UPDATE the Scheme is now live

After the court approved the Amigo scheme in May 2022, the Scheme is now live. The deadline for making claims has now passed.

See Amigo’s Scheme – waiting for claims to be decided for details.

UPDATE on the result of the voting

- Amigo announced on 13 May that c. 89% of people voting had voted in favour of the new Business Scheme.

- the next stage in the Scheme approval process is the second court hearing which will be on 23 and 24 May.

Over 160,000 people voted, which was twice as many as voted on the first Scheme in 2021. The first Scheme was voted for by more than 95% of people voting.

After the court hearing on 8 March 2022, the judgment issued on 15 March 2022 approved the voting arrangements for the new Amigo Schemes.

The fairness of the Schemes will be considered by the Court in late May, after Amigo customers have had a chance to vote on them.

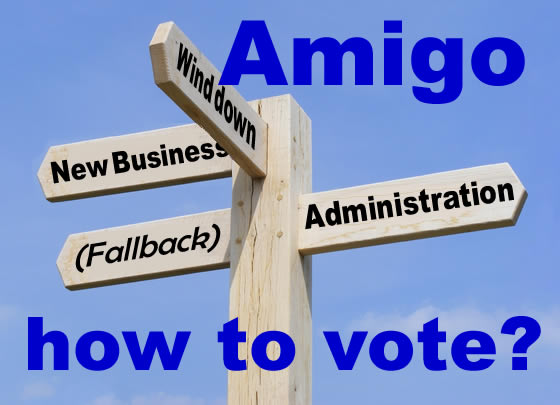

Two Schemes are being voted on, also the first Scheme has a “fallback” option if it fails. And if neither is approved Amigo will go into administration.

I encourage you to read Amigo’s detailed Explanatory Statement, even though it is long.

I can’t tell you how to vote but I can suggest points to think about:

- how much money might you get back? Amigo says you may get between 41% (the New Business option) and 31% (in administration) of the proper compensation you should have had;

- people with current loans can get balances reduced or cleared and their guarantor released – that is the same in both schemes and in administration;

- do you want Amigo or administrators to decide on your complaint?

- do you want Amigo to be able to start lending again?

Contents

A brief look at the background

In late 2020 Amigo was losing 88% of complaints and couldn’t afford to carry on paying refunds. So it proposed its first Scheme to pay lower refunds.

This was rejected by the Court in May 2021 after the FCA, Amigo’s regulator, opposed it saying that it was not fair to customers and too generous to Amigo shareholders.

Amigo had said it would go into administration if the first Scheme was rejected, but it didn’t.

Instead it proposed a new Scheme, issuing a Practice Statement Letter – a short summary – in December 2021.

The different options and possible payouts

4 options

There are four options:

- New Business Scheme – you vote on this. This is Amigo’s preferred option because it will let them start lending again in the future.

- Fallback option – not voted on. This will happen automatically if the New Business Scheme is approved but then Amigo can’t make it work. This could happen if the FCA doesn’t let Amigo start lending again (the FCA’s current position is here) or Amigo’s shareholders don’t raise the money Amigo needs. Then the New Business Scheme will collapse into this Fallback option.

- Wind Down Scheme – you vote on this. Here the current Amigo company won’t start to lend again and it closes down. (It is possible that Amigo will start lending through a different subsidiary. It has told investors that Vanir Business Financial Limited was there to “hedge its bets”, but this is not mentioned in the Explanatory Statement.)

- Administration – not voted on. This will happen automatically if neither the New Business nor the Wind Down Schemes are approved. So if this is your preferred option, you should vote against both the New Business and Wind Down Schemes.

Do you have an affordability complaint?

A loan is only affordable if at the time it was given, someone could have been expected to make all the repayments and still be able to pay their other debts, bills and living expenses, without having to borrow any more money.

Amigo should have checked a loan was affordable for the borrower and for the guarantor. But it failed to do so in many cases. That is why so many people have been winning complaints against them. And why a lot of people are expected to make complaints to the Scheme or to administration.

If you make an affordability complaint, your Amigo loans will be looked at to see if they were “affordable”.

Who decides on affordability?

- in the New Business, Fallback and Wind Down options, Amigo will make the decision about which loans were unaffordable;

- in the Administration option, the decision will be made by the administrators;

- the option of taking your complaint to the Financial Ombudsman will not exist in any of the options. After a Scheme has finished, you will still not be able to take a complaint to the Ombudsman.

What compensation do you get for an unaffordable loan?

