UPDATE the Scheme is now live

After the court approved the Amigo scheme in May 2022, the Scheme is now live. The deadline for making claims has now passed.

See Amigo’s Scheme – waiting for claims to be decided for details.

UPDATE on the result of the voting

- Amigo announced on 13 May that c. 89% of people voting had voted in favour of the new Business Scheme.

- the next stage in the Scheme approval process is the second court hearing which will be on 23 and 24 May.

Over 160,000 people voted, which was twice as many as voted on the first Scheme in 2021. The first Scheme was voted for by more than 95% of people voting.

After the court hearing on 8 March 2022, the judgment issued on 15 March 2022 approved the voting arrangements for the new Amigo Schemes.

The fairness of the Schemes will be considered by the Court in late May, after Amigo customers have had a chance to vote on them.

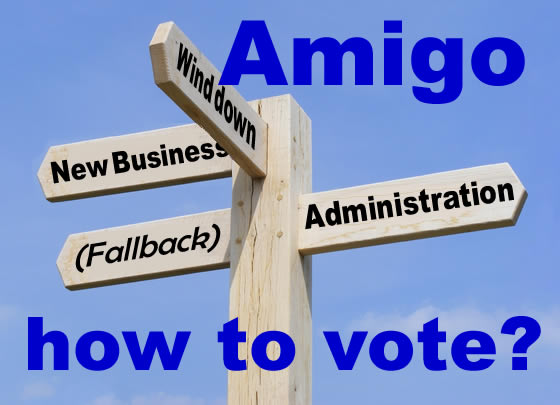

Two Schemes are being voted on, also the first Scheme has a “fallback” option if it fails. And if neither is approved Amigo will go into administration.

I encourage you to read Amigo’s detailed Explanatory Statement, even though it is long.

I can’t tell you how to vote but I can suggest points to think about:

- how much money might you get back? Amigo says you may get between 41% (the New Business option) and 31% (in administration) of the proper compensation you should have had;

- people with current loans can get balances reduced or cleared and their guarantor released – that is the same in both schemes and in administration;

- do you want Amigo or administrators to decide on your complaint?

- do you want Amigo to be able to start lending again?

Contents

A brief look at the background

In late 2020 Amigo was losing 88% of complaints and couldn’t afford to carry on paying refunds. So it proposed its first Scheme to pay lower refunds.

This was rejected by the Court in May 2021 after the FCA, Amigo’s regulator, opposed it saying that it was not fair to customers and too generous to Amigo shareholders.

Amigo had said it would go into administration if the first Scheme was rejected, but it didn’t.

Instead it proposed a new Scheme, issuing a Practice Statement Letter – a short summary – in December 2021.

The different options and possible payouts

4 options

There are four options:

- New Business Scheme – you vote on this. This is Amigo’s preferred option because it will let them start lending again in the future.

- Fallback option – not voted on. This will happen automatically if the New Business Scheme is approved but then Amigo can’t make it work. This could happen if the FCA doesn’t let Amigo start lending again (the FCA’s current position is here) or Amigo’s shareholders don’t raise the money Amigo needs. Then the New Business Scheme will collapse into this Fallback option.

- Wind Down Scheme – you vote on this. Here the current Amigo company won’t start to lend again and it closes down. (It is possible that Amigo will start lending through a different subsidiary. It has told investors that Vanir Business Financial Limited was there to “hedge its bets”, but this is not mentioned in the Explanatory Statement.)

- Administration – not voted on. This will happen automatically if neither the New Business nor the Wind Down Schemes are approved. So if this is your preferred option, you should vote against both the New Business and Wind Down Schemes.

Do you have an affordability complaint?

A loan is only affordable if at the time it was given, someone could have been expected to make all the repayments and still be able to pay their other debts, bills and living expenses, without having to borrow any more money.

Amigo should have checked a loan was affordable for the borrower and for the guarantor. But it failed to do so in many cases. That is why so many people have been winning complaints against them. And why a lot of people are expected to make complaints to the Scheme or to administration.

If you make an affordability complaint, your Amigo loans will be looked at to see if they were “affordable”.

Who decides on affordability?

- in the New Business, Fallback and Wind Down options, Amigo will make the decision about which loans were unaffordable;

- in the Administration option, the decision will be made by the administrators;

- the option of taking your complaint to the Financial Ombudsman will not exist in any of the options. After a Scheme has finished, you will still not be able to take a complaint to the Ombudsman.

What compensation do you get for an unaffordable loan?

This is for borrowers. There is a section at the bottom of this article for guarantors. NB if you are a borrower, you should encourage your guarantor to read this if there is a current loan.

For people whose loans have been repaid

The compensation is the interest you paid on the unaffordable loan. This is sometimes called redress. Any negative marks on your credit record are also removed.

There is not enough money to pay you the full amount under any of the options. You will only get a small proportion of the true compensation – Amigo calls this the payout percentage.

This is often expressed as “pence in the £” – that is the same as a percentage.

An example – if your compensation is calculated at £2,000 and the payout percentage is 30%, that is 30p in the £ and you would get £600.

For people who still have a current loan

Your balance is reduced so you only have to repay the amount you borrowed.

You are getting the “full” value of this balance reduction, the payout percentage doesn’t matter. You will get the same balance reduction in either of the Schemes and in administration.

If you should be getting more compensation than your balance, the balance is cleared and the rest will be paid in cash. You will get the payout percentage of that cash amount.

Two examples:

- you have borrowed £5000, repaid £3500 and have a balance of £7000.

You have not yet repaid what you borrowed.

If you win your complaint, your balance is reduced to £5000-£3500=£1500. You can repay this at an affordable rate and your guarantor is released. Any negative marks on your credit record are removed.

You won’t get any cash refund so the payout percentage in the different options doesn’t affect you at all. - you have borrowed £5000, repaid £6000 and have a balance of £5500.

You have repaid more than you borrowed.

If you win your complaint, your balance is cleared, your guarantor is released and you should get cash compensation of £6000-£5000 = £1000. Andy negative marks on your credit record are removed.

If the payout percentage is 30%, you will get 300 of this 1000. But your balance has been cleared, which may have been what really mattered to you.

Amigo has changed the payout percentages significantly

Amigo has estimated the payout percentage for each of the four options.

These are very different from the first Scheme, rejected in May last year, when no one would get any cash payout in administration!

And they are also different from the numbers that Amigo gave in the new Scheme’s Practice Statement Letter in December 2021.

Here are Amigo’s latest numbers showing how they have changed since December:

| Name | previous | current |

|---|---|---|

| New Business | 42p | 41p |

| Fallback | ? | 33-37p |

| Wind Down | 29p | 33p |

| Administration | 24p | 31p |

These are important changes since December:

- with their previous numbers you could have got 42p with the New Business Option, nearly twice the 24p they thought in administration;

- now Amigo says you will get much more in administration – 31p – and the payout in the New Business option has dropped a bit to 41p;

- Amigo now admits that you will get nearly the same amount from administration that you would get from the Wind Down Scheme.

So you can see that the difference between all the options is now much smaller.

The payout percentage is only a part of the picture

It isn’t clear how real these numbers are

Many people want the option that gives them the most money. Fair enough!

But it isn’t simple.

The fact the numbers have changed so much since December may make you wonder how good these estimates are.

Amigo hasn’t explained how it has arrived at the 41p number. This number could be anything depending on how Amigo handles the complaints. If Amigo rejects a lot of complaints the payout percentage will be large, but not many people will get one.

The money you will get depends not just on the final payout percentage but on:

- which of your loans are upheld; and

- whether any deductions will be made.

If you have a loan and Amigo says it is affordable, but in administration the administrators were to uphold your complaint, you would be better off in administration.

31% of something is worth more than 41% of nothing.

Amigo has not been clear how it will decide what loans are affordable. You may not feel sure about what Amigo would decide in your case. This isn’t helpful.

