’t work out from this who owned the house, whether there was a mortgage and a second secured loan or what the interim charging order was for. I suggest she should talk to the solictor that did her coneyancing if she is concerned.

Abi says

Ok it is the builder who now owns the house his solicitor did not carry out searches etc. so I don’t think he knew about the charge. Would this charge still be on the house even though his mother does not own the house anymore? I think just worried about any come back once the builder sells on to a new purchaser. There was a mortgage which has now been paid off as the house was sold. Thanks

Abi says

mother owned house and her name on deeds, my husband (her son) got remortage for her in his name when she was in some financial trouble – I didn’t think he had to be on the deeds to do that but maybe he was put on at that point. Interim charge order for a debt in my husbands name however it is not listed on his credit report, it only came to light when a previous buyer Solicitor to the house found it. Now that the debt is not showing anywhere and the house is sold and mortgage paid off in full, is that the end of it? Sorry it has been a bit of a mystery. Thanks

Sara (Debt Camel) says

i think your husband muct have been on the deeds. And so he should have been involved in agreeing to the sale. Sorry he and his mother need to speak to the solicitor who did the conveyancing for them.

Barron Crossland says

I have just received a charge order letter today that was apparently placed against me in 2011. however I do not think I ever got any paperwork and am almost certain I didn’t get a CCJ at the time. Can this still be enforced and also be the reason why we can not remortgage. What steps can I take to get this removed/resolved?

Sara (Debt Camel) says

You need to find out if there was a CCJ – if there was and you were unaware of it you need to apply to have it set aside if you don’t think you owed the money.

If you did owe the money, I am afraid your best option may simply be to pay the CCJ which will remove the charge. National Debtline can help you look at your options, see https://www.nationaldebtline.org/.

Having a charge is very likely to be the reason you cannot remortgage.

John C says

HI , approx 10 years ago i had a charging order put on our house (due to an outstanding loan ) , myself and my partner parted company , and the house was sold, i didn’t want anything to do with the ex , and i was informed that my half of the equity would pay off the charging order , i am now receiving letters from the bank (now part of HSBC) where the loan was taken saying that i may be entitled to refund.

How does the outstanding debt get paid , also what i am worried out is are these letters a ploy to chase me for the money that may of not be paid ?

Is there anyway i can check that the loan was paid off , the loan was taken out in 2003.

Sara (Debt Camel) says

“I am now receiving letters from the bank (now part of HSBC) where the loan was taken saying that i may be entitled to refund.”

That doesn’t sound alarming to me and there doesn’t seem to be any reason to suspect the debt was not repaid when the house was sold. It sounds as though the bank has found some computer error that it needs to correct. I suggest you get in contact with them about it – obviously, if they start demanding money, that is different!

Gemma says

Hi

Just read the above about charging orders not being possible without a ccj. I have what was originally an unsecured loan with Paragon, I got made redundant (never claimed on the insurance) and ended getting behind with them. Next thing I know I receive a court letter saying they are Have successfully obtained a charging order and were looking to sell the house and a letter form the land registry saying a change has been placed on my property. No I don’t have a ccj and never have had. The application and hearing for the charging order was held without me being notified or present. This all happened back in around 2012. The local council came in to court with me and prevented the house getting a sale order and tried to get some sense from the Paragon legal chap but nothing, they still have a charge on the house and I am paying back and additional £30 a month on the original monthly payment. Apparent from some letter s letting me I was not meeting the full payments back when it was bad I haven’t heard from them. I don’t get any statements unless I ring for one. When o get a something sent through it is a computer printout (i.e. Not a formal statement) the only way I know the debt is going down is through what is recorded on my credit file. The big point for me though is how could a charging order have been obtained of i never had a ccj and it was an unsecured loan.

Sara (Debt Camel) says

I would be interested to know the answer! I think you should talk either to your local Citizens Advice or National Debtline about this. It may help if you send Paragon a Subject Access Request, then they have to send you all the information they have about you…

Gemma says

Thank-you, I will wait until June and ask for the SAR as I am in a much better position now I am back at work an able to pay them. I just don’t like the idea that they can choose to to go for a sale order when they feel like it. I have all the papers from the court charging order being made but nothing was ever issued following the agreement made outside in the court lobby to pay the extra amount despite going back into the court and the judge saying that was fine. I will speak to Nationdebtline once I have the SAR stuff.

