A reader asked if he has to give the Official Receiver details of his expenditure.

If the expenditure is before he went bankrupt, the answer is “Yes, definitely – but this probably won’t be in a huge amount of detail”.

But if he is worried about whether he has to report to the Official Receiver about his spending while he is bankrupt, the answer is “No, not normally”.

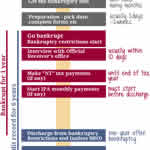

Expenditure before you went bankrupt

After you go bankrupt, someone on the OR’s office will look through your bank statements and you may be asked what some items were.

You have a duty to co-operate with the OR, so you do have to attend an interview (normally done over the phone), provide bank and credit card statements and answer questions about them.

This may sound alarming – almost everyone who goes bankrupt has made some spending decisions and the previous year or two that they now really regret.

But the OR isn’t interested in foolish over-spending or purchases that weren’t really necessary.

He is looking for dishonest or reckless behaviour. See Might you get a Bankruptcy Restriction Order? which looks at the facts about BROs – they are actually pretty unusual, less than 2% of people who go bankrupt get one.

So the items that the OR will ask about are things like:

- transfers of money to other people;

- evidence of significant gambling;

- large purchases where there is no corresponding “asset” listed on your bankruptcy application;

- large debt repayments to one creditor when other creditors were not being paid.

There will be in practice a sliding scale of importance – the OR will be more interested in larger and more recent amounts.

Sending your son £50 for his birthday ten months ago isn’t going to matter. Sending him £1,000 three weeks before you went bankrupt is rather different.

After you go bankrupt

The OR is much less interested in what you do with your money after you go bankrupt.

On your bankruptcy application, you have entered details of your expenses. The OR uses these to decide whether you have enough “surplus income” to set an Income Payments Agreement. The large majority of people going bankrupt don’t have to make any monthly payments.

From then on, providing you make any set monthly payments, you can spend the rest of your money as you like.

So for example the OR won’t want to see monthly receipts showing how much you spent on groceries. If you decide to become a vegetarian, grow all your own food and spend the money you save on setting up a hedgehog sanctuary, the OR won’t know and won’t care.

You have to inform the OR of additional income and any windfall payments you get before you are discharged after a year.

If you are paying an IPA and your expenditure has increased or your income has reduced- perhaps you have moved house and your new rent and council tax are higher – you can tell the OR and the IPS will be recalculated, possibly down to zero.

Jonny says

Great thanks Sara

Yes tbh there’s plenty coming back from that account that as there was going to it.

I already have every statement provided by her that shows every deposit into the account from me and subsequent payment to the betting company in anticipation/preparation of that ever being needed.

My priority is making sure she isn’t affected, although it seems extremely unlikely that she would be, I felt a duty to at least cover those bases.

Sara (Debt Camel) says

Right to set up a DMP with StepChange now so you are safe, get on with living a life without gambling and read that article about affordability complaints and have think about them.

Then revist the choice in 6 months – carry on with the DMP, IVA or bankruptcy.

Jonny says

Thanks Sara

Have a great Easter

Jonny