Amigo intends to carry on with the deduction it makes for “for unpaid interest”. No other lenders do it and the Ombudsman has said it is not fair. Some people only lose a few hundred pounds with this deduction but I have seen cases of more than £3,000.

Who do you want to decide your complaint – Amigo or administrators?

If administrators would make the same decision as Amigo, this wouldn’t matter. Amigo thinks administrators would make the same decisions that it will.

But I have seen a lot of high-cost lender administrations over the last three years. In general, administrators tend to try to roughly follow what the Ombudsman would have decided. The Ombudsman was upholding 88% of Amigo complaints, the vast majority for all loans a customer had.

I have never seen an administrator apply a deduction for unpaid interest and Provident does not apply this deduction in its Scheme.

Amigo says it expects to uphold 65% of complaints, but won’t say what percentage of loans it’ll uphold. A lot of people have had more than one loan, so this is important. It may be Amigo expects to reject many one loan complaints and only uphold the last loan in multiple loan complaints.

Many Amigo borrowers and guarantors have already had very poor decisions from Amigo in the past.

The company says it is now under new management. But it has carried on with its aggressive approach to debt collecting over the last 18 months, pressuring customers to make unaffordable payments. And it seems as though it intends to carry on making the unfair deduction for unpaid interest. Has it really changed that much?

Amigo has also said that it will ask some borrowers and guarantors to provide documents in support of their claims when they make them. We don’t know what those documents will be or how many people will be asked.

I have never seen administrators ask for evidence when a customer makes a claim against a high-cost lender. If a claim is rejected by the administrators and goes to an appeal, the customer can then produce extra details they think may help. But Amigo may be trying to put people off complaining by asking for this information.

So there are some reasons why you may decide you prefer administrators to handle the claims and not Amigo.

Do you want Amigo to restart lending?

Some people may not care about this – you may just want as much money as possible.

And some people were quite happy with their Amigo loan and didn’t feel under emotional pressure to protect their guarantor.

But other people think the Amigo loan was one of their worst financial decisions. And they would never suggest that a friend or relative should take a guarantor loan. So they may not want Amigo to be able to carry on lending.

There isn’t a right or wrong here – it depends on how you feel.

Issues for guarantors

There are various reasons you can complain, see How to complain when you are the guarantor for a loan which looks at these.

The simplest complaint to win is often that the loan was often unaffordable for you – at the time the loan was given, was it likely that you could have made all the payments to it out of your spare income, and still been able to pay your own debts, bills and living costs? You may own a house, but that doesn’t mean you had a lot of spare income!

Guarantors of repaid loans:

- You may be able to get a refund if you made payments to a loan.

- If you win your complaint, you will get a refund of part of what you have paid, at the payment percentage rate.

Guarantors of current loans:

- If you win your complaint you will be released as guarantor for the loan. You can also get a refund if you have made payments to the loan.

- If the borrower is also making a complaint, it is good if you too can complain if the loan was unaffordable for you.

- This gives you two ways to be released as guarantor – if you win your complaint or the borrower wins theirs.

The expected timetable if the New Business option is approved

16 March to 10 May Online voting

12 May (optional) online creditors meeting starting at 1pm to consider the Schemes. Register in advance if you want to attend.

12 May (optional) deadline for customers to inform the appointed Customer Advocate at jy@amigoca.co.uk if you think the proposed Schemes are unfair.

23 & 24 May 2nd court hearing to consider the voting and the fairness of the proposed Schemes

Late May The Scheme starts. Customers can make claims to the Scheme

End November Deadline for making claims to the Scheme

December 2022 to August 2023 Amigo decides claims and appeals are decided

September – November 2023 Money is distributed to customers with upheld claims.

The mechanics of voting

Voting has now ended.

Any other questions?

Comments are now closed on this page. Please read the latest page on making a claim to the Scheme and leave any comments there.

kerri russell says

how do i make a complaint

Sara (Debt Camel) says

do you have a current loan? This makes a difference.

Gaynor says

Can I still make a claim for a loan I had that’s been fully paid back.

Sara (Debt Camel) says

Yes, you can.

Was it affordable? A loan is only affordable if you can repay it and still be able to pay your other debts, bills and living expenses without having to borrow more.

Gaynor says

Thank you Sara,

I could not Afford the loan and was struggling to pay all my bills at the time of the loan and through out.

Dionne says

I’m same

elizabeth says

Hi I became guarantor for my son but he missed payments and defaulted and as guarantor I had to make the payments which I couldn’t afford as I was on esa at the time, it went to court and they put charging order on my house which still stands today. Is there any way out of this for me as guarantor and to remove the charging order and get debt sent back to my son, thank you.

Sara (Debt Camel) says

Yes you will be able to make a claim to the Amigo Scheme if it is approved, or to the administrators if it isn’t, saying the loan was unaffordable for you. If you win this you will be removed as guarantor.

At the moment so far as I know Amigo is not planning to remove CCJs from upheld loans – yet another way Amigo is trying to be as difficult as possible and not do the right thing for its customers who have been mis-sold loans.

However if you are released as guarantor, at that point you can then try to get the CCJ removed yourself – a good debt adviser such as Antional Debtline can help you with this.

Are you currently making any payments to this?

Elizabeth says

Hi Sara no payments have been made since charging order was made 3 years ago the debt still stands at 8,000 thank you.

Sara (Debt Camel) says

OK so I don’t need to explain your options about getting the payments reduced / put on hold!

Good luck with your claim.

Helen Walls says

How do we claim if we have already paid the bill back?

Sara (Debt Camel) says

For people like you without a current loan, there is no point in claiming now – Amigo will ignore it.

If the Scheme is approved, you will be able to submit a claim to it, starting from about the end of may.

Or if the Scheme is rejected, you can make a similar claim to administration.

Lyn Silvester says

Thank you Sarah. Very helpful explanations

danielle says

Hi, Sara

I hope you are well :-)

Ive had multiple loans of amigo and even as far back to when they called flm loans

I think i ended up having around x7 in total with re loaning a top up loan again and again

Theyve been repaid in full now since nov 2019

but it was crippling to be fair i sent a complaint sometime early last year

I was just wondering really whether id receive anything even if it was upheld?

The loans id taken out was these…

Dear Danielle,

Thank you for your email. Your previous agreement numbers are as follows:

38596891 – created 26/10/2017 / £4,500

28390717 – created 05/04/2016 / £5,000

16529131 – created 09/06/2014 / £5,000

10206861 – created 06/12/2012 / £5,000

WST5761104 – created 25/03/2011 / £5,000

EXS414408 – created 03/01/2008 / £3,300

WST1788198 – created 09/04/2009 / £5,000…

these was just the loan amounts without the interest etc

would i be looking at anything substantial as i dont really understand the payout percentage calculations for my situation being a previous customer without outstanding loans

And do you receive an intrest total or omis that basically all in the payout percentage total all in one toral

Sara (Debt Camel) says

That is a LOT of loans. It is hard to say much about what the refund might be unless you know the interest paid on each loan?

Some general points without those interest numbers:

1) At the Ombudsman I would expect have expected either all of them to be upheld or the last 6. That would have been a VERY substantial payout. But cases can no longer go to the ombudsman

2) I can’t guess how many Amigo will choose to agree are unaffordable. I am worried that the reason it won’t explain more about how it got the “42p in the £” refund figure is because Amigo expects to reject many loans. Also with so many top-up loans, if they reject an earlier one, Amigo will take money off your refund for “unpaid interest” – sometimes onlt a few hundred but I have seen thousands being deducted.

3) I also don’t know how many loans an administrator might uphold – but they do normally try to follow roughly what the ombudsman does. And I have never seen an administrator make a “deduction for unpaid interest”

So you are in the difficult position of trying to decide if you would rather vote for Amigo to decide your complaint and possibly get 41% of the amount Amigo calculates. Or if you would prefer administrators to make this decision so you would only get 31%, but possibly the administrators may uphold more loans than Amigo would.

