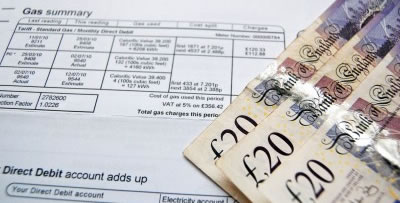

You need a financial selfie. Not a posed, glamour shot, but a realistic picture showing where you are now. With that information, you will have the basis for making good decisions about how to clear your debts.

A Financial Summary

The first thing is to get a Financial Summary which looks at your income, expenditure and debts.

You don’t have to get all the numbers for the Financial Summary worked out at the start – it’s fine to use some guesses and you can then go back and make it more exact later on if you need to.

There are lots of places on the net where you can find a budget planner tool to look at how your monthly income compares to your expenditure.

National Debtline’s My Money Steps is good:

- it converts everything into monthly amounts, from weekly or fortnightly to quarterly or annual;

- it has lots of categories so this will help you remember expenses that don’t happen every month.

This Statement of Affairs calculator was specifically designed to let people enter details which they could then post on internet chat boards such as Money Saving Expert’s Debt Free Wannabe Forum.

It has the major advantage that it looks not just at the money that you have coming in and out each month, but also at your assets: the size of the debts (mortgage and consumer) and the value of the house are essential bits of information for someone trying to see their full financial picture, not just their cash flow situation.

The totals that come out from your financial summary will then help in exploring your likely debt solutions.

Exploring your debt solutions

The debt solutions roadmap gives an outline of these.

The aim is for you to:

- get a good basis for looking in detail at specific debt options, and not waste time on those that can’t possibly work for you; and

- get a better feel for where you may be able to Improve your Finances.

Of course if you can improve your finances, for example you decide to reduce your spending on something, that changes your financial summary and – if the change was large or you were on the border between two possible debt choices – may make a difference to what you decide to do. So this “financial selfie” process isn’t just a means of recording your current status, it’s also a tool for exploring what you could change.

When big things change in your life – get divorced, get promoted, children leave home – it’s worth having a good look at your new situation to see if you have any different options.