Bill says

Hello, I had an Interim Charging Order place on my property in 2009 which was never made final, by a debt company who had bought my debt from a bank. I subsequently went into an IVA in 2012 which was completed last year. This debt company had bought other debts of mine as well, but the charging order was for 1 particular debt, they were named on my IVA but looking at the creditor meetings they didn’t respond to any of them, I am now being told by the IVA company the charging order part of the debts would still be outstanding. Is this correct even though the charging order is interim? Could they have been applying interest on this debt for 9 years? I want to re-mortgage but fear this charging order will stop this? Any help would be appreciated.

Sara (Debt Camel) says

My first thought is to wonder why the Interim Order was not made final and whether the creditor served the correct notices after the interim order was made within the time limits set out in the court rules.

I suggest you phone National Debtline on 0808 808 4000 and discuss this. They will also be able to talk about whether interest has been added to this debt. I think this needs to be resolved first, before it is considered if this debt should have been included in your IVA and, if it should not have been, if the IVA firm should have realised this before your IVA started,

TONY T says

Dear Sara,

Please give your opinion on the following…

A High Street Bank Credit Card Debt during Divorce Proceedings results in a CCJ – (approximately £14k) The Creditor then obtains a Legal Charge over the now-divorced single Debtor’s home.

The Creditor takes no action for ten years (except to write a routine letter which stated that if any successful PPI claim were made it would only reduce the Debt, – there would be no payment to the Claimant), then sells the debt to a Third Party Debt Company, which in the following three years take no action either, ( theirs is the third charge on the property with some £300k upstream of them) Does the Third Party Debt Recovery Company derive any benefit from the charge which is not in their name, – or putting it another way is the Legal Charge portable? Or will a new application need to be made to the County Court by the Third Party Debt Company for a charge in their own name? Are there any Statute Barring issues in the foregoing?

Hope to hear your opinion.

Regards

TONY T

Sara (Debt Camel) says

A CCJ which has resulted in a charge will never become statute barred. And yes a debt which is the subject of a CCJ can be sold. I can’t see any reason not to try to reclaim PPI on this. But I suggest you talk to National Debtline about this, and about whether interest is being added to this debt at the moment.

Beth says

I have agreed a final settkement figure of £6,000 with a creditor that says they have restriction registered against my property. The loan was gor 25,000, i paid nearly £20,000 off but they say i still owe £21,500 still. They have agreed to remove the restriction once payment is received. I take it this is a charging order but I was never made aware of this. They obtained a Ccj nearly 6 years ago which drops off in October. I pay the settlement next week. How long does it take to remove the restriction off? I didn’t even know there was one on there.

Sara (Debt Camel) says

Have you looked at the Land Registry entry for your property to see what it says? https://www.gov.uk/search-property-information-land-registry

Beth says

No, I just assumed as they said they had a restriction that it would be a charging order, what else could it be?

Beth says

I have just purchased the title register for the property from Land Registry as suggested and they are not in the charges register as far as I can see, they all relate to the date I bought the property all 2006. The property is Leasehold, so has the mortgage company, the three entries are as follows:

1.(05.06.2006) REGISTERED CHARGE dated 12 May 2006.

2.(05.06.2006) Proprietor: this says my mortgage company and address

3. (05.06.2006) The proprietor of the Charge dated 12 May 2006 referred to

above is under an obligation to make further advances. These advances

will have priority to the extent afforded by section 49(3) Land

Registration Act 2002.

Does this mean there is no charge by a company on my property?

What do they mean by they the appropriate steps will be taken to request the restriction registered against your property be removed? What restriction can they have?

Sara (Debt Camel) says

that looks odd. I suggest you talk to National Debtline on 0808 808 4000. Of course making a partial settlement on this debt may still be a good idea, but it’s good to think about the whole situation.

Paul says

My brother moved in with me a few years ago following his divorce. He was in a lot of debt at the time and this resulted in a CCJ. He was a homeowner when he took out the credit but is no longer. Recently he received notice of his creditors intent to apply for a charging order on his home. He does not own this property. I am the owner, although he lives with me rent free (he is my brother and is going through a difficult time). How can we prevent this? I have not co-signed any credit agreements with him.