And do you want Amigo to carry on in business? Some people liked their loans and do. Others found them really difficult and would never recommend Amigo to a friend.

Lee sharratt says

Hello. I made a complaint in 2012 about a 2500 loan. I lost. Where do I stand ?

Sara (Debt Camel) says

You should be able to make a new complaint to the Scheme or to the administrators if the Scheme is not approved.

In the Schemes, Amigo will look again at your complaint. In administration the administrators will.

Mark says

I took out a loan with amigo back in 2016 for £7500,I’ve paid back roughly £14000 to date,I’ve activated my equitable set off a few weeks back as well,I went to the FOS in 2019 to get them to look into amigo lending to me irresponsible which a few months later the FOS found amigo irresponsible of lending to me in 2016 as my financial situation was in dire straits and it was obvious I was always gonna struggle without getting myself in more debt to pay this back fully,my complaint got thrown in with the 1st scheme of arrangement which we all know what happened with that!

This has been a long 3 years for me and I just want disclosure now like pretty much everyone else!! If I’m honest yes I would like some compensation cuz I think I’m rightfully owed it but I’m at loggerheads as how to vote! I want amigo completely out of my life even if that means not getting any compensation! Can I please ask you how you think I should vote please because I really don’t know my best option and it would probably push me over the edge if they were to tell me that my claim has been rejected and I need to start resuming my payments again,

I look forward to your reply…many thanks Mark.

Sara (Debt Camel) says

OK so you have paid much more than you borrowed. If this is upheld in a Scheme or administration, your balance would be cleared and your redress would be set at

14,000 – 7,500 = £6,500

In the New Business Scheme Amigo says you may get back 41% of that, so c £2650

In administration you may get back 31% of that, so £2015.

But the big unknown is, are administrators more likely to uphold your claim than Amigo? For you getting the balance cleared sounds more important that a minor difference betwen the refund you might get.

Unfortunately you have to make a decision based on this. No-one can tell you if you loan will be upheld by amigo. or by the Administrators.

Keith U says

I had an initial loan in around 2016 and the two top up loans Afterwards.

My total outstanding now is around 17,500 including interest. I put in an affordability claim a couple of years back.

Really confused as to how they would work this out and worried about paperwork, ie bank statements as I’ve changed banks a few times in that time.

Do you think they would remove the interest and the deduct all the payments I’ve made from the date of the first loan ?

I have checked with them recently and my Affordability claim is definitely on the system.

My monthly payment should be 560pm, but as it stands they are in agreement that this monthly payment is too much so I pay 130pm, but they said that will take 10 years to clear.

Do you think I have a chance to have this removed as I have been paying for nearly 7 years now with differing monthly amounts ?

Sara (Debt Camel) says

You can bank statements from closed accounts – do this NOW do not wait to be asked. You want statements for 3 months before and three months after each loan / top-up application.

If you can’t get the earliest one back, get as many as you can.

And also download now a copy of your credit report and save it.

What is your guarantor’s financial position? Could they really have repaid these huge monthly payments for years and still been able to pay their own debts, bills and living expenses? They too may be able to make an affordability complaint.

Emma says

Thank you for the update Sarah. I have received yet another threatening notice/letter today despite having an equitable set off arrangement agreed. I am in the midst of a complaint to them about this, on top of my affordability complaint. Really fed up with this horrible company. I have voted against both schemes.

Jim says

Have you voted no against them hoping for administration or what is it you want? I’m not sure what to do but I had a loan in around 2017 paid for maybe 6months complained and got rejected. I have bank statements showing gambling before the loan very bad and I had other debt falling behind. I think I’m administration id get interest removed and off my credit or at least hoping so, but they don’t try contact me for the balance in the last few years and it’s around 5500

Emma says

I hope they go into administration as I don’t want them to be able to continue lending. I feel in administration any affordability claim will be dealt with more fairly than if by Amigo themselves, so 30% of something is better than 40% of nothing I guess.

Lisa G says

I’ve just voted against both options too… I want them to go into administration. I believe claims will be looked at more fairly in administration.

Liz says

I’m swaying to a no vote as well. What is everyone’s thoughts on this?

B Robinson says

Ive voted against too. Amigo have dragged this on for far too long, complaints cannot be dealt with but that does not stop them sending threatening texts and emails.

Rachel says

Originally I’d voted in favour of both schemes but tbh it was hard to understand, I just thought that would get everyone some of their money back and a lot of complaints upheld. But after reading Sara’s article I see this might not be the case, and that administration will be more fair in its dealings. I also don’t want them to be able to lend anymore, so I logged back in and changed my vote for both schemes to be against.

bob says

I feel like ive just done an exam there trying to work out which ways to vote lol

Doris says

can iget money back

Sara (Debt Camel) says

Hi Doris, do you still have a loan? how many Amigo loans have you had?

S.Phynex says

The guarantor part still seems very unfair. My borrower only made 6 payments on a £18000 loan- pay back amount not borrowed amount- I have now paid over £10000. The fact that I am not going to get back even half feels Brutal. I will be more then happy to get out of the situation, but not to loss more then I get back.

Why are guarantors being treated the same as borrowers??

Also confused as to why do we vote on which we want Before the Courts role if it’s a fair thing to be voting on? Should they not say if it’s fair first then we vote on it??

Sara (Debt Camel) says

Why are guarantors being treated the same as borrowers??

because to the law you are all just creditors that should be refunded money.

Also confused as to why do we vote on which we want Before the Courts role if it’s a fair thing to be voting on? Should they not say if it’s fair first then we vote on it??

The whole way Schemes are set up is bonkers. But it is what it is, and there is no chance of getting English Insolvency Legislation changed. Sorry, I take a resolutely practical approach here.

Are you currently making payments?

Do you feel the loan was unaffordable for you? It’s hard to win a complaint saying it was unaffordable for the borrower without the borrower’s co-operation.

Sally says

Hi there!

My sister took out a loan with our stepdad as a guarantor, she sadly passed away in December and no my stepdad is obviously continuing to pay the loan!

I feel this was Missold as she was in over £40k of debt when this

Loan was taken out and she earnt lates 20s per annum.

Do you think we should fight for a claim? My parents can stretch to this if bank statements are looked at but why should it eat into their later life disposal

Income due to a miss sell?

Sara (Debt Camel) says

Do your parents have any proof about what your sisters debts were when she took the loan?

Are your parents house owners?

Do they have other debts themselves?

Can they afford the payments they are being asked to make, especially as energy bills and everything else are going up so much?

Sean says

I’d rather my claim be upheld by administrators at 31p, then take a gamble that amigo uphold and don’t change there 41p claims.

Frank says

Hi Sara.

I have read through all the info. I have one question, my situation is this I stopped paying amigo about 5-6 months ago. As I had already paid more than the principle loan amount. I have had all the usual threats to me and my guarantor.

And the credit file has took a beating. In either scheme if my original complaint is upheld will my credit file have all those missed payment remarks be removed. I didn’t see any info on this aspect of any of the schemes.

Sara (Debt Camel) says

Yes in all options – either Schemes and also administration – your credit record will be repaired for a loan that is decided to be unaffordable.

Lisa G says

Hi Sara / all,

I’m going to vote against both proposed Amigo schemes. I’d rather have an administrator look at claims to see if they’re valid. Other than Amigo picking and choosing which ones they want to uphold.

However, I’ve been trying to “vote” on their site. You put in your phone number and date of birth, they send you a code (that’s all fine) but when I put in the code and press submit to get to the actual “voting page” I get a “known error” message and I can’t go any further than that. So I can’t vote.

Has anyone else had this problem? I can’t imagine it’s because their system is too busy?

Sara (Debt Camel) says

They had some voting problems on the first couple of days last time around. I suggest you try again tomorrow.