This is for borrowers. There is a section at the bottom of this article for guarantors. NB if you are a borrower, you should encourage your guarantor to read this if there is a current loan.

For people whose loans have been repaid

The compensation is the interest you paid on the unaffordable loan. This is sometimes called redress. Any negative marks on your credit record are also removed.

There is not enough money to pay you the full amount under any of the options. You will only get a small proportion of the true compensation – Amigo calls this the payout percentage.

This is often expressed as “pence in the £” – that is the same as a percentage.

An example – if your compensation is calculated at £2,000 and the payout percentage is 30%, that is 30p in the £ and you would get £600.

For people who still have a current loan

Your balance is reduced so you only have to repay the amount you borrowed.

You are getting the “full” value of this balance reduction, the payout percentage doesn’t matter. You will get the same balance reduction in either of the Schemes and in administration.

If you should be getting more compensation than your balance, the balance is cleared and the rest will be paid in cash. You will get the payout percentage of that cash amount.

Two examples:

- you have borrowed £5000, repaid £3500 and have a balance of £7000.

You have not yet repaid what you borrowed.

If you win your complaint, your balance is reduced to £5000-£3500=£1500. You can repay this at an affordable rate and your guarantor is released. Any negative marks on your credit record are removed.

You won’t get any cash refund so the payout percentage in the different options doesn’t affect you at all. - you have borrowed £5000, repaid £6000 and have a balance of £5500.

You have repaid more than you borrowed.

If you win your complaint, your balance is cleared, your guarantor is released and you should get cash compensation of £6000-£5000 = £1000. Andy negative marks on your credit record are removed.

If the payout percentage is 30%, you will get 300 of this 1000. But your balance has been cleared, which may have been what really mattered to you.

Amigo has changed the payout percentages significantly

Amigo has estimated the payout percentage for each of the four options.

These are very different from the first Scheme, rejected in May last year, when no one would get any cash payout in administration!

And they are also different from the numbers that Amigo gave in the new Scheme’s Practice Statement Letter in December 2021.

Here are Amigo’s latest numbers showing how they have changed since December:

| Name | previous | current |

|---|---|---|

| New Business | 42p | 41p |

| Fallback | ? | 33-37p |

| Wind Down | 29p | 33p |

| Administration | 24p | 31p |

These are important changes since December:

- with their previous numbers you could have got 42p with the New Business Option, nearly twice the 24p they thought in administration;

- now Amigo says you will get much more in administration – 31p – and the payout in the New Business option has dropped a bit to 41p;

- Amigo now admits that you will get nearly the same amount from administration that you would get from the Wind Down Scheme.

So you can see that the difference between all the options is now much smaller.

The payout percentage is only a part of the picture

It isn’t clear how real these numbers are

Many people want the option that gives them the most money. Fair enough!

But it isn’t simple.

The fact the numbers have changed so much since December may make you wonder how good these estimates are.

Amigo hasn’t explained how it has arrived at the 41p number. This number could be anything depending on how Amigo handles the complaints. If Amigo rejects a lot of complaints the payout percentage will be large, but not many people will get one.

The money you will get depends not just on the final payout percentage but on:

- which of your loans are upheld; and

- whether any deductions will be made.

If you have a loan and Amigo says it is affordable, but in administration the administrators were to uphold your complaint, you would be better off in administration.

31% of something is worth more than 41% of nothing.

Amigo has not been clear how it will decide what loans are affordable. You may not feel sure about what Amigo would decide in your case. This isn’t helpful.

Amigo intends to carry on with the deduction it makes for “for unpaid interest”. No other lenders do it and the Ombudsman has said it is not fair. Some people only lose a few hundred pounds with this deduction but I have seen cases of more than £3,000.

Who do you want to decide your complaint – Amigo or administrators?

If administrators would make the same decision as Amigo, this wouldn’t matter. Amigo thinks administrators would make the same decisions that it will.

But I have seen a lot of high-cost lender administrations over the last three years. In general, administrators tend to try to roughly follow what the Ombudsman would have decided. The Ombudsman was upholding 88% of Amigo complaints, the vast majority for all loans a customer had.

I have never seen an administrator apply a deduction for unpaid interest and Provident does not apply this deduction in its Scheme.

Amigo says it expects to uphold 65% of complaints, but won’t say what percentage of loans it’ll uphold. A lot of people have had more than one loan, so this is important. It may be Amigo expects to reject many one loan complaints and only uphold the last loan in multiple loan complaints.

Many Amigo borrowers and guarantors have already had very poor decisions from Amigo in the past.