Sara (Debt Camel) says

Is this the house that he owned when he took out the debt?

Paul says

Yes. I took over the mortgage and the deed was transferred fully to me.

Sara (Debt Camel) says

Then I suggest you talk to National Debtline on 0808 808 4000 as you may have a problem if he has any beneficial equity in the property.

Paul says

Thank you for your assistance. May I ask exactly what is beneficial equity? When I purchased the home it was because he could no longer afford it.

Sara (Debt Camel) says

If you purchased the home for its full market value there probably won’t be a problem. But I am not a lawyer, that is why I am suggesting you talk to National Debtline.

Hannah says

I have adhered to all payments set out by the court, yet my creditors have placed a charging order on my property and have applied for a forced sale. Is there anything I can do to stop this?

Sara (Debt Camel) says

If your CCJ was after October 2012 a charging order should not have been given if you were up-to-date with the court ordered payments. Talk to national Debtline on 0808 808 4000 about what you can do.

Hannah says

May 2018. All payments made on time and up to date.

Jenny says

Hi we had a charge on our property in 1995 for £5000

After going to court my husband paid it off in instalments but the bank wanted interest so we went back to court judge threw it out this wS years ago now we want to sell there is still this charge in the house which is making things difficult for us what can we do the solicitors that dealt with the case are no longer around

Sara (Debt Camel) says

“judge threw it out” judge threw what out?

Louise beck says

Hi there. My partner is divorced from his ex wife and she is refusing to sell their house. He has 3 interim charging orders on the house, one of these is to the CSA. He’s missed a few payments this year due to having little or no work. The csa are now wanting to enforce the charging order and force the sale off the house, but..his ex wife now has custody of their 2 year old grandson. Will the judge agree to the sale? My partner wants it selling as he just wants rid of it.

Sara (Debt Camel) says

That will depend on the facts of the case and I can’t reasonably make a guess at it.

Louise beck says

Ok, thank you.

Victor says

I have a charging order against my property ….Will i be able to remortgage my property . ?

Sara (Debt Camel) says

Do you also have a CCJ? Defaults on your credit record?

You shouldn’t have a problem with your current mortgage lender but may well do if you try a different lender. Best suggestion is to go through a broker and talk to the broker about remortgaging to repay the charge.

Victor says

Not anymore ….by the way it is an interim charging order and it was obtained in 2012

David Midgley says

Hi

Not sure if anybody can help, a creditor is chasing a debt of £3500, which we believed was Statute Barred (Letter sent), they are saying that no acknowledgement or payment in last 6 years, but they had put a Voluntary restriction on our previous home back in 2008 ( this property was repossessed in 2012, the debt is not any mortgage shortfall). We have been renting for 7 years.

I know for a fact there was never any CCJ or interim Charging Order placed, do not trust the debt collection company.

Can they still enforce or can we find out for definite about any restriction ??

Sara (Debt Camel) says

Was there a mortgage shortfall? Have you asked them to prove there was a CCJ? I suggest sending them a Subject Access Request asking for a copy of personal information they have about you.

David says

Hi Sarah there was a mortgage shortfall but that was paid overtime. But this is nothing to do with that. On paperwork from the company no claim reference number, will ask for sar, is there anywhere you can find out about ccj over 6 years because I do think they are not telling the truth and trying it on. Debt is for 3k thanks

William Parkhill says

Hi,

I had a charging order on my house in 2010 for £16000, that has now risen to £23000 because interest been added. The question I have is the ccj was always paid on time never missed any payments. I was not in a good place when I got notice and just done what Link solicitor said. I have now found out the reason was they sent a letter and received no reply from my wife!!! She passed away 2 years before hand and I never opened any letters to her but, link were informed of her passing at the time. How can they get a CO on the basis of that? I have just learned about this recently, can I do anything about this.

Regards,

Bill

Sara (Debt Camel) says

Hi Bill, I suggest you talk to National Debtline on 0808 808 4000 about:

– whether you have any options to challenge this charging order so long after it was made

– whether it is correct that interest can be charged on the CCJ.