Lisa G says

Thanks Sara. I’ve finally been able to cast my vote against both schemes.

Elliott says

Is it true that administration won’t pay out until 2024? That’s a long wait! The scheme pays quicker doesn’t it?

Thanks,

Elliott

Sara (Debt Camel) says

Having seen several administrations and schemes, I think the timetables are largely guesswork. So much can go wrong that requires extensions in either case.

C says

Hi Sarah I had loads off loans with them plus top ups loss my job went on benefits and dropped payments too 100 from 320 a month got a job now only do 12 hours so called them they give me 2 months off from payment but still get alot off emails and my guarantor in nasty and they told me too call police if need too but that will make it worse as he an ex, I could not afford payments too start with but needed money so lied a little bit too get loan which they did not look in too,put complaint in last time went too court nothing happened so went too financial ombudsman but cause court ruled them out got too wait now do I put in complaint again or will old one still stand as my credit records are shocking now thankyou

Sara (Debt Camel) says

I think you will be able to make a complaint – but of course Amigo may reject it.

Apart from this Amigo debt, what is the rest of your current financial situation like?

Geraldine says

Hi Sara, I was a guarantor for my step daughter and as a result of her not being able to pay and the fact that we owned our own home (not much equity available) in the end I had to declare myself bankrupt, not sure where I stand at all .

Sara (Debt Camel) says

What happened to your house in bankruptcy?

Did you have a lot of other debts as well that went into bankruptcy?

Geraldine says

Hi Sarah , I managed to sell my house prior to the bankruptcy to avoid amigo putting a hold on it so I managed to pay off my mortgage but had debts of our own due to my husbands illness , I declared myself bankrupt after taking financial advice from citizen advice.

Sara (Debt Camel) says

You can make a claim to the Amigo Scheme (or to administration neither Amigo Scheme is approved) but any redress will be paid to the Official Receiver, not to you. If the redress would be large enough to repay all the debts in your bankruptcy plus the OR’s costs, the remainder would be returned to you, but from what you have said that sounds unlikely?

Kay says

Hi Sara

I had an unaffordable load from Amigo a few years back and received a refund of all interest paid in 2020 (I had already paid the loan balance off so was just refunded the additional interest I had paid so ended up paying 0 interest in the end (I think) and just paid the balance of the actual loan (around 10K). This was after complaining to the Ombudsman. Are the compensation payments just for the interest paid and not the actual loan? I.e. so would I not nor he entitled to any compensation if they had already refunded the interest? Thanks, Kay

Sara (Debt Camel) says

if you have already had a complaint upheld and a refund of all interest, then you cannot get any more under any of the options – Schemes or administration.

So unless you had a previous loan that wasn’t refunded, you have no interest in this.

Jenny Hislop says

my loans were several years ago also going back to FLM days. do I just vote for amigo to calculate my claim?

Sara (Debt Camel) says

You don’t have calculate what a claim is worth, in the Amigo Schemes or in administration.

With old loans there is a possibility that Amigo has deleted all the loan information. In this case unless you can provide details of the loans it won’t be possible to win a claim.

AC says

Hi Sara, if the loan information has been deleted by Amigo can bank statements from borrowers and guarantors showing money being paid in by and paid to Amigo suffice as proof of the loans being paid in?

Sara (Debt Camel) says

yes I would expect so. Well worth a try and appeal it if they refuse.

Linda says

Hi just wanted a bit of advice please. My guarantor has received email details about voting in the new scheme of arrangement but strangely I haven’t. I do have a complaint that is outstanding with Amigo and none of my email details have changed I just wondered if I should contact them and ask why I haven’t received this information too?

Sara (Debt Camel) says

I think they must be sending them out in batches. I would give it another couple of days.

And I assumed you have checked your spam folder?

Linda says

Hi yes checked my spam folder too. Will give it until early next week and maybe email them. Thanks for your reply

Rebecca Nolan says

Hi could someone confirm for me if this is right?

I spoke to amigo last week to confirm that if I’ve already sent in a complaint any money I’ve since paid is put into a separate account where if my complaint is upheld I get back ALL of what I’ve paid, not just the percentages there talking about now?

They told me this is correct so I explained I borrowed money from a family member to pay it off as it was causing me more stress and they confirmed again I would get it back if my complaint was upheld.

So I’ve made the complaints and paid the loan off.

Do I have to do anything now?

What would other people suggest?

Sara (Debt Camel) says

Amigo set up this arrangement late last year. If you made payments after that point and after you had made a complaint, then you should get them all back once the amount you borrowed has been fully repaid if your complaint is upheld in a Scheme or administration.

Do I have to do anything now?

What would other people suggest?

You can vote on the Schemes if you want. That may come down to voting for who you would like to decide your complaint – Amigo in a Scheme (vote for both Schemes) or administrators in administation (vote against both Schemes.)

Rebecca says

Thank you for the reply,

Is there one which seems to be better than the other? I’ve been so stressed about this for so long and everything keeps changing so I just get confused.

Sara (Debt Camel) says

It is confusing and the way they keep changing the numbers doesn’t inspire confidence that the current numbers are right.

Can you give some details about your loan. Did you just have one? How large was it? How much had you paid in total before the recent settlement? How much was the settlement?

Rebecca says

I got a loan about 4 years ago, wasn’t working nor was my garuntor both on benefits and garuntor has disabilities , had a couple tops ups, I honestly can’t remember how much but they were a bit. Was paying over £235 every month and it just wasn’t going down.

So paid the remaining 4000 off when they told me I should get it all back if claim is upheld.

Sara (Debt Camel) says

how large was the loan? how many months did you pay £235?

I can be more specific if you can say this.

Rebecca says

I honestly can’t remember and that’s stressing me out now, I’ve tried checking my bank but there’s sooooo many transactions.

And I’m sure some aren’t showing.

Can I ask amigo to send me a summary of all loans and payments?

I think the last top up was for 5,500 and that was 7th jan 2020 £235 payment every month I don’t think I missed any.

Paid the last 4000 last week.

Sara (Debt Camel) says

yes you can ask but I am not sure how quick they are at responding to this sort of question.

you may be able to see from your account with them if you can login?

Rebecca says

I’ve logged in, it doesn’t show me details of any of the loans except the last one, I can see that I’ve had one loan and two top ups.

It only shows me the most recent one.

5,500 over 48 months

82 payments of 58.82

5 payments of 235.26

One final payment of

3954.63

Sara (Debt Camel) says

Ok so you must have been paying weekly, not monthly. It’s good to have the exact figures.

It doesn’t change what I said about the current loan. All the settlement payment will be protected and you should get it all back 100% UNLESS Amigo makes a deduction “for unpaid interest”.

Then you will get a small amount back of the rest of the interest you have paid, but that is only a few hundred pounds. You may get 41% back in Amigos New Business Scheme and 31% in administration but the numbers are small so there is little difference here.

The deduction for unpaid interest is hard to explain as it is simply unfair. Only Amigo does this. IThe Ombudsman told another lender they couldn’t do it. Provident doesnt make this deduction in its Scheme. I have never seen an administrator make this deduction and I have seen a lot of lender administrations over the last few years.

If you want to avoid this deduction by Amigo, you could decide to vote against both Amigo Schemes. If neither scheme is approved, it will go into administration and it will be up the administrators to make the refund calculations.

Sara (Debt Camel) says

ok so that sounds like it was a 4 year loan. If you made 24 payments (possibly 25, depends on the exact payment dates) then you have paid £5640 to this loan plus £4000 settlement.

So you had paid more then the 5500 you borrowed before the final settlement. The whole of that final settlement is now protected and will be repaid in full if you win the complaint. The extra £140 interest you had already paid will be refunded at 41% in the New Business Scheme or 31% in administration (if Amigo’s latest numbers are right.) As this amount is tiny, it doesn’t really make much difference to you!