The company says it is now under new management. But it has carried on with its aggressive approach to debt collecting over the last 18 months, pressuring customers to make unaffordable payments. And it seems as though it intends to carry on making the unfair deduction for unpaid interest. Has it really changed that much?

Amigo has also said that it will ask some borrowers and guarantors to provide documents in support of their claims when they make them. We don’t know what those documents will be or how many people will be asked.

I have never seen administrators ask for evidence when a customer makes a claim against a high-cost lender. If a claim is rejected by the administrators and goes to an appeal, the customer can then produce extra details they think may help. But Amigo may be trying to put people off complaining by asking for this information.

So there are some reasons why you may decide you prefer administrators to handle the claims and not Amigo.

Do you want Amigo to restart lending?

Some people may not care about this – you may just want as much money as possible.

And some people were quite happy with their Amigo loan and didn’t feel under emotional pressure to protect their guarantor.

But other people think the Amigo loan was one of their worst financial decisions. And they would never suggest that a friend or relative should take a guarantor loan. So they may not want Amigo to be able to carry on lending.

There isn’t a right or wrong here – it depends on how you feel.

Issues for guarantors

There are various reasons you can complain, see How to complain when you are the guarantor for a loan which looks at these.

The simplest complaint to win is often that the loan was often unaffordable for you – at the time the loan was given, was it likely that you could have made all the payments to it out of your spare income, and still been able to pay your own debts, bills and living costs? You may own a house, but that doesn’t mean you had a lot of spare income!

Guarantors of repaid loans:

- You may be able to get a refund if you made payments to a loan.

- If you win your complaint, you will get a refund of part of what you have paid, at the payment percentage rate.

Guarantors of current loans:

- If you win your complaint you will be released as guarantor for the loan. You can also get a refund if you have made payments to the loan.

- If the borrower is also making a complaint, it is good if you too can complain if the loan was unaffordable for you.

- This gives you two ways to be released as guarantor – if you win your complaint or the borrower wins theirs.

The expected timetable if the New Business option is approved

16 March to 10 May Online voting

12 May (optional) online creditors meeting starting at 1pm to consider the Schemes. Register in advance if you want to attend.

12 May (optional) deadline for customers to inform the appointed Customer Advocate at jy@amigoca.co.uk if you think the proposed Schemes are unfair.

23 & 24 May 2nd court hearing to consider the voting and the fairness of the proposed Schemes

Late May The Scheme starts. Customers can make claims to the Scheme

End November Deadline for making claims to the Scheme

December 2022 to August 2023 Amigo decides claims and appeals are decided

September – November 2023 Money is distributed to customers with upheld claims.

The mechanics of voting

Voting has now ended.

Any other questions?

Comments are now closed on this page. Please read the latest page on making a claim to the Scheme and leave any comments there.

Ewan says

Given current circumstances, what options do I have at present? I’ve missed the boat raising a complaint with the Ombudsman, however still believe I have valid reasons for a complaint.

Since 2017, I have had 6 loans / top ups with Amigo, ranging from my initial loan of £1000, to my current loan of £7500.

As it stands I have paid somewhere in the region of £12,500 on the current loan (started March 2019), and have 27 payments of nearly £300 a month remaining.

As bills have gone up, as well as changing circumstances, I am finding I have less disposable income now than I used to. Once I have paid everything, I only have around £400 left spare, which is just begging for something like car problems to creep up and hit me.

Every time I have applied for a top up, my credit score was dismal and showed numerous outstanding debts, arrears and defaults with other companies. I have since paid all those off, the only thorn in my side is the ongoing Amigo loan. What should I do?

Sara (Debt Camel) says

Having multiple top ups is usually a sign that the later loans were unaffordable so I would hope that some of them will be decided to be unaffordable in either Amigo’s Scheme or in administration if the Schemes are not approved.

There are three things you need to make a decision on now.

1) whether you should make a complaint to Amigo right away that the current loan was unaffordable. There is no downside to doing this and it will protect the money that you are paying Amigo from now on – some of that money goes into a Trust Fund and will be refunded in full if your claim is upheld, rather than at 30% or 40% or whatever the final % turns out to be. See How do I make a claim? section in the article above

2) whether you should choose to stop paying Amigo now by asking for Equitable set off. This lets you pause paying until your claim is decided and Amigo will not ask your guarantor to pay. You need to assume that your complaint will not be settled before the end part of this year or or early next year.