If the previous loan (or more than 1?) is also upheld, you will get the interest you paid on that refunded at 41% or 31%.

But there is a problem here.

If Amigo upholds the complaint about your current top-up loan in a Scheme but not your previous loan, it makes a “deduction for unpaid interest” from the refund you will get. Sometimes this is only a few hundred pounds but I have seen cases where it is £3,000 or more.

I have never seen administrators make this sort of deduction. The Ombudsman says it isn’t fair. Provident in its Scheme isn’t making this deduction. Only Amigo does.

So you may prefer to vote against both Amigo Schemes, because in that case Amigo won’t make the decisions and it will be down to administrators.

This is all trying to work out what may happen, sorry, there are no 100% clear cut answers here.

Rebecca says

I’m sorry I don’t understand?

Some months my interest was nearly half of what I was paying.

I’ve found some emails which I’ve tried to work out as best I can if this helps.

First loan £1000-12months

4x £103.06

£70

£25

Interest £110

Top up 1 £2,500- 60 months

3x £98.81

Interest £236.41

Top up 2 £3750-60 months

4x£148.22

3x£49.91

5x£37.07

Interest £753.47

Top up 3 5500-48 months

85x£58.82

5x£235.26

£3954.63

Interest £3741

Sara (Debt Camel) says

Unfortunately the “interest” amount in each payment doesnt add up to the interest you paid on loans that have been settled. You also need to know the settlement amount on each loan and work the interest paid out from that.

With 3 top up loans, you probably have a very good case that the last loan will be upheld by Amigo.

I can’t guess how many of the earlier loans Amigo will decide are affordable or unaffordable. Amigo just has said so little about this.

Rebecca says

Okay thank you for your help :)

Rebecca says

Sara, I’m about to vote but I’m still on the fence which way to vote.

Which one would you say I should vote for as you understand this better than me.

Thank you.

Sara (Debt Camel) says

I can’t tell you that – but why not write down what you think are the two best reasons to vote for the New Business Scheme and the two best reasons to vote against both schemes, preferring that Amigo goes into administration?

If you do this, it will often become clear to you what you think is the most important things.

L says

Hi Sara,

Do you know if those who already settled can vote yet? I think this was unsure before but wondering if they’re now allowing this. In the new scheme with 31%, I would have got thousands more than I settled for. I know it’s all a bit up in the air because nothing is certain, but if I can vote I would like to. Though, heard nothing to say I can. Not even an email from them since the court date.

Sara (Debt Camel) says

yes I think you can. let me know if you have problems.

L says

Thanks, Sara. I’ve not received any communication as yet. I would still vote against, but meant 31% in administration (if I’ve got that right)! Will keep you posted.

DM says

Hi Sara, apologies as became a longer comment than I thought so have split into two:

I am voting no to both schemes and thought I would share just some of my reasons why:

• No details of their ‘detailed claims methodology’ on how claims are assessed

• No details if the deduction unfair unpaid interest will still be applied

• No suggestion of a system that is simpler to make assessments and less costly to Administrate by weighting decisions in favour of redress claimants in line with FOS

• Uphold rate in the supplementary information is predicted to be 65% which is a 20% upwards movement, so if I have read that right they were only predicting to uphold 45% of claims in the original Scheme which had over 90% of people vote in favour of, but that figure was not shared before. Would people be voting Yes if they put this information at the top of their correspondence rather than the predicted headline redress amount from their preferred option?

• Are only predicting an additional 77k complaints to be received when the scheme opens which seems very low. …

DM says

Continued ..

• Assumes cash collections will continue and no mention on the impact of an increase of those requesting equitable set off from Dec until decision is scheme is made and payments to be returned through the trust where complaints have been made

• They are offsetting their additional cost of the 8% statutory against the people who are continuing to pay back loans who might have valid claims but have not yet met the criteria for equitable set off on their current loan

• Company could not respond to initial complaints within the 8 week window with a fair resolution. How efficient do you think they will be in managing a scheme this size?

• In my opinion Company will be better managed in the hands of Administrators as people are more likely to get a fair and independent assessment and outcome even if the % value of redress will be less (for those with multiple loans you could end up worse off if Amigo reject one of the loans or makes the deduction of unpaid interest which an Administration is less likely to do)

• If you believe that Amigo are going to run this effectively and will get a 41p payout in Sept 2023 you are probably one of the people they believe are naïve enough to borrow from these vultures again!

Sara (Debt Camel) says

lots of good points there!

Shannon says

About the complaint part, can anyone do it or does there have to be a reason?

If we said no to both schemes will we get any money off them or is it just if we said yes to a scheme? I’m a guarantor for my partner we’ve got a current loan started with 5k in August 2019, we pay £243.95 a month and have £2,683.45 left and should finish February next year. At the moment we’re able to pay bills and not in debt but the first 1+half – 2 years of the loan we struggled so bad.

Sara (Debt Camel) says

Anyone who has been an Amigo customer can vote. In theory you are only supposed to vote if you think you have a claim, but there are no checks on this.

Of course if you don’t have a claim, then what is the point in bothering? If you don’t think you have a reason to make claim then you aren’t that likely to win a claim…

However you vote – For Against or Didn’t Vote – you will still be able to make a claim to any Scheme that is approved or in administration if neither Scheme is approved.

If the loan was a real struggle from the start, then it may well be that it wasn’t affordable for you then. The affordability test is at the start of the loan, the fact you can afford it now is not relevant. A loan is only affordable if you can pay it and also pay all your other debts, bills and living expenses – if paying Amigo left you to short to pay other things, so your credit cards, overdraft, BNPL usage went up, it wasnt affordable.

As you have a current loan and you have repaid more than you borrowed already, it is URGENT that you make a complaint immediately. If you don’t and you later win the claim in a Scheme or administration, you will only get back a percentage of each £243 a month payment. If you make a complaint, the £243s will be put into a seperate account and if you win your claim they will be refunded in full! So do this now – there is no downside. Send a very short email to hello@amigoloans.co.uk with COMPLAINT as the subject. Just say you want to make an affordability complaint about your Amigo loans. Amigo is not going to look at your complaint before the Scheme so there is no reason to write a lot.

Yvonne says

I was a guarantor the loan was for 5k paid back about 9k. I was mislead about what a my part was. Also even though my income couldn’t afford the payments they made it out i could

Can we claim the loan was paid by off in 2017

Sara (Debt Camel) says

As a guarantor that has made payments, yes you can complain about a loan that has been repaid. To a Scheme or to administration if no scheme is approved.

You may have several reasons to complain as a guarantor. I have listed them in this article: https://debtcamel.co.uk/amigo-complaints-by-guarantor/. You don’t need to use the long template there to send a complaint now – it will be ignored. But it shows the sorts of things you can complain about.

I can’t say this too strongly – it’s good to complain about everything you think was unfair but the complaint you are most likely to win as it is easiest to produce evidence is that the loan was unaffordable for you. Bank statements may help. As this was a while ago, its a good idea to try to get hold of them now, don’t wait until you are asked in 9 months time. you can get bank statements from closed accounts.

Kim says

My son took out a £5k loan. He put in a claim for mis-selling due to unaffordability (he already had several loans with other companies and various debts) and so has his guarantor. Amigo never responded so they put in a complaint to FOS who haven’t been able to deal with due to this scheme proposal.

Should my son continue making his reduced monthly payments or stop? If he stops will they pursue the guarantor?

And should they lodge a new complaint in the new scheme, or will the current ones still be valid? We have reference numbers for each.

Sara (Debt Camel) says

Do you know how much he has paid so far? Are the payments he is making affordable now? Will they be affordable next months as a lot of bills and National Insurance is going up?

Kim says

I don’t know what he’s paid so far but have asked him to try to get a statement.

He is paying off all his loans at a reduced rate, but it’s putting him under a huge strain and we’ve had to bail him out a few times, but we’re retired and it’s not easy. (He had a gambling problem. Now it’s bitcoin, which is the same thing!) Also he’s just changed jobs from weekly to monthly pay which has left him without any money for 4 weeks, so we’ve had to help him out there.

My biggest worry is for his guarantor, who is an innocent in all this, and was a student at the time the loan was taken out.

Sara (Debt Camel) says

if the guarantor was a student, then they have a good complaint that they should be removed from the loan as it was unaffordable for them.

Johnny says

Hi

Just to let you know, I had irresponsible lending claim against a company called ” My Money Partner” 2 years ago, the company went into liquidation. I was left with no information from them for 6 months. Then the liquidation company rejected my claim and said if you wanted to appeal you would have to go through the courts at my own costs. Maybe it’s different to Amigo because MMP was a payday loan lender. I also had 2 weeks to pay my balance or my credit file would be affected.

Sara (Debt Camel) says

How many loans did you have from MMP?

Sean says

I’ve been contacted regarding my No vote, I explained why. There is no clarity in any of the scheme reports, it’s so uncertain as to what will actually happen. In administration I just feel, I have a fairer opportunity. 41p could drop, complaints being upheld will drop.

He did say they were contacting everyone, regardless of vote and this wasn’t to to sway opinions. I said it felt wrong I was even being asked…he said he wanted me to have all the facts. Amigo don’t seem to have all the facts, so not sure how he’d do that!

Johnny says

Hi

I had 2 loans within a 6 month period. So I had 1 lian for 3 months and then renewed another loan for 3 months.

If they go into administration and you fail with your redress then I dont think you will be able to take it to the Onbudsman.

Sara (Debt Camel) says

Claims rejected in one of Amigo’s Schemes or in administration can’t be taken to the Financial Ombudsman.

2 loans within 6 months sounds like a strong claim to me. The biggest problem for you, with a top up loan so soon after the first loan, is that in a Scheme Amigo may uphold just the top up loan and then make a deduction “for unpaid interest” on the first loan. Even though that loan was settled with the top up loan. these deduction can be small but in your case they may amount to most of the interest that would have been charged on the first loan, reducing your compensation to very little.

The Ombudsman says this is unfair. No other lender does it. Provident in its Scheme didn’t do it. I have seen quite a few high cost lender administrations and administrators don’t make this deduction.

Obviously this may not happen if Amigo upholds both of your loans. But you may decide you would prefer your claim to be resolved by administrators, not Amigo?

Johnny says

What I’m trying to say is, voting for the administration scheme wont be easier than going with the Amigos scheme. In fact I’d say you’d have to have a very strong case with the administrators. Just my opinion.

Sara (Debt Camel) says

I understand Amigo thinks the administrators would uphold the same loans as Amigo will do in a Scheme.

Emily says

My complaint with Amigo was on the ground of being a guarantor and coerced into being one by the borrower. The borrower stopped paying the loan just before a court case of assault by beating as a way of trying to get me to drop the criminal charges. Amigo took no payment from me but neither did they inform me that the borrower had stopped paying the account and hasn’t for over 2 years. Amigo are also aware that the borrower was then subsequently convicted of stalking and given a suspended prison sentence and charged with another offence. Amigo notified me that they stopped informing me about the account because they thought “I wasn’t interested” . Amigo not longer charges interest on the account and in my complaint – at the time I had fled domestic abuse.

Amigo states that I seemed happy to agree to be guarantor at the time (which shows no understanding of coercion) and my complaint is now with the FCA but this has been paused due to the Amigo court hearing. Any advice? As Amigo dismissed my complaint which I initially complained are they likely to reject it again?

Sara (Debt Camel) says

I hope not! if they do, then say you want to appeal and supply evidence about the assault and stalking.

Shannon says

I’ve voted against on both! It annoys me that they’ve sent texts saying they recommend voting yes to both, of course they are going to say that. But people who are confused about it all will just go with what they’ve said instead of making their own choice. I was confused and misread the first scheme so went with what they said, thinking we will get more money so I said yes to the first scheme. It’s like they’re minipulating people, they should of just texted saying voting open here is the information to help you choose etc not give you recommendation as of course they still want to trade. I really hope they go into administration because I seriously wouldn’t want anyone else to go though what most of us have gone through. Fingers crossed.

Charles says

Hi Sara and All,

Thank you for everyone’s feedback here as I too have been scratching my head as to which way to vote but am definitely of the mindset that I do not want Amigo to continue to lend and deserve to be wound up or liquidated.

I just wanted to add a quick point here that may have already been mentioned or considered – that is that Amigo refused to support me when I entered a debt management plan with Stepchange in 2013, even though reduced payments would be made. They instead insisted that they would proceed to take payments from my retired mother instead whose home the loan was guaranteed against. Thankfully, Stepchange understood the circumstances and engineered an allowance within my repayment to them that enabled me to continue to pay Amigo the full amount whilst all of my other creditors received significantly reduced amounts.

Of course, this has gone into my complaint to Amigo (made in Jan 2021 unfortunately). Hopefully it will also help those that are undecided which way to vote to see Amigo for what they are.

Good luck everyone!

Jen says

Hi Sara, I’m wondering if you can help me.

I made a affordability complaint last week with Amigo and received this email from them…

“ Thanks for your message.

I have raised a complaint for you.

I can see you have advised that you are struggling at the moment so I have cancelled the arrangement we have in place with you for the 28th. Whilst the nature of these complaints are on hold due to our Scheme of Arrangement, we would still need to reach a suitable outcome for you in the mean time. There are going to be options available.”

I have now received a txt message off them today to advise if I do not contact them within the next 2 days they will be taking payment from my mum.

What can I do? I do not have the money to pay this as I have already told them and neither does my mum

Sara (Debt Camel) says

how large was this last loan? how much have you paid to it so far?

if you have paid more than your borrowed, then you can ask Amigo for Equitable Set Off This harms your credit rating but not hers.

your mum – was this loan unaffordable for her right from the start, as she may also be able to make a complaint?

If your mum can’t afford to pay, she needs to cancel the direct debit with her bank to Amigo and also phone them up and cancel the Continuous Payment Authority that Amigo has over her bank account.

Rosalind says

Hi,

I had an amigo loan from around 2010-2013. I was on my last 1 or 2 payments and my circumstances changed and I defaulted, was devastated after paying perfectly for the 3 years. I believe it was £4000 over 3 years and payments were around £248 per month.

Amigo have never chased me for payment until the last few months. I keep waiting for it to come to an end on my credit report, being well over the 6 years, but they have simply marked every month as a missed payment so the 6 years have never started.

Out of the blue they have started emailing me, which is the only reason I came across this, I had no idea any of it was happening. Could you please give me some pointers at this point as to what action I should take, if any?

Sara (Debt Camel) says

Do you think that the loan was affordable at the time it was given?

A loan is only affordable if you can repay it and pay your other bills, debts and everyday living expenses without being left so short that you have to borrow more money. You may have paid almost all the payments but it could still have been unaffordable if you wanted to protect your guarantor and you got deeper into debt.

Rosalind says

Completely unaffordable, I was leasing a hotel so rent and utilities were taken care of, but I was a single mum with a 7 year old and only paid myself £500 per month so they took half. My guarantor was accepted because he was a homeowner, don’t think there were any other checks for him and he sold the house a couple of months in.

Sara (Debt Camel) says

ok so it sounds as though you have a very good claim for unaffordable lending.

if you win this, you will the balance cleared and the interest you have paid (that is what you have paid so far minus the £4000 you borrowed) refunded plus some 8% interest. Your credit record will also be cleared.

You can make a complaint immediately but this won’t be considered until Amigo’s scheme is in operation or when the schemes are rejected and they go into administration.

But it’s good to make a complaint now as this will also let you opt for “Equitable Set Off” where they agree not to ask your guarantor to pay until your claim has been decided. I can’t see it has any downsides for you at the moment.