3) how to vote on the Scheme

Ben says

Hello,

Thanks for your help! I have just voted on the Amigo scheme and have been asked to fill out a form at the bottom of the voting for the value of my affordability claim and all other claim values, so far I have left these blank

I was wondering should I be putting any figures into these boxes?!

Sara (Debt Camel) says

Unless your Amigo loans are very old, there is probably no need.

Lee says

The comments on this page by Sara are very valid in some points and very misleading in others. Her replies are purposefully written in order to suggest, without suggesting administration is the best option. Despite the money taking longer and more likely to be less than the other options. Sara makes claims about previous history etc etc. however there is no mention that Amigos new business model has been approved by the FCA. The majority owner has sold up and left and that any new lending requirements will be tightly monitored by the FCA. In life generally when organizations make mistakes they are rightly punished. Check deepwater Horizon disaster £50 billion paid out by BP after some many deaths and a natural disaster. Most importantly we live in a society where it is better to educate than punish. To wind down a business that wishes to apologise compensate and learn from mistakes will only make it 10 times harder for vulnerable individuals to borrow money when required. It is short sightedness to think credit unions can meet the demand. As an previous provident loan owner, I believe it is much better to have businesses that borrow responsibly than no option other than an unregulated money lender who will jump with glee if Amigo goes under. Let’s not forget there are currently over 100 employees who are working without knowing they have a job next month….

Sara (Debt Camel) says

Despite the money… more likely to be less than the other options.

Whether that is the case depends on the situation of each customer. As the article above sets out, it is not a simple matter of saying 41% is more than 31% so everyone will be better off in the new Business Scheme.

Amigos new business model has been approved by the FCA

That isn’t quite what the FCA has said. See https://www.fca.org.uk/publication/correspondence/amigo-loans-limited-proposed-scheme-of-arrangement.pdf

a business that wishes to apologise compensate and learn from mistakes

Ah but does Amigo?

A responsible business that wanted to compensate customers and learn from mistakes would:

– not refuse to explain what percentage of loans it expects to uphold in the SCheme

– not have carried on sending texts and emails last year to people with a current loan that sounded as though Amigo would take them to court if they stopped paying, when there was not the slightest chance of Amigo doing this

– have put current customers payments into an escrow account from the beginning of last year

– have abandoned the unfair “deduction for unpaid interest” it makes. No other lenders does this. FOS says it is unfair. But it saves Amigo money…

I don’t think any vulnerable customer should take a guarantor loan. And Amigo loans are large and long term – not in the same market as unregulated money lenders.

L says

Not continued to send mocking emails when a severely ill and vulnerable person is trying to explain why what Amigo is doing is wrong. And yet, being facetious about their mental health.

Sorry, but I couldn’t not add this when absolutely nothing has changed and, I believe, nothing will. I feel for the most vulnerable going forward.

Ben says

I have raised a complaint with amigo and so has my guarantor. I have had a swift reply from an account manager to say he has raised the complaint for me and that the complaints team will officially acknowledge the complaint within 3-5 days.

At what point would you recommend raising the possibility of equitable set off with them?

Sara (Debt Camel) says

Now if you want this, there is no reason to delay.

Lee says

Hi Sara

Thanks your reply, without asking sensitive questions we never get to understand each other’s views. I appreciate your replies and understand your view on Amigo, it’s a very tarnished organization that will struggle to ever change its terrible reputation and administration would probably be a fitting end to the situation. I would never take offense to comments from strangers, you are championing reform in an sector that has ruined peoples lives. Your replies have highlighted to me your knowledge and empathy on this matter, unlike Amigo.

Regards

Trin says

Hi, Could you recommend what is the best option to vote on as a guarantor (current loan) that thinks the loan was unaffordable?

I’m not concerned about compensation but rather being released as guarantor altogether.

Thanks

Sara (Debt Camel) says

The loan was unaffordable for you? or for the borrower? or both?

Steve says

Is there any chance that, with certain worded emails or using sites like Resolver, that Amigo would review peoples accounts and write of debts before any of these scheme really starts?

Surely it would be a nice easy way for them to cut some losses having to pay people thousands of pounds back in compensation if they simply said we’ll just clear your entire balance and off you go.

I had an outstanding balance with Glo, and that’s what they ended up doing.

Sara (Debt Camel) says

No.

I don’t think they are even reading complaints at the moment.

Steve says

This is what I don’t get. There’s no easy win for the borrower. They won’t look at complaints, and even if you trigger equitable set off, your credit score gets ruined. It wouldn’t be so bad if the scheme was done and dusted in a few months, but for it to be strung out over 2 years is a joke. I deleted the CPA and the direct debit, and told them in future I’ll be paying on a lunar pay cycle instead of on their terms by direct debit. If they’re so desperate about getting their money out of me they can take me to court.