You can vote on their Schemes now.

Your guarantor also has a good reason to complain the loan was unaffordable for them. This gives them 2 ways to be released as guarantor – if you win your complaint or they win theirs. two chances is better than one!

Mike says

Never dealt with such a company, terrible ruining peoples lives including mine and my guarantor

Sara (Debt Camel) says

So how are you and your guarantor going to vote on the Schemes?

Marta says

Hi,

My situation is complicated because I am a guarantor for the person who left the country and no longer repays the loan –

However, while being accepted as a guarantor I was a student on a low income and my student loan was taken into consideration (as an income) even though it was only temporary. This loan was never affordable for me and now I’m not able to make any payments to clear the balance as I’m living on my own and after paying all my bills I’m left with a minimum.

I have raised a complain but nothing was done about it.

What else can I do?

Thank you

Sara (Debt Camel) says

do you have other debts as well?

Marta says

Yes, I have a credit card

Sara (Debt Camel) says

And is this credit card affordable or are energy prices rises and other inflation resulting in you struggling to pay for the essentials anyway, even if this Amigo debt was removed?

How much have you paid to Amigo?

John says

I have outstanding complaints and administration is the only way forward with this company we all understand how amigo operate and that should be enough information to vote against this company.

Ashley clark says

Has anyone had the video in a text message from amigo saying how to vote as it’s very amusing.

It won’t let me copy and paste it

Sara (Debt Camel) says

is it meant to be funny?

Stacey says

Hi just watched the video on YouTube about amigos proposed scheme to vote in. However it says in the video if you have a live loan to claim now as you could receive more back in compensation has anyone else done this? Or know of this is correct.

Sara (Debt Camel) says

See the article above. As it says “If you have a current loan and you have not already complained then it is URGENT that you send Amigo a quick complaint. “

Stacey says

Thankyou I have put the complaint in now. I was a little hesitant to put it in as I had heard they weren’t looking at complaints anymore due to the vote going on. Hopefully I will hear from them soon.

Sara (Debt Camel) says

You won’t hear from them soon… Amigo won’t look at your complaint until they look at all the complaints in the Scheme (or if the Scheme is not approved, your complaint will be looked at be the administrators when Amigo goes under into administration.)

Is making the payments causing you a lot of problems at the moment? How large was your last loan and how much have you paid to this loan so far?

Stacey says

I my total loan amount was £4000. I pay £196 a month the loan ends in 10 month. I have struggled but figured I’ve manged this long its best to keep going and get it paid off.

Stacey says

Hi this is the response I was given from amigo does this seem about right?

Hi Stacey,

Thanks for your email

I recommend reading the practice statement we have released as this will include important information regarding what we are proposing, you can read this here: https://www.amigoscheme.co.uk/practice-statement-letter, there is also an FAQ page which may answer any questions you may have.

Sara (Debt Camel) says

what was your email about – sending a complaint? or asking for equitable set off? or something else?

Stacey says

Sorry it was a affordability complaint

I have 10 payments left.

Sara (Debt Camel) says

are the payments currently affordable or causing your problems?

If you want to ask for equitable set off, you need to phone Amigo up.

Sara (Debt Camel) says

Also you need to decide which way to vote on the proposed Schemes. eg do you want Amigo to decide your complaint or administrators? the article above has points for you to think about.

Stacey says

once I pay the usual monthly bills aswell as amigo I’m left with nothing until the next pay day the month after but then its the same again. I just presumed it would be best to pay it off whilst there was this vote etc going. Didn’t want a bad mark going against me or my guarentor

Sara (Debt Camel) says

SO that is your choice. If you opt for equitable set off, your credit rating is harmed, but that damage will be removed if you win your claim in the Scheme (or administration if neither Scheme if approved).

The Amigo loan does not appear on your guarantor’s credit record and that won’t be harmed by Equitable set off.

Incidentally, do you think the loans would have been affordable for your guarantor to make all the payments to? And still be able to pay their own debts, bills and living expenses?

Tim says

My partner took out a loan with amigo in 2019.

Her only income was personal income payments ( pip )

Since then her payments were stopped by DWP.

Therefore as her guarantor, I then took over the payments. I am roughly in 30k of debt myself ( also had a lot of debt when the loan was taken out ), made worse by covid and being furloughed whilst I was supposed to be training for a new job which got put on hold putting me into financial misery.

Anyone have any idea what sort of outcome I could likely expect? Cheers in advance

Sara (Debt Camel) says

SO how are you managing your other debts at the moment?

Are you buying or renting?

Tim says

Not very well to be honest. Juggling bills each month, kind of in the trap of using credit to pay off credit.

I do expect my financial situation to improve in the distant future as my salary increases, but that won’t be until February next year.

For the time being it’s a case of trying to scrape through each month.

I currently rent

Thomas says

Hi Sara,

The F.O.S have a complaint on hold with regards to amigo. Will these cases be progressed once the scheme etc has been approved? Hope i making sense ? Cheers.

Sara (Debt Camel) says

No.

If a Scheme is approved, Amigo will decide all the complaints. There will be an inter appeal process within the Scheme but not to the Ombudsman. If your claim is rejected in the Scheme you will not be able to go to the Ombudsman when the scheme has finished.

If both Schemes are rejected, Amigo will go into administration and your claim will be decided by the administrators.

The only choice you have at the moment is how to vote on the Schemes. That will determine if Amigo or administrators decide if your loans were unaffordable.

Thomas says

Thanks for explaining that Sara.

Leonie says

Hi, Sara

Howdon I make a complaint? I still have a open loan with them

Josh says

Hiya, I’m a guarantor.

I am a guarantor to a man who was my boss at the time and I thought we were friends. He’s stopped paying the loans and stopped replying to me.

I’ve put in a complaint about the situation but what happens if Amigo starts the wind down or goes into Administration for guarantors?

Do all guarantors get released or is it only ones with successful claims?

Thank you

Sara (Debt Camel) says

You can complain you felt under pressure to agree to the loan as it was for your boss at work.

Was the loans also unaffordable for you? A loan is only affordable if you can pay it and pay your other debts, bills and living expenses without having to borrow more money or get behind with bills.

You will only be released if your complaint is upheld in any situation.

In the New Business Scheme and the Wind down Scheme Amigo makes the decision. In administartion it is made by the administrators.

Bobby Jones says

Hi Sara My friend has had one complaint thrown out by Amigo ,will he have to complain again ? He has voted on the proposals.

Sara (Debt Camel) says

did he send his complaint to the Ombudsman?

does he have a current loan?

Bobby Jones says

No Sara the ombudsman had stopped claims being sent .He is a guarantor for a loan ,that was hardly repaid .

Sara (Debt Camel) says

“that was hardly repaid”

So to be clear, is he currently making payments to this? Are these causing him problems?

Was the loan affordable for him when it was taken out – a loan is only affordable if he could make all the repayments and still be able to pay his own debts, bills and living expenses?

Has the borrower also made a complaint?

A

Bobby Jones says

Hi Sara the borrower made about 4 payments before as guarantor my friend was made to pay .His payments have been reduced from £155 a month to £20 due to him struggling himself to make payments.The borrower has not made a complaint.

Sara (Debt Camel) says

I can’t tell if he will have to complain again – if the Scheme is approved, I suggest he tries to submit a cliam to be sure. Or the same if Amigo goes into administraion, he should try to submist a claim to the administrators.

If he is in contact with the borrower, he could also suggest that the borrower should make a claim. Otherwise if if he is released as guarantor, Amigo wuill expact the borrower to start repaying the full amount.

LEE says

I’m finally free of Amigo having made my final payment , I want to thank Sara for all the advice. I got a partially upheld complaint outcome and decided to get rid of the debt and for the sake of my mental health! You’re providing invaluable advice for so many of us, thank you.

Sara (Debt Camel) says

it’s what works for you that matters!

Jordan says

Hi i took out a loan of mutliple top ups so a few years back but it anounted to 7.5k in may 2019 apparently and ive been paying this since then and my current balance is still 8.3k to pay back after this time i find this shocking i want to make a claim and dont know what to say or how to do this could you tell me what to do and what my chances are of a claim?

Sara (Debt Camel) says

Taking several top ups is usually a sign that the loans were unaffordable!

Are you struggling to pay them at the moment? If so, can you say how large the last top up loan was – the size of the loan, without interest, not what you got in cash?

And how much have you paid Amigo since taking that loan – ignore whether Amigo says it’s interest or not, just add up all your payments eg 33 lots of £296?

Jordan says

Its leaving me very short yes but i still pay them im paying £320 a month now because its in arreas of £420 on it and i think the last top

Up one would of been 2k i got cash i think i dont know if they valued it all at like 17k overall to pay or something, and yeah i was originally paying £296 a month back from may 2019

Jordan says

Hi again i dont want to do eqitable set off because i dont want my guarantor to recieve messages or post about this or feel in any type of way in threat, i have emailed them that but i dont know what to do in regards to voting so whats the next step

Sara (Debt Camel) says

It’s your choice if you don’t want to do Equitable Set Off.

But it is important that you do complain now, whether you are going for equitable set off or not. You say you have emailed them – was this to send a complaint?

Voting – are you asking which way you should vote or how to register your vote?

David says

Hi Sara

Hope you can advise me. I have a current loan with approx £4K outstanding debt, the initial loan was for £8K, I have paid off almost £7K in repayments. Up until the pandemic I was paying off the agreed £500 p/m, however since, I have been paying back £200 p/m due to personal circumstances (my wife had a brain tumour). I think I have a good chance of an affordability claim, but the wait is making things difficult as we want to move and I need the loan removing from my credit file. Hope you can help.

Thanks

David

Sara (Debt Camel) says

Is the £200 a month affordable? or is it becoming less so every month with bills and prices going up?

There is nothing you can do to speed the claim handling process up. Your complaint won’t be considered until a Scheme is started or Amigo goes into administration.

In the Provident and Money Shop Schemes, no one heard about their claims until nearly at the end of the 6 month claim period… if that happens with Amigo, the earliest you may hear would be November, but it could be several months later. And then if your claim is rejected it may take another few months going through the appeal process.

What is the rest of your financial situation like?

David says

Hi Sara

I can afford the £200 payments, however given my personal circumstances, I didn’t know if my claim could be considered outside of the scheme?.

Thanks

Sara (Debt Camel) says

So far as I am aware Amigo aren’t handling any complaints faster, whatever the personal circumstances.

Ross says

Hi Sara

I lied in my amigo application and top up that I lived with my parents when I was actually paying rent, obviously meaning my expenses were very downplayed. Would making an affordability complaint open me up to any kind of liability?

I’ve now paid the value of the old+top up loan despite being in a DMP. I always intended to repay but I was desperate. I don’t want to make a complaint if it will cause more harm than good.

Thanks

Sara (Debt Camel) says

A lender should not accept what a customer says on their application without verifying it, unless the loan is very small, a few hundred.

Some payday lenders routinely make threats that if a customer has lied on their application this is fraud and they will be reported. No customer who has ignored this and proceeded has had a problem that I have heard about – it just seems like unpleasant, aggressive bluff trying to get people to drop good complaints.

But I have not seen Amigo make these sort of empty threats. At the moment Amigo is desperate to try to look good to the regulator, so I don’t think Amigo will change its policy on this.

Andi says

Are we now to vote on the new scheme?

I’ve tried logging into the portal from the link above but after confirmation code is sent – I just get a welcome to amigo loans – welcome back” message

Sara (Debt Camel) says

yes you need to vote now. If you are having trouble, phone them email Amigo at amigoscheme@amigoloans.co.uk or phone Amigo on 01202 629798.

Kim says

When I tried to vote (I have proxy for my son) it said I couldn’t vote until 12 May…???

Sara (Debt Camel) says

that isn’t right. You can vote online until 10 May. Then there is an online creditors meeting on the 12 May if you want to attend that… but there is no reason why you should.

Email Amigo at amigoscheme@amigoloans.co.uk or phone Amigo on 01202 629798 and say you want to vote online now.

M Burke says

How do I vote please?

Sara (Debt Camel) says

are you a borrower or a guarantor?

do you have a current loan?

have you had more than one loan from Amigo/

Cj says

So I’ve got a current loan with amigo I still have 3600 left to pay , it I’ve paid the initial loan amount back two months ago, if I put complaint in now , do I ask for the equitable set off or do I have to wait for them to offer this..at the time of the loan I clearly could not afford it as my bank statement showed I was in my overdraft my over 4K and my credit report would have shown pretty poor scores. But my guarantor could afford ..I’ve kept up to date with payments but been a struggle with me missing other bills to ensure I pay amigo.

Cj says

Also would they chase my guarantor if I asked for the set off

Joanne says

Sara I have had loans with amigo over the past like lot of years all continuous starting from 7.500 to 10,000 not being below 10,000 in bout 5/6 years topping up . The last top I have was 10, 000 I’ve currently paid back to date 15.046.48 and still have a balance of 7803.00 .during this time to save my guarantor and paying provident at a reduced rate I had to enter a debt management programme thankfully I’m out of that at the min and provident has been cleared , I’m scared I won’t get anything what’s ur views fell behind on rent and everything

Joanne says

I just went for the set off and now praying for upheld loan/or loans , having been in touch I now know over all I borrowed 11,563.74 and in total I’ve paid 27,695.48 absolutely awful I just hope my gaurantor isn’t tortured constantly by them until it is resolved . Thank you

Joanne says

Do u think at least one of my loans will be upheld

Sara (Debt Camel) says

I would hope so! having even one top up is usually a sign you are in difficulty.

M says

Hi Sara

I have had 3 Amigo loans over the years and topped up each within a day of each other. Those were some bleak times.. I am currently paying off a loan which is due to end in June of next year. Would you please be able to explain more about where you said once you complain, the money will be protected from that stage etc? I complained and got a response in Sept/Oct 2021 that it had been received.

M

Sara (Debt Camel) says

See section 6.33 in https://www.amigoscheme.co.uk/documents/explanatory-statement

Are the payments currently affordable for you?

M says

Thanks for that Sara. Only just affordable! I just ensure I pay it every month without missing as I don’t have time to have my credit score get affected. I am looking into getting Mortgage by the end of the year and want to keep my score as high as it is now.

I can’t wait to have this lingering thing go away once and for all. I hope all of us with complaints get something decent from all of this!

Tim says

I was a guarantor of a loan that was fully paid and I didn’t have to make a payment. I’m not sure if it would have necessarily been affordable for me if I would have had to, I certainly would have had to have changed my lifestyle in order to ensure it was repaid. I presume there’s nothing much in this for me even though I keep getting texts urging me to vote.

Sara (Debt Camel) says

If you didn’t make any payments and the loan has been repaid, then there is no reason for you to ask for a refund.

You can ignore the voting.

Glen Baines says

Hello,

I took an Amigo loan out in December 2016 over 5 years. I paid 24 months, never missed, and a final payment in full after I received a small inheritance.

Although I afforded the loan repayments at the time, I did, on a monthly basis have to juggle things to maintain the loan and if not for the inheritance, I probably wouldn’t be in the position I am now, financially.

It doesn’t matter to me either way if Amigo goes into administration or trades again, although I wouldn’t be recommending them, but if I have a valid claim then any compensation would be greatly received. So I guess my question is which way should I vote?

Sara (Debt Camel) says

So your choice comes down to what percentage payout you might get in the various options and whether you would prefer Amigo or administrators to make the decision on your claim. the article above looks at the points that are relevant.