Sara (Debt Camel) says

I think Amigo has behaved very badly and the FCA should not have allowed them to stop complaint handling.

David says

Hi

I have posted a couple of times on this site and Sara you are a brilliant resource for us. I’m doing really well recovering from gambling addiction, it’s been 3 years now!, however, I can’t move on as I have an outstanding debt with amigo and I am reluctant to pay the £5K settlement when it could well all be cleared if my claim is accepted. The problem I have is not about affordability it’s more about the impact that this has on my credit score as I am hoping to move house! Reading other comments, my only option is to settle the balance but it just does not sit right with me at all!! Rant over

Sara (Debt Camel) says

how many times did you borrow from Amigo?

the last loan – do you think it was affordable?

have you missed payments to it?

David says

Hi

My loan was 8K, my monthly repayments were £495 however since Covid I have been in a payment plan, paying £200 p/m. I can afford the payments but I believe I was miss sold the loan.

Thanks

David says

Sorry, I have only have had this loan, I have not missed any payments but I did take the 6 month Covid break.

Thanks

Sara (Debt Camel) says

so the 6 month covid payment break should not have affected your credit record.

But if you have been on payment plan after than, it would have been? Is this what has happened?

David says

Yes, my wife was unwell and this affected our income therefore i requested reduced payments.

Thanks

Sara (Debt Camel) says

Well settling this now will not improve your credit score. But it shows the payment arrangement problems are in the past.

Winning an affordability complaint will clear the credit score problem – you can win the complaint whether you settle this now or not – but are you saying you think the loan was affordable? In that case you may not win.

Are you renting or buying?

David says

I am buying. At the time I took the loan in 2019 I was in a DMP and was heavily gambling, the loan was unaffordable in my view.

Thanks

Sara (Debt Camel) says

OK so you do have an affordability complaint. Your main aim may be to get your credit record cleaned but that is only going to happen if you win an affordability claim to Amigo in a Scheme or to the administrators if a Scheme is not approved.

There is no way you can get this speeded up, you have to live with the impaired credit record until the end of the year at least.

If you settle the debt now, it will look better on a mortgage application but it is still VERY unlikely you will be able to get a mortgage at an OK rate from a normal lender for at least a year. Only a bad credit lender will look at you now. I suggest you talk to a mortgage broker who should confirm this.

David says

Thanks for the advice Sara

Nina says

Help please. I wonder if i can make a complain if i have not paid the loan for 3 years. It was so unaffordable at the time i even got evicted until now i am intemporary accomodation and unemployed. I have paid more than i have borrowed but i still owe them alot. They lend me 10k i have paid around 12k and still left with £16k. I want to know if atleat i can have this reduce or something. What should I do?!

Sara (Debt Camel) says

Have they asked your guarantor to pay?

Christina says

Hiya Sara, I have spent some time today reading through this page and some people’s comments after recieving an email about a last chance to vote. I had a large loan a number of years back, which has now been paid off. The reason that it was paid off was because after starting to struggle massively with the 50% interest payments each month they were threatening to take myself and my guarantor to court, resulting in CCJs on our record if not paid by the certain date noted on the letter. It was a very hard time for the both of us, desperately asking friends and family members for thousands of pounds to pay this. Thankfully, we both found friends able to help us with this and it was paid by the date given to avoid the CCjs (unsure whether they were false threats but it scared us enough to pay) we were then left with debts to them instead which was very stressful and very embarrassing. Where do I stand do you think, with this situation in mind? I have read that previous history of loans have probably been wiped etc. Should I complain? Should I vote against? ( this is what I’m edging more towards! I don’t think they should be able to lend again after ruining so many peoples lives and mental health) do I have a claim at all for compensation? thanks for your help! Hope to hear back!

Sara (Debt Camel) says

when was your loan taken out? when was it settled?

Joanne says

When will we hear how the vote went

Sara (Debt Camel) says

The Creditors’ meeting is tomorrow – not until after that.

Joanne says

Any updates yet from the credirors

Sara (Debt Camel) says

not yet.

joanne says

I voted against both schemes

simon says

I saw on the news that 88.8% of creditors voted for the new business scheme to go ahead unfortunately.

Sara (Debt Camel) says

The voting was about 90% to approve the New Business Scheme – full details in here: https://www.londonstockexchange.com/news-article/AMGO/result-of-creditors-meeting/15451157

The next stage is the second court hearing whihc will be on 23 & 24 May..

Kelly Mckane says

Noone is getting a. Claim now amigo is still carrying on aren’t they so we have to pay it back?xx

Sara (Debt Camel) says

Amigo has now announced that customers have approved the New Business scheme. The next step is for the New Business Scheme to be considered by the court on 23 & 24 May. If it is approved by the Court, the Scheme will start.

At that point there will be 6 months for customers to submit claims to the Scheme.

Do you have a current loan? Have you already made a complaint?

Mar Glo says

Hi Sara, gutted to hear about this is was hoping for administration.

Can you help and answer what would happen if I haven’t been paying my loan for quite a few months ? I haven’t repaid over half of what I’ve borrowed. In facet I’ve repaid barely anything as I genuinely cannot afford it.

I’m not entirely bothered about a make on my credit file it is damaged anyway but my guarantor has a gleaming credit file.

Once the new business scheme starts to go ahead and we have to make new claims will they ask me to start repaying again ? Can they take my guarantor to court if they don’t pay – they cannot afford to pay either.

All this is so stressful and it’s mentally challenging I don’t know what to do from here. I feel utterly trapped.

Sara (Debt Camel) says

it’s not 100% definite tet that the New Busines Scheme will go ahead – the court case to approve it isn’t for another 10 days. But it seems likely to so it’s sensible for you to think what you will do.

You have already stopped paying and they haven’t asked your guarantor to pay?

Your guarantor – would the loan have been affordable for them at the time the loan was given – could they have afforded to make all the payments and still been able to pay their own debts, bills and living expenses?

Mar Glo says

No neither of us have had any contact for quite some time. We both have outstanding complaints which as you’ll know haven’t yet been dealt with. I also took my complaint to the FOS but that’s too on hold as they aren’t dealing with complaints as yet.

No my guarantor wouldn’t have been able to pay. She was on long term sick from work at the time following 2 strokes and was only receiving sick pay.

I would go bankrupt as I have got other debts in the meantime as the amigo loan crippled me then at least it would all be wiped and I could breath but my guarantor would suffer and I cannot do this to them. So I’m stuck.

Sara (Debt Camel) says

So when the Scheme starts (assuming it does):

– both you and your guarantor need to check whether a claim is in there (it may be done automatically as you had a FOS complaint but you must not assume this – check) and submit claims if there isn’t.

This should not cause Amigo to ask you to pay again. If they weren’t doing anything about your account before, putting in a claim doesnt change that.

It seems more likely that they will ask people to pay who HAVEN’T submitted a claim.

But if they do ask you to pay – you just explain why you can’t. And if they ask your guarantor to pay, she explains why she can’t. I hope she has cancelled the Direct Debit to amigo and also phoned her bank and cancelled the Continuous Payment Authority Amigo has over her debit card? Better safe than sorry…

Not paying will affect your credit record but not hers. An Amigo loan doesnt appear on a guarantor’s credit record. The only way her credit record can be harmed is if Amigo takes her to court for a CCJ – Amigo hasn’t done that for more than a year and it isn’t going to start when there is a Scheme in place and she has a complaint in.

So then it will take a few months – possibly 6 or more – until Amigo d3ecides your complaint and also decides her complaint.

If her complaint is upheld, she is released as guarantor. Or if your complaint is upheld , she is also released.

As soon as she is released, you can go bankrupt if that is the best option for you -(NB do talk to a debt adviser first. This is ALWAYS a good idea before bancruptcy. And if your total debts are less than £30,000 a Debt Relief Order may be a better option for you than bankruptcy.)

So the only problem given that you intend to go bankrupt if it doesn’t affect your guarantor is if your complaint AND her complaints are rejected by Amigo. Then you both need to appeal the decision and go through that process.

If at the end of that both claims are still rejected, then you both need to take debt advice on your options. Because at that point Amigo will expect you to start repaying and will ask her to if you can’t.

Sean mcconkey says

Hi

I had a complaint rejected then went ombudsman’s who was looking at my claim. They had the claim for about 14 months then amigo asked for the 1st scheme. The ombudsman’s said my claim would be put on hold but as that was some time ago will I need to make new complaint or speak to ombudsman’s about my old claim again

Sara (Debt Camel) says

Assuming the Scheme is approved – at that point there may be details about claims that have automatically been lodged. I suggest you should check if yours has been and if it isn’t clear, try to submit a new claim – better safe than sorry!

Sean mcconkey says

Thanks, should I check with ombudsman’s first or start a new claim with amigo

Sara (Debt Camel) says

Forget the ombudsman – make a claim with Amigo. There may already be a claim in there for you, but check!

Tony says

Hi Sara,

I received am email from Amigo informing me thwy were going to reduce by balance by nearly £800 due to overcharging on interest during the period when Covid breathing space was in effect.

Did anyone else get an email please?

Laura says

No I haven’t, that’s interesting. Did you take the breathing space at the time?

Tony says

Hi Sara,

Yes I took the breathing space. I was surprised when i received a text and email last week informing me of the reduction.

Jim says

I have an amigo loan from 2017, haven’t paid from 2018 and complained around 2019 but was told by amigo they didn’t think it was unaffordable and then nothing else to it, they haven’t chased me for payments or anything. My credit shows the debt as in arrears. I’m wondering will I be able to complain again through the scheme. I’m sure I’m administration I’d have gotten it removed from my credit, would i be right to assume the same with the scheme?

Thanks,

Jim

Sara (Debt Camel) says

I think you will be able to complain again – it is a pity you did not send it to FOS in 2019.

If the loan is upheld as unaffordable it will eventually be deleted from the credit record.

Sean says

How do you think they’ll ask for claims to be made? And will we be able to argue against decisions? I have had 4 too ups, I’ve paid 17k interest inc the original amount. I owe £1200, I’m refusing to pay out of principle.

Also when can we expect to even get pay outs?

I received a call when I voted no to both, I wonder how many people got this call, and sold a lie to change votes! I can’t believe Amigo are being allowed to do as they please….is there anything we can do as consumers?

Sara (Debt Camel) says

Payouts in the New Business Scheme are expected September – November 2023

is there anything we can do as consumers?

No, it’s down to the court next week.

Carly says

I have an affordability complaint in and have done for some time. Naturally, as most, I struggled through covid and got the payment break etc.

I am £36 shy off of paying off my original loan balance (with a balance of around £1100 still to be repaid which is interest).

I’ve queried a couple of times in regards to equitable set off but as I had not paid off my balance they said get back in touch when I had. Do you think it is now a good idea to just pay up to my original loan balance and apply for the equitable set off? So that I am not continuing to pay further money and potentially lose money in the long term.

Sara (Debt Camel) says

Are the repayments affordable?

Carly says

I’ve struggled month on month since I got the loan. I don’t feel like I should’ve been given it as if they had seen at the time, and still currently, I am on a DMP with thousands upon thousands of debt.

Michelle says

Hi , I won my affordability complaint with amigo directly they upheld loans 1 , 2 and 4 but not 3 , They charged me over £3000 in unpaid interest will I be able to complaint again about this if the new scheme comes in to play ? I haven’t been paying it for over 2 years now , I voted no to all schemes

Sara (Debt Camel) says

Yes I think you will. Of course they may make the same decision….

John says

I had 2 of my 4 loans upheld and refused this sending it to fos in early 2020. Amigo contacted me in 2021 making the offer again. Do I still need to complain or will it still be dealt with.

Sara (Debt Camel) says

I hope Amigo is going to make it clear who has automatically had a complaint set up and who needs to submit one.

If it isn’t clear then it’s best to try to submit one, better safe than sorry!

AmigoAmigoYeeHa says

41p in the £1 on redress, now that’s quite a chunc.of change.

I presume that will be based upon interest paid and not the amount borrowed/full loan amount?

Sara (Debt Camel) says

We dont know what the payout will turn out to be.

It will be based on interest paid plus 8% statutory interest for a borrower. It will be based on the full amount paid plus 8% interest for a guarantor.

AmigoAmigoYeeHa says

I’m just going by the MSE website, following there recent ‘MSEs Money Tips’ email. There’s a link to Amigo scheme info and when you view the story, it states “It’s predicted that customers who are owed money, and no longer have a loan with Amigo, will get back 41p of every £1 they’re owed. So, if you’re owed £100, you’ll actually get back £41. “

Sara (Debt Camel) says

Yes it’s that little word “predicted.”

The actual payout won’t be known for a long while. It depends on how many people claim, what % of their loans are upheld etc. it als depends on them restarting lending and raising money from shareholders.

Jo says

Do you think they will look at claims that have been logged sooner and tell people what loans r being upheld , or when do u reckon this will begin

Sara (Debt Camel) says

I really can’t guess.

Jo says

Will Amigo look at claims already made and tell u if any loans r being upheld soon or will they all be looked at after the six months of waiting on more claiming

Sara (Debt Camel) says

I don’t know. Provident waited until nearly the end of the 6 months before anyone heard. It would be good if they give priority to people with current loans, but Amigo doesn’t usually set out to be helpful.

Ruth says

I’ve been trying to find this out too , my complaint has been with them since august 2020. The reply I got was that any redress due to customers would on the current plan be made September 2023..no word of when decision s would be informed to us though. The idea of waiting over another year is ridiculous

Sara (Debt Camel) says

It should be less than a year for most people. That is allowing for appeals when people are unhappy with the Amigo decision.

Lee sharratt says

So. Had a complaint with them a while ago. They rejected. From a loan in 2012. Can I still claim ?

Sara (Debt Camel) says

Yes you should be able to. When was the loan repaid?

Lee sharratt says

2013. So fingers crossed

Sara (Debt Camel) says

It’s possible that Amigo have wiped the loan details then. Do you have them?

Lee sharratt says

No. They have them. I called them for my vote

AmigoAmigoYeeHa says

So when I first tried to reclaim. I was met with Amigo pushing me back saying they can not find my details as loan is too old (2011 to 2013)

This was despite providing them with copy of credit report which showed amount of loan and repayment amount.

When Voting started I was given a temp id so I could take part in the vote – this was registered to my mobile number.

Well I’ve just logged into Amigo’s site (as an existing customer) and low and behold – I have my agreement number (not the same as what is recorded on credit as it was initially FLM Loans) and a FULL statement of account showing loan amount, Payments made & Interests charged.

I’m a happy chappy considering they were saying they couldn’t find the info.

So if you have been fobbed off before by amigo – try logging in with your mobile number (or previous number) and date of birth.

Amazing how they now have found the details.

AmigoAmigoYeeHa says

Based on claim date as today

26/01/2011 Broker Fee 300

26/02/2011 to 30/04/2013 £1,945.60 of interest

So including the Broker Fee, that works out at:

£2,245.60 + 8% Simple Interest £4,132.46

Even at 20p in the pound that’s a late holiday somewhere… or christmas presents.. nope def. holiday

Lloyd says

The timeframe is becoming ridiculous. I’m currently on equitable set off because the only thing I owe to amigo is about 1/3 of the interest, I didn’t want to keep paying them money whilst there being investigated for irresponsible lending. Since then, my credit rating is completely ruined. I don’t understand how that’s a fair compromise from Amigo to keep reporting missed payments when they’ve offered an equitable set off? Do you know if there’s anything I can do about this? I’m looking to get on the property ladder this year but I’ve got no chance of a mortgage right now!!

Sara (Debt Camel) says

No there isn’t anything you can do about this. I agree the timetable has been excessively prolonged.

Cj says

So amigo emailed me today about equitable set off saying if I asked for it then my credit file gets damaged .unless they agree in the scheme my loan was unaffordable and they would then wipe it clean and if I was to lose they would they chase me for the arrears as well as the rest of the interest . Not sure if that’s a big risk having my credit file damaged when I’ve been doing do well. When I took the loan I was heavily overdrawn every month had another loan which was in arrears and my mortgage and council tax and electricity and water were all in arrears. I’ve only had the one loan with them and on occasions paid then and ot another bill which my bank statement would prove .do I have a chance of winning an affordability claim with this

Sara (Debt Camel) says

It sounds like a good complaint to me but no one can be sure what Amigo will decide.

How large was the loan?

What is your credit score like at the moment and how hard is it to make the repayments? How many are left to go?

Cj says

The loan was dor 4000 my credit score still bad but better my mortgage and council and water are still in arrears my overdraft is down to 500 . My other loan is on special arrangement. So with todays bills it’s tough everyone month .I’ve paid pri Cople amount back by over 450 so now im just paying interrst have got til jan 24 til it finishes

Sara (Debt Camel) says

Well it sounds as though your credit score isn’t good so does it matter if equitable set off harms it? If you win your claim, the negative marks on your credit record will be removed.

As I said, it sounds like. Good claim to me, but it’s not me making the decision. You have to weigh up the 100% chance of tough months for the next 6-9 months (could be more, could be less) against the chance of you losing your claim.

If equitable set off would let you clear some of council tax and mortgage arrears that would put you in a better position to repay Amigo if you do lose the claim.

Sara (Debt Camel) says

Comments are now closed on this page. Please read the latest page on making a claim to the Scheme https://debtcamel.co.uk/amigo-scheme-claims/ and leave any